Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

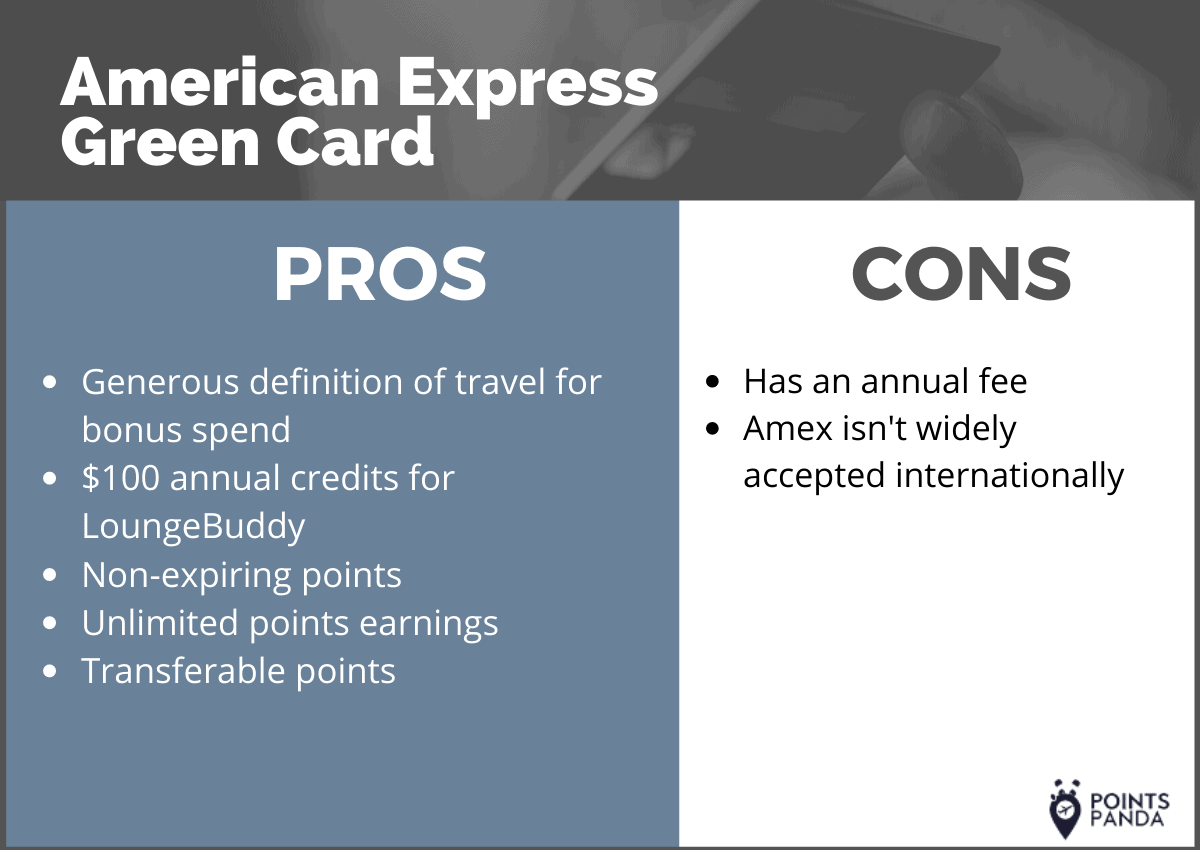

The American Express Green Card is a great choice for travel enthusiasts, digital nomads, and the whole millennial market. Amex has completely re-vamped the card and it’s packed with valuable travel perks despite the $150 annual fee.

It’s comparable to the Chase Sapphire Reserve since they have the same points earning system. However, there are still a few differences when it comes to benefits, so keep reading for more on that below.

American Express Green Card Basics

The American Express Green Card earns 3 points per $1 spent on global travel, 3 points per $1 spent on global dining, and 1 point per $1 spent on other purchases.

Currently, the welcome bonus is 30,000 points and you’ll get it if you spend $2,000 within six months of getting the card.

The new points system is actually better compared to the old model which was pretty restrictive – 2 points per $1 spent on Amex-related travel. Now, the spending categories both include the Amex Travel portal, hotel stays, plane tickets, and other global travel purchases.

In addition, the dining category was also upgraded because it now covers global spending. The old rewards model only covered restaurant spending within the U.S. This new feature makes the AMEX Green Card a top choice amongst other travel credit cards.

American Express Green Card Benefits

The American Express Green Card is a mid-tier credit card at best, simply because it’s built that way. But it’s a great rewards card that allows people to earn valuable travel redemptions and benefits without spending a lot on annual fees.

But it’s not your usual credit card because the Green Card allows you to carry a balance for certain charges (but not all).

Annual $100 LoungeBuddy Credit

LoungeBuddy is an American Express program that allows lounge access for travelers to over a hundred locations worldwide. Lounge access can start as low as $25 so the annual statement credit is definitely worth it.

Not to mention the LoungeBuddy program has partnerships with some of the top lounge brands worldwide, such as the Delta SkyClub, Plaza Premium, Dragon Pass, and Priority Pass.

Travel Perks From Amex Travel Services

The American Express Travel service provides Amex cardholders a wide selection of benefits from its travel catalog. The benefits may come in the form of cheap flights, hotel discounts, travel upgrades, and other special offers.

The offers change from time to time so it’s best if you sign up to their newsletter to get the latest updates.

Amex Special Offers

American Express is pretty generous to its cardholders when it comes to rewards. You’ll get special discounts, statement credits, and earn additional points on other eligible purchases aside from the default bonus categories.

For example, Amex was giving its cardholders a $150 statement credit to purchase items on Away this January 2020.

Some of the partner merchants include Starbucks, Macy’s, ESPN+, Pandora Media, and many more. Just log in at Amex Offers, pick an offer, and use your Green Card just like any other online purchase.

There’s usually minimum spending required but it’s worth it. You’ll see your rewards and savings in your account after a couple of business days once you’ve made the purchase.

Guaranteed Discounted Hotel Rates

Amex will offer price-difference refunds if you have proof that you’ve found a cheaper price of the hotel offer they have on Amex Travel. You need to submit your proof, fill in a form before the check-in date, and make sure that it’s the exact hotel reservation (same hotel, room, dates, etc).

This feature is a big deal because there’s the possibility you can get bonus points on an Amex offer, and at the same time, get a cheaper price for that room through the price-difference refund.

If Amex approves your claim, the refund takes about 15 business days to appear in your account after the claim is submitted.

Free ShopRunner Membership

Active cardholders can enroll for a free ShopRunner membership that typically costs $79 per year. The benefits include a free two-day shipping/returns at over 140 partner merchants online.

No foreign transaction fees

A great travel credit card does not have foreign transaction fees and the Green Card is no exception. The fees usually cost 3% per transaction and is based on the price of the purchased item. If the item is expensive, then expect higher fees.

However, do take note that American Express cards aren’t widely accepted worldwide, particularly in developing countries.

Who’s This Card For?

The American Express Green Card is perfect for people who love to travel, dine out, and spend on other travel-related expenses. If you use CLEAR and LoungeBuddy frequently, it just makes sense to get this card.

Digital nomads and backpackers would most likely benefit from it since it has zero foreign transaction fees and has an affordable annual fee.

Amex Green Card Vs Chase Sapphire Reserve – Which Is Better?

Both of them have the same points earning but the differences lie in the rewards. For example, the Chase Sapphire Reserve Card offers full Priority Pass access, better trip delay coverage, and a welcome bonus of 50,000 points.

A Priority Pass membership costs $429 per year and it gives you access to more than 1,200 airport lounges worldwide.

The Sapphire reserve’s annual fee is $550, which is pretty expensive, but the $300 Annual Travel Credit will make things easy on your wallet. It would seem like you’re only paying for $250.

Now, the Amex Green Card does have a cheaper annual fee but the perks aren’t as lucrative as the Sapphire Reserve. It only has a $100 Annual LoungeBuddy credit and a decent 30,000 points welcome bonus.

However, this doesn’t mean that the Green Card isn’t a great credit card because it would all boil down on what perks you want. It is a good alternative if you want to earn points and decent rewards, but can’t afford a premium card like the Chase Sapphire Reserve or the Amex Business Platinum.

Read More: Chase Sapphire Reserve Benefits Guide | Top 10

Thoughts From Points Panda

Do remember the annual fee is $150, so if you don’t do a lot of travel an dining, you’re on the losing end. Here are some suggestions on how to properly use the card:

- Make direct travel and hotel purchases so you can get the full 3 points per dollar spent. This includes all travel-related purchases like ride-hailing services, buses, and train rides.

- Always check Amextravel.com for special travel offers and bonus points. Make sure to cross-check the prices too to get your price-difference refund.

- Pair your Amex Green Card with an Amex cashback credit card so you can also earn rewards on other purchases. The Amex Blue Cash Preferred is a great option with a low annual fee of $95 and a high 6% cashback rate on groceries.

To sum it all up, this card is perfect for frequent travelers who spend a lot of money on travel and dining categories. If you’re a budget traveler who sleeps at hostels or a casual traveler who only flies about 3-4 times a year, you might as well get a beginner credit card with no annual fees. But if you want to get the best travel deals and not worry about managing your credit cards, you can sign up for our premium travel concierge to get unlimited credit card consultation for one whole year.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.