Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Life insurance is one of the most needed financial products and yet, one of the least understood. The reason behind that is because life insurance is very different than other insurance products. And other financial products in general.

You see, with auto insurance or personal loans, for example, you are the one who is getting the benefit. Imagine an accident happens while you drive. You won’t have to take money out of your pocket to fix the damage, provided you have sufficient car insurance.

If you take out a personal loan you decide what to spend the money on. So basically with other financial products, it is you who is getting the benefit. But with life insurance, this is not the case.

The main idea you have to understand is that life insurance is not actually for you. It is to secure the financial future of your loved ones. Your family or whoever you put as the beneficiary on your life insurance policy will get the death benefit.

So if you have people that you care for you should absolutely have an active life insurance policy. In times of grief, financial struggle is not necessary. The support of a death benefit payout can be a lifesaver (no pun intended) in so many situations. Everybody can find their meaning in having a life insurance policy.

To help you do that we created this guide to life insurance with the hope you will find your own meaning. So without any further ado, let’s begin. First with the basics.

What is Life Insurance and How Does it Work?

Life insurance is a financial product people typically buy to secure the financial future of their family or close ones. In case a person who has life insurance dies, the insurance company pays out a certain amount to the person or people listed in the policy as beneficiaries.

Back in the days, life insurance as a financial product was created mostly as a consequence of war. Death of military soldiers was an everyday experience. There was a need for a financial instrument to support the ones who the fallen have left behind.

So the main purpose of life insurance was to aid widows and orphans and at least, to cover burial expenses. Life insurance has evolved a lot since then. However, the main idea still remains. It is to provide financial help to the ones you leave behind when you pass away.

Key Elements of Life Insurance

From an official point of view, a life insurance policy is a contract between you and an insurance company. When you are approved, the insurance company issues a life insurance policy. You are the policyholder and can name a person or people (usually family) who will receive the death benefit in case you die.

This person is called a beneficiary. Respectively if multiple people will share the death benefit you have multiple beneficiaries. The death benefit is typically a fixed lump sum that is paid out to your beneficiaries when you die.

To keep a life insurance policy active you must pay your premiums on time.

A premium is a periodic installment of a certain amount of money. Basically it is the price of your life insurance.

Depending on the type of insurance, its price, your preferences, and what the insurance company can offer, you can pay differently. Typically you can pay monthly, quarterly, or once per year.

Once again it is crucial to make the payments on time. If you don’t and something happens while you are late with the payment, the insurance company can deny paying the death benefit.

You obviously don’t want this to happen, right? That is the whole purpose of having life insurance in the first place. Provided you have paid your premiums and you pass away the death benefit isn’t paid out automatically to your beneficiaries. They must file a claim with the insurance company.

Nowadays many people buy their life insurance through insurance agents, insurance brokers, or financial advisors. If that is the case your beneficiary can contact the agent that advises the family and he will help with the claim.

If not, the beneficiary should contact the insurance company directly and request to speak with a claims representative who will help with filing a claim.

All required documentation (like a death certificate) should be gathered and filed with the insurance company. Once they have all the documents they need, the company will pay out the death benefit to the beneficiaries.

Another important aspect of life insurance is the ability for you to add riders. A rider is an additional and optional coverage you can choose to add to your life insurance policy.

A typical example is getting insured against impairment so the insurance company will cover your premiums if you are not able to work. Another typical case is adding a child to your policy.

Bear in mind that if you name a child as a beneficiary a custodian of the policy should file the claim. Also, this custodian would be responsible for managing the funds from the policy until your child turns 18 years old.

Main types of life insurance

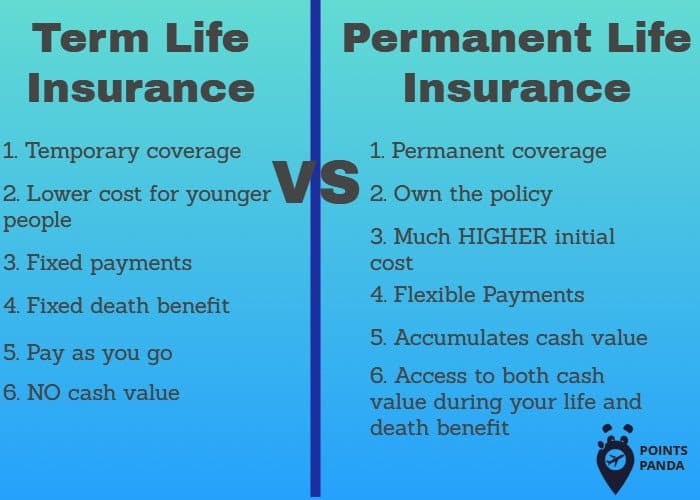

You probably already see the benefits of getting a life insurance policy. But what are actually your options? In general, there are two main categories of life insurance. Term life insurance and permanent life insurance.

Also, there are different types of term and permanent life insurance. Each with their own advantages and disadvantages. Let’s explore.

Term Life Insurance

Term life insurance is a simple and straightforward form of life insurance. The term policy is written for a set time period, usually, 10,20, or 30 years and up to a certain age. It typically provides fixed coverage and only pays a death benefit to the beneficiary.

Also, it usually comes with a fixed amount of payments over the period, whether that would be 10,20,30 years or a different term. That means the policy price stays the same throughout the years.

And if you buy it while you are young it can be ridiculously cheap. On the downside, once the term is over you are no longer insured. When you want to buy a new term policy you will find out that the price has skyrocketed.

That is because you‘ve become older and the chance of you passing away is much greater. The risk for the insurance company is much more. As a result, they will charge you an arm and a leg or refuse to insure you at all.

At the end of the day, the insurance company doesn’t want to pay the death benefit. This may sound brutal but after all, that is how the insurance industry works and makes a profit. Despite the fact term life insurance is simple there are still different types of term life insurance policies.

1. Level Term Insurance Policy

Level term insurance is the most common type of term insurance. Almost all term policies that are issued are level term. It has all the basic traits of term insurance we already mentioned.

You pay the same amount to have coverage for a set period of time in the future. Let’s say you are now 30 years old. You can get 30-year term life insurance for $375 annually and coverage of $500,000 (yes that is a realistic price).

That means until you turn 60 you won’t have to worry about life insurance as long as you pay this $375 a year. Regardless of your health condition throughout these years.

2. Renewable Term Insurance Policy

If there is one thing that you should definitely consider before buying term life insurance is whether you want it to be renewable. This is very important because renewable term insurance knocks off one of the main disadvantages of term life insurance.

More precisely – the term will eventually end. After the term ends you will need to undergo additional and new health checks for a new policy. However, if your health condition worsened severely throughout the years, you probably won’t be able to insure yourself again. Never again.

The renewability of the policy allows you to renew your policy at the end of the term and keep the same amount of coverage. On the downside, the price of the renewed policy will still be higher and you will have to pay a fee for the renewal.

Also, naturally, renewable term life insurance is more expensive than level term insurance. The insurance company is taking a higher risk so they charge more.

Convertible Term Insurance Policy

Having a convertible term life insurance allows you to turn your term insurance policy to a permanent insurance policy at a later date. The same as with renewable term insurance you won’t have to qualify for an insurance policy again.

That means no additional health checks will be made. You can simply convert your term policy to a permanent one once the period is over. And since permanent life insurance is for life and has the added option to stack up cash value, this is an advantage.

However, convertible term insurance is more expensive. Also, permanent life insurance is more expensive. Much more expensive. So you take a high risk unless you are certain you will be well financially when the time comes to convert the policy.

Decreasing Term Insurance Policy

This is a term policy that is designed to pay for financial obligations that decrease over time. Such as a mortgage. Essentially the death benefit becomes less and less over time.

But what is the advantage of decreasing life insurance you may ask.? As you may guess it is cheaper even than other types of term life insurance.

Adding Additional Coverage to Your Term Life Insurance

An interesting fact about insurance policies is that they often can be modified to your liking. Not only life insurance policies but other insurance types as well. Like auto or home insurance. How?

By adding riders to your insurance policy. In simple words, riders are additional protections or advantages you can add to your policy. Logically, this results in higher premiums. At the end of the day, however, it may be well worth it.

With life insurance, there are several popular riders. You can add a waiver of premium rider which allows you to stop paying your life insurance if you become ill or disabled. Thus unable to work and make sufficient income to cover your policy payments.

You can also add an accidental death rider which will result in a larger death benefit if you die in an accident. However, one rider you should definitely pay attention to is the return of premium rider.

Basically, this rider allows you to have the whole amount you paid for life insurance at the end of the term. For example, you can have a 20 year level term insurance for $500 a year. You pay a total of $10,000 and forget about this money.

The same term policy with a return of premium rider can cost about $800. This will result in you paying $16,000. The difference is in the second case you will get these $16,000 back at the end of the insurance period. So think about that carefully.

Also, the premiums you paid will be added to the death benefit if you pass away during the term. So let’s assume your term policy death benefit was $300,000 and you passed away on the 10th year while having this rider. The death benefit will be $308,000.

Permanent Life Insurance

Permanent life insurance is different from Term for two main reasons. First, it is permanent, meaning for the whole life of the insured. Second, it allows part of the premium to go towards the so-called “cash value” which acts as a saving/investing vehicle.

There are different types of permanent life insurance as well.

Whole Life Insurance Policy

Whole life or ordinary life is the most popular type of permanent life insurance. With whole life, you get death benefit coverage and at the same time, cash growth. Part of the premiums you pay for a whole life insurance policy goes towards fees and covering the death benefit.

The other part goes into your whole life insurance “savings account” where the cash accumulates over time tax-deferred. However, the return rates on whole life insurance are typically very low. Between 1.5-2% annually. So it is not the best investment.

On the bright side, you can surrender the policy later on and get the cash value. Also, you can borrow from the cash value. But that means you will pay interest on your own money. Once again, not a very smart move, financially speaking.

As with term life insurance, there are a lot of whole insurance policy types. Like a participating whole life insurance policy, non-participating whole life insurance policy, indeterminate premium whole life insurance, limited payment whole life insurance and others.

You can read more about the different types of whole life insurance policies here.

Universal Life Insurance Policy

Universal life insurance is like whole life insurance, but generally more flexible. Usually, the owner of the policy can change the amount of the premium, the amount of the death benefit or both.

You have an “investment account” in which the cash value can grow tax-deferred. Also, as long as there is enough cash value in the account to cover the premiums, the policy remains active even if you don’t pay.

Variable Life Insurance Policy

Variable life gives the usual protection and death benefit, yet again with a savings account. You can use the accumulated cash to invest in securities, like stocks, bonds, and indices, such as the S&P 500.

Of course, you are responsible for the risk associated with that. So don’t do it unless you are an experienced investor or have a trusted financial advisor.

There is also a variable-universal life insurance policy. It combines the benefits of universal life insurance – death benefit and premium adjustments, and variable life – securities investments. Before we continue, here is a useful picture that summarises the benefits and downsides of term and permanent life insurance.

How Life Insurance Policies Are Issued

There are two main ways insurance companies issue life insurance policies.

Depending on the required information, life insurance policies are simplified issue policies or fully underwritten policies.

Each of the two has different eligibility criteria. To obtain a simplified issue policy you are only required to fill in a health questionnaire. Again, when you answer the questionnaire don’t lie. The insurance company will eventually find out and can cancel your policy or deny the death benefit.

Also, bear in mind that simplified issue life insurance is more expensive. The insurer has less information about your health status hence taking on higher risk. In insurance that means a higher price.

When you want to get a fully underwritten insurance policy you have to undergo a medical examination and do some lab tests.

It is more work, however, you are rewarded with a lower premium if you are healthy. The results will serve as proof you are in good health so the insurance company will take on lower risk. Hence lower price.

Factors That Determine Your Premium Rate

Many factors determine your premium rate. We already touched on the most important.

More precisely, the type of life insurance policy from all of the described above term and permanent life insurance policy types. Whether the policy is simplified or fully underwritten. And of course, the coverage amount and the period (if it’s term life insurance).

However, there are a few more factors that are crucial to determining your life insurance price. As well as some more which are not so important but still affect the pricing.

For example, a young healthy person is obviously going to get a lower premium. So age is another key factor. For that reason, it is best if you sign up for life insurance as early in your life as possible. That is how you get the best price.

Today is actually the best day for doing it if you still haven’t got life insurance. If you keep postponing the moment may never come. And honestly, there is always a chance tomorrow would be too late.

Anyways, another important thing that determines your life insurance price is whether you are a smoker. Tobacco users, especially heavy ones, have higher rates. Much higher.

The rates for tobacco users can be literally 2, 3, or even 4 times higher than the rates for non-smokers. Apparently, life insurance companies are very serious about that, They wouldn’t have separate rates for smokers and non-smokers if they weren’t.

That should give a red flag to smokers on how bad smoking is actually for your health. After all, it is simple math. Your premium is four times higher.

That means you are four times more likely to die younger and right now if you are a smoker. And believe us, insurance companies would prefer to charge you less if they could afford it.

They don’t want to lose potential clients. But when you take into account that smoking is strongly related to many deadly diseases, like cancer, nobody wants to pay the bill.

So if you are a smoker and you have been thinking long to quit smoking, here is the perfect reason.

It won’t be easy, but once you are tobacco-free for 12 months you will qualify for a non-smoker policy. Your premiums would be much more affordable. More importantly, your health will be much better.

Another surprising factor that determines your life insurance price is gender. No, life insurance companies are not discriminative. But life insurance is more expensive for men. Why?

It’s pretty simple. Men’s lifespan is on average lower than the lifespan of women. Meaning women are less risky clients. Here are some more factors that determine your premium rate:

- Lifestyle – not only smoking, alcohol use and risky hobbies like cliff climbing are also considered

- Family medical and health history

- Your job

- Living location

- Marital status

- Driver’s history

- Your premium payment frequency – when you pay less often you will pay less

Why Do I Need Life Insurance?

To understand why you need life insurance you will first have to ask yourself. Is life insurance worth getting?

Your answer may be no, but in most cases that is the wrong answer. The truth is everybody needs life insurance of some kind. At least to cover your burial expenses if the worst happens.

In the majority of cases, more things need to be taken care of when you leave this world apart from your final expenses. The benefits of getting life insurance can be more than one. A common case is having sufficient coverage to pay off the mortgage of your family house.

Another reason it is worth getting life insurance is replacing your income so your family won’t struggle financially when you are gone. Naturally, there are many more reasons why people need life insurance.

In fact, every person most likely has their own reasons. If you are unsure what they are, think carefully and you will find at least one good reason to own a life insurance policy.

Read More: Does Life Insurance Cover Coronavirus?

How to Buy Life Insurance?

Getting life insurance nowadays is not as hard as you may think. However, before you buy your life insurance you have to decide what is the best type of policy for you.

Also, you need to decide what is the amount of coverage you need. If you have any doubts about the two, read once again through this article. Take your time and decide. After you are done you can continue to the next step.

The good news is you don’t have to go out there, amid the Coronavirus pandemic and actually risk your life while trying to insure it. You can simply check some life insurance quotes and buy life insurance online, without exposing yourself to the deadly virus.

Be mindful that the insurance company may ask you about your travel plans. If you plan to travel a lot despite the pandemic your application may be rejected. The insurance company can also postpone making a final decision whether they will insure you until 30 days after you return home.

Understanding the Life Chart

Different life insurance policy types can be appropriate for different stages of a person’s life. While you are very young you typically don’t have much to think about and a simple term life insurance policy can suffice.

When you become older you may start to turn more to permanent life insurance to accumulate savings. That is perfect in the case your financial situation is stable and especially if you maxed out all other tax-deferred saving options.

By the time you retire, you will accumulate lots of cash with permanent life insurance. You can give up the policy and use the cash to enjoy life in the last years of your beautiful life. Or leave it as a heritage to your children.

Still, don’t take our advice for granted. At the end of the day, it is a matter of personal preference and needs. If you consider permanent life insurance a good choice you can get one early on. The opposite is also valid. When you become an elder you can still think a term life insurance is the best option for you.

The main point of emphasis is this. Everybody needs life insurance, no matter the age, lifestyle, or financial situation. Because every person in this world has somebody and something they care about.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.