Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

The Southwest Companion Pass (R) is probably the coolest benefit any U.S. airline offers. After either 100 one-way flights or 110,00 qualifying Rapid Rewards points in a calendar year, Southwest honors its more frequent flyers with the Companion Pass (R). The pass holder is then allowed to designate one companion who can fly with them on any Southwest Airlines flight for only the taxes ($5.60 one way). OK, so not completely free, but close enough.

Buy one, get one free airfare for two years? Yes, please. Please note this offer is now over. However, as of 2021 Southwest is currently offering a Companion Pass (R) as a welcome perk for any of their 3 credit cards with Chase, making it much easier for cardholders to get it. However, we’ll keep this content up here for convenience.

But here’s the thing: as infrequent flyers, we’re NEVER going to fly 100 one-way flights on Southwest Airlines. That’s like flying roundtrip every week for the entire year. Nope, never going to happen.

So why am I even writing about the Companion Pass (R)? Because any points earned with the Southwest Airlines credit cards count towards the 110,000 points needed. This includes both the sign-up bonus (up to 60,000 points) as well as points associated with the spending on the credit card itself.

And if you have the ability to sign-up for a business credit card, you could easily sign up for one personal card and one business card to acquire the 110,00 Rapid Rewards points needed to earn the Companion Pass (R) within months.

The Southwest Credit Cards

Southwest offers five different credit cards:

- Southwest Airlines Rapid Rewards Plus Credit Card – $69 annual fee; 75,000 bonus points after spending $5,000 within three months of card membership. 3,000 anniversary points each year

- Southwest Airlines Rapid Rewards Premier Credit Card – $99 annual fee; 75,000 bonus points after spending $5,000 within three months of card membership; 6,000 anniversary points each year

- Southwest Rapid Rewards Priority Card – $149 annual fee; 75,000 bonus points after spending $5,000 within three months of card membership; 7,500 anniversary points each year

- Southwest Airlines Rapid Rewards Premier Business Credit Card – $99 annual fee; Companion Pass (R) + 60,000 points after spending $3,000 within three months.

- Southwest Airlines Rapid Rewards Performance Business Credit Card – $199 annual feel; Companion Pass (R) + 80,000 points after spending $5,000 within three months.

Currently, these five cards come with a Companion Pass (R) if you are able to meet the spending requirements (The offer is valid through 2/28/2022).

Companion Pass (R) aside… those are pretty boring perks. The Chase Sapphire Preferred Card offers 3x points on dining and 2x on all travel purchases rather than spending ONLY on Southwest flights. Plus, the Chase Sapphire Preferred Card is a transfer partner with Southwest airlines, so while these point transfers wouldn’t count towards the Companion Pass (R), you could earn more points towards travel on Southwest Airlines by using the Chase Sapphire Preferred card on everyday spending rather than any of Southwest Airlines’ own credit cards.

Earning the Companion Pass

While the credit cards themselves probably aren’t what you want to use for everyday spending, they do make the Companion Pass (R) within a more reasonable reach. If you sign up for a Southwest Airlines credit card when the sign-up bonus is 75,000 points, that means you only need 35,000 more points in a calendar year to earn the pass.

If you have an upcoming wedding or home renovation, maybe spending $70,000 on the Southwest credit card would be an option. Or better yet, if you own a business, maybe spending $70,000 is a bit easier.

And here’s a potential game-changer: you can sign up for both a personal Southwest credit card and a business Southwest credit card, and all of those points count towards earning the Companion Pass (R).

So let’s say the business card offers a sign-up bonus of 60,000 points, and the personal card’s sign-up bonus is 50,000 points. Literally, with two credit card sign-ups, you could earn 110,000 Rapid Rewards points and the Companion Pass (R).

I know what you’re thinking. “Can’t I sign up for both the Southwest Plus and Southwest Premier credit cards and earn both sign-up bonuses for potentially 110,000 Rapid Rewards?”

I like where your head is at. Up until April 5, 2018, one person could sign up for both personal credit cards and both sign-up bonuses would count towards the Companion Pass (R). However, Chase (the bank that issues the credit cards) now only allows one personal Southwest Rapid Rewards credit card per person. Total bummer, right?

“Can’t I just sign up for one of the Southwest Airlines credit cards, then transfer over the 50,000 points from my Chase Sapphire Preferred credit card?”

Again, excellent thought. However, while those transferred points from the Sapphire Preferred card turn into Rapids Rewards points, they are not Companion Pass (R) qualifying points. So they’re good for reward flights… but not good for earning points towards the 110,000 needed for the Companion Pass (R).

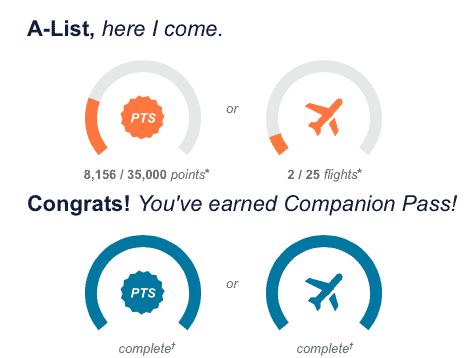

As you can see, the new rule of only signing up for one personal credit card is relatively new. And we got super lucky, because Taryn recently signed up for both personal credit cards and was able to earn the Companion Pass (R) in February.

Taryn signed up for the Southwest Rapid Rewards Plus card in October 2018. She purposely didn’t meet the spending needed to meet the sign-up bonus until January 2019, so that her bonus wouldn’t be realized until the calendar year 2019. On January 1, she then applied for the Southwest Rapid Rewards Premier card.

After meeting the minimum spending requirements for both cards, the sign-up bonuses are posted at the end of each card’s billing period. We were able to earn 110,000 Rapid Rewards points by the end of February, which means Taryn earned the Companion Pass (R) for the rest of 2019 as well as all of 2020. Like we needed any other excuse to travel.

Bottom line: the Southwest Airlines Companion Pass (R) is money. No, it’s not business class. And yes, you’ll still need to check-in online to obtain your boarding position (which is the bane of Southwest Airlines for many people). But buy one, get one (almost) free airfare for 12+ months is an incredibly valuable perk.

Want to know how exactly we plan to use our Southwest Airlines Companion Pass (R)? Check out our awesome plans here. You can also sign up for our travel concierge to get an unlimited credit card and award booking assistance.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.