Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Not sure what the best travel credit cards are for 2021? Have no fear, Points Panda is here! Here are some of the cards that we’ll discuss below.

- Hilton Honors Aspire Credit Card

- IHG Rewards Premier Credit Card

- Marriott Bonvoy Boundless Visa Signature Credit Card

- Citi Premier Card

- Chase Sapphire Preferred Card

Hilton Honors American Express Aspire Card

Rewards

Earning Rewards

The Hilton Aspire card earns up to 14 Hilton Honors bonus points for every dollar you spend:

- 14x on all Hilton purchases

- 7x on purchases on amextravel.com and eligible car rental companies

- 7x on dining at U.S. restaurants

- 3x on all other eligible purchases

Redeeming Rewards

Hilton Honors points can be redeemed for stays at Hilton Hotels including Hilton, Conrad Hotels & Resorts, Embassy Suites, and Homewood Suites:

Hilton Benefits

Free Weekend Night Reward

Cardmembers will earn a Free Weekend Night Reward and also after every card renewal (annually).

This reward can be redeemed for one weekend night standard accommodation at eligible Hilton properties. Keep in mind, there are some hotels excluded from the Free Weekend Reward night.

Hilton Honors Diamond Status

The Hilton Honors American Express Aspire Card comes with complimentary Hilton Diamond status.

Hilton Diamond status benefits include complimentary continental breakfast, premium wi-fi, 100% bonus on points earned during HIltion stays, as well as guaranteed executive lounge access and upgrades up to a one-bedroom suite (where available).

Hilton Property Credit

When you book a stay of two (2) or more nights at HiltonHonors.com/aspirecard, you can get up for $100 in credits toward qualifying charges. This benefit is available at participating Waldorf Astoria Hotels & Resorts, as well as Conrad Hotels & Resorts.

Additional Travel Benefits

Airline Fee Credit

The Honors Aspire Card comes with a whopping $250 Airline Fee Credit. When you select a qualifying airline, you can receive up to $250 in statement credits per calendar year for eligible fees, like checked bags and in-flight refreshments.

Priority Pass Select

The Honors Aspire Card also comes with Priority Pass Select, providing access to over 1,300 airport lounges around the world. Furthermore, there a number of airport restaurants where Priority Pass members can receive a credit toward their final bill.

This benefit allows up to 10 free Priority Pass airport lounge visits each year, once enrolled.

Global Assist Hotline

The card also comes with a 24/7 Global Assist Hotline to provide medical, legal, financial and other services. This hotline, available if you are traveling over 100 miles from home, can assist with medical emergencies, passport replacement, and missing luggage.

Fees

The Honors Aspire Card has no foreign transaction fees, but it does have an annual fee of $450.

Card Summary

The Hilton Honors Aspire Credit Card matches a 150,000 point welcome bonus – the best of all of our hand-picked credit card welcome bonuses, with great travel benefits include Hilton Diamond status and Priority Pass Select membership.

IHG Rewards Premier Credit Card

The Chase IHG Rewards Premier Credit Card offers an incredible welcome bonus of 140,000 points after spending $3,000 within three months of getting the card.

You may be ineligible for this offer if you have received five (5) or more personal credit cards in the past 24 months. This general rule, known as the “Chase 5/24 Rule,” applies to credit cards issued by any bank which may appear on your credit report.

Rewards

Earning Rewards

You can earn up to 26 points per dollar with the IHG Rewards Premier Card:

- 26x points at IHG Hotels & Resorts

- 5x points at gas stations

- 5x points on travel

- 5x points at restaurants

- 3x points on all other purchases

Redeeming Rewards

IHG Rewards Club is the rewards program for IHG Hotels & Resorts, which includes KImpton, Holiday Inn, InterContinental, and Candlewood Suites:

Extra Rewards Nights

Each year following your anniversary of becoming a cardmember, you will receive an Anniversary Reward Night. This reward can be redeemed for a free night at IHG Hotels that have a value of up to 35,000 points.

Also, when IHG Rewards Premier cardholders book a stay of three (3) or more nights, they’ll get one free reward night. For example, cardholders using IHG Rewards points will be charged points for the Reward Night redemption rate for the first three (3) nights, and zero (0) points for the 4th night.

IHG Benefits

The IHG Rewards Premier Card comes with IHG Platinum Elite status.

IHG Platinum Elite status benefits include room upgrades, extended check-out (subject to availability), and either a “Raid the Bar” or “Raid the Mini Bar” credit.

Additional Benefits

TSA Pre-Check/Global Entry

In addition, cardmembers can receive a credit of up to $100 towards applications for either Global Entry (expedited customs for international flights), TSA Pre-Check (expedited airport security), or NEXUS. This fee credit is available once every four (4) years.

Fees

While the Reward Club Premier Card does have an annual fee of $89, it has no foreign transaction fee.

Card Summary

The IHG Rewards Premier Card matches one of the best credit card welcome bonuses, with fantastic rewards and benefits for IHG hotel stays and a statement credit for either TSA Pre-Check or Global Entry.

Marriott Bonvoy Boundless Credit Card

The Marriott Bonvoy Boundless Visa Signature Credit Card has had various welcome bonuses but as of this writing, new cardholders will earn 3 Free Nights (each night valued up to 50,000 points) after spending $3,000 on qualifying purchases in the first 3 months of account opening.

Rewards

Earning Rewards

Here are the earning rates for the card:

- Earn up to 17X total Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy(R) with the Marriott Bonvoy Boundless(R) Card.

- Earn 3X Bonvoy points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining.

- 2X Bonvoy points for every $1 spent on all other purchases.

Redeeming Rewards

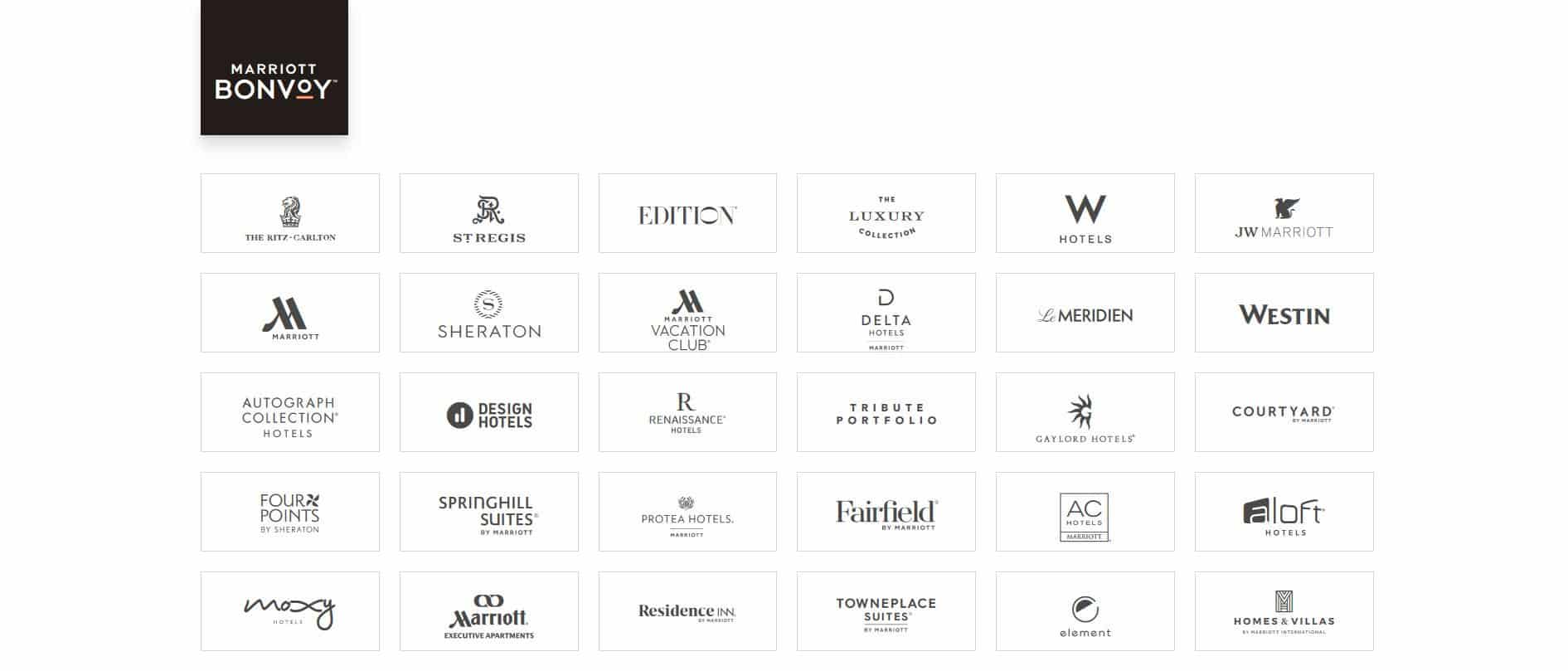

Marriott Bonvoy is the rewards program for Marriott Hotels, and hotel brands include Marriott, JW Marriott, Ritz Carlton, St. Regis, Renaissance Hotels, Westin and Fairfield Inn & Suites:

Each year following your anniversary of becoming a cardmember, you will receive a Free Night Award. This reward is valued up to 35,000 points and can be redeemed for a free night at Marriott Hotels.

Marriott Benefits

Elite Status

As a cardmember benefit, you will receive 15 Elite Night credits upon opening your credit card account. Each subsequent year your card remains open, you will continue to receive the 15 Elite Night credits on or before March 1.

With 15 Elite Night credits each year, you will also automatically qualify for Marriott Bonvoy Silver Elite status. Silver Elite benefits include free wi-fi, late checkout, and 10% bonus points during each stay.

Spending on your card will even fast-track your way to elite status because you’ll get 1 Elite Night Credit for every $5,000 you spend. Furthermore, each year that you are able to spend $35,000 on the Boundless Card, you will receive Marriott Bonvoy Gold Elite status. Gold Elite benefits include welcome bonus points at check-in, room upgrade (if available), and 2 P.M. late checkout.

Ram Suite/Elizabeth Hotel, Ft. Collins, CO

The Bonvoy Boundless Card also comes with Premium in-room wi-fi when staying at Marriott Hotels.

Additional Benefits

The card comes with Visa Signature Concierge Service, which offers assistance with making reservations for travel, dining, and entertainment.

Fees

The Bonvoy Boundless Card has a $95 annual fee but it has no foreign transaction fees.

Card Summary

The Marriott Bonvoy Boundless Credit Card gives cardholders instant Marriott status and an annual Free Night Award.

Citi Premier Card

With the Citi Premier Card, you can earn a welcome bonus of 60,000 Citi Thank You points after spending $4,000 within three months of getting the card.

Rewards

Earning Rewards

The Citi Premier Card earns:

- 3 points per dollar on travel including gas stations, airfare, hotels, and car rentals

- 3 points per dollar spent at restaurants and supermarkets

- 1 point per dollar on all other purchases

Redeeming Rewards for Purchases

You can use your Citi ThankYou Points to Shop with Points in two different ways:

Points can be used when you checkout to pay for purchases with Amazon and PayPal.

You can also use points for statement credits at 1-800-flowers.com and BestBuy. Your card will be charged for the full purchase amount, the selected amount of points will be deducted, then you will receive a statement credit in 2-3 days.

While the redemption rate to use Thank You points for purchases may vary, at most you can get 1 cent per point redeemed.

Redeeming Rewards for Gift Cards

Another way to redeem Thank You points with marginally more value is redeem for Gift Cards from dozens of restaurants and retailers. Points redeemed for gift cards are redeemed at a rate of 1 cent per point.

Redeeming Rewards for Cash Back or Statement Credited

Citi Thank You Points can be redeemed as cash back or a statement credit.

Thank You points used for statement credits will post in one to two billing cycles.

If you choose to redeem your points for cash back, Citi will make a check payable to you in denominations of either $50 or $100. Checks will be sent via USPS First-Class Mail and arrive within one (1) to three (3) weeks of redemption.

Both statement credits and cash back are redeemed at a rate of 1 cent per point.

You can also use points to pay for all of or part of a bill through Online Bill Pay with Points, but you will only get 0.75 cents per point.

Redeeming Rewards for Travel through the Citi ThankYou Travel Portal

A better way to redeem Citi ThankYou points to book travel through the Citi ThankYou Travel Portal.

Through this portal, you can book flights, hotels, rental cars, and cruises. Points redeemed through this portal are currently redeemed for 1.25 cents each now through April 10, 2021. After that, points redeemed through Thank You Travel portal will be worth 1 cent each.

Transferring Rewards to Arline and Hotel Transfer Partners

Your best option for using Citi ThankYou points is likely going to be to transfer them 1:1 to the following Citi ThankYou’s airline transfer partners:

- Aeromexico

- Asia Miles (Cathay Pacific/Cathay Dragon)

- Avianca LifeMiles

- Emirates Skywards

- Etihad Guest

- EVA Air

- Flying Blue (AirFrance/KLM)

- JetBlue TrueBlue

- Jet Airways InterMiles (Formerly JetPrivilege)

- Malaysia Airlines Enrich

- Qantas Frequent Flyer

- Qatar Privilege Club

- Singapore Airlines

- Thai Royal Orchid Plus

- Turkish Airlines Miles & Smiles

- Virgin Atlantic Flying Club

Additional Benefits

Annual Hotel Savings Opportunity

With the Citi Annual Hotel Saving Opportunity, you can enjoy $100 off of a single hotel stay of $500 or more. Just book through Citi Thank You Rewards Portal and pre-pay for your complete stay.

Fees

The card does have an annual fee of $95, but it does not have foreign transaction fees.

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card features a welcome bonus of 80,000 Ultimate Rewards points (worth $1000) upon spending $4,000 in the first three (3) months from account opening. You’ll also get a $50 annual Ultimate Rewards Hotel Credit.

You may be ineligible for this offer if you have received five (5) or more personal credit cards in the past 24 months. This general rule, known as the “Chase 5/24 Rule,” applies to credit cards issued by any bank which may appear on your credit report.

Rewards

Earning Rewards

When using the Chase Sapphire Preferred Card for purchases, for each dollar you spend you earn:

- 5X points on travel purchased through Chase Ultimate Rewards(R)

- 3X points on dining

- 2X points on all other travel purchases

Redeeming Rewards for Cash Back

Points earned from the welcome bonus of 80,000 Ultimate Rewards points can be redeemed in the form of cashback via the Chase Ultimate Rewards Portal.

When you do so, you can receive cash back as either a credit card statement credit or in the form of a deposit to your bank account.

Redeeming Rewards for Purchases

Chase Ultimate Rewards points can be used for purchases with Amazon, Apple, and gift cards.

Ultimate Rewards points used for Amazon purchases are redeemed at a rate of 0.8 cents each, while points used for Apple and gift card purchases are redeemed at a rate of 1 cent per point.

Redeeming Rewards for Travel through the Ultimate Rewards Travel Portal

One of the better ways to use your Chase Ultimate Rewards points is to book travel through the Ultimate Rewards Travel portal. Through this portal, You can book flights, hotels, vacation rentals, cars, cruises, and even experiences like tours and museums.

Travel booked through the Ultimate Rewards Travel portal is redeemed at a rate of 1.25 cents of value per point.

Redeeming Rewards for Ultimate Rewards Transfer Partners

The best way to redeem Ultimate Rewards points in many cases is to transfer them at a 1:1 ratio to airline and hotel transfer partners.

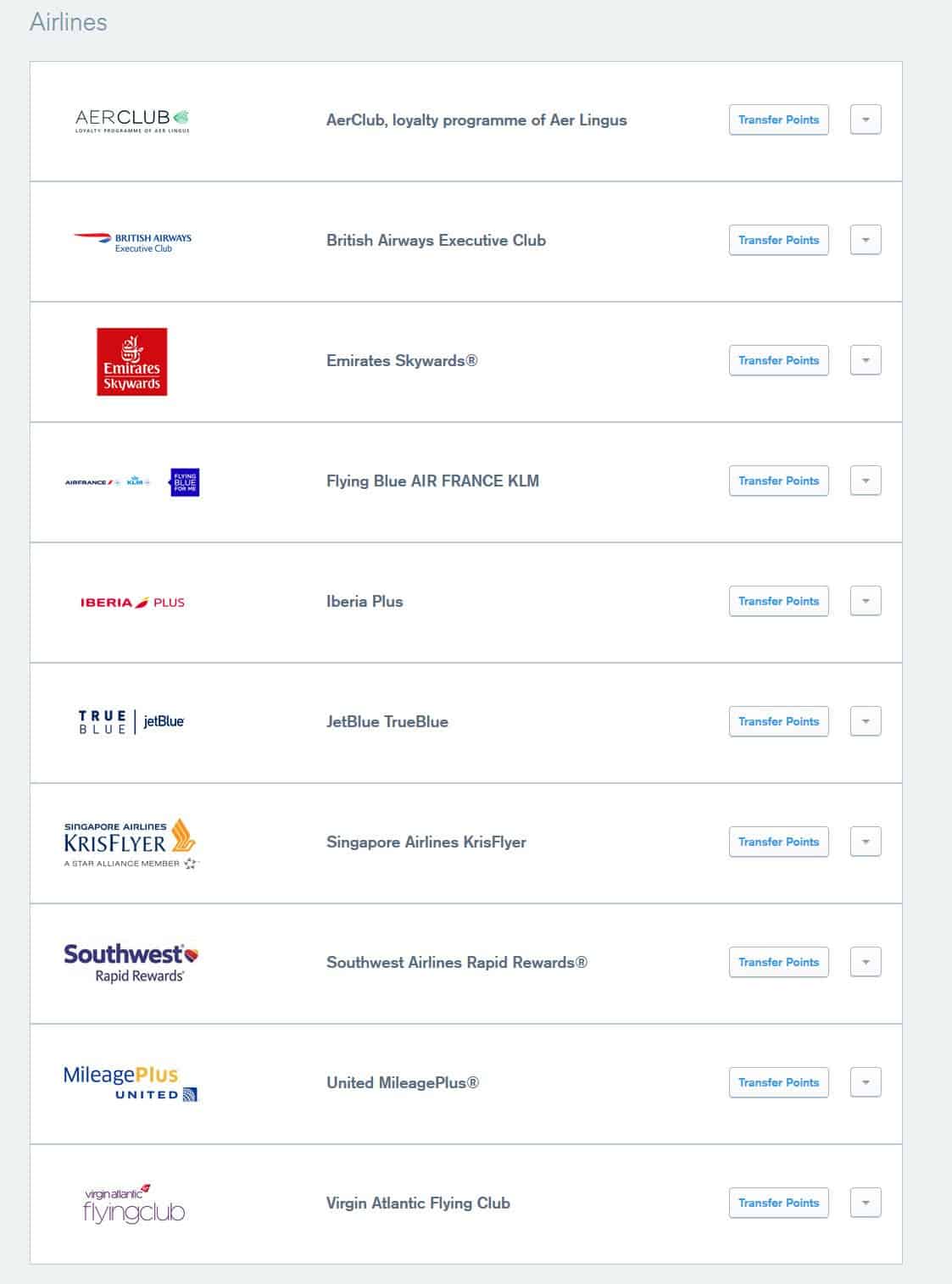

Airline transfer partners including British Airways, Jet Blue, United, Singapore, Southwest, and United:

And the hotel transfer partners are IHG, Marriott, and Hyatt:

Additional Benefits

The Chase Sapphire Preferred also comes with DoorDash benefits. A monthly subscription costs $9.99 per month but you can get unlimited FREE deliveries and reduced service fees for orders that are $12 or more for a minimum of one year.

This benefit only applies to eligible food purchases made through DashPass (Doordash’s subscription service).

Fees

The Sapphire Preferred Card has a $95 annual fee, but it does not have foreign transaction fees.

Card Summary

The Chase Sapphire Preferred Card pairs a great welcome bonus of 80,000 Ultimate Rewards points with the possibilities of the Ultimate Rewards Transfer partners.

Points Panda’s Thoughts on the Best Credit Card Welcome Bonuses

There are a lot of great credit card welcome welcome bonuses, so we encourage you to understand what each card offers. and match the minimum spending requirements to your spending habits.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.