Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

The Chase 5/24 rule was implemented somewhere around June of 2015. The rule resulted in a massive spike in credit card application denials, regardless of people’s status or credit score.

It’s no doubt that Chase credit cards have big welcome bonuses and fantastic rewards, that’s why a lot of people sign up for them. However, people started to game the system by getting a lot of cards, redeeming the bonuses, canceling the cards, and then re-applying shortly thereafter.

Chase caught on to this trend, realized they were losing money, and hence the 5/24 rule was born. This article explains some of the most common questions people have about the rule and provides some tips on how to get around it.

Read More: Chase Freedom Flex – Best Beginner Credit Card For Travel

1. How Does The Chase 5/24 Rule Work?

The rule is pretty simple, Chase will reject your applications if you have at least 5 existing credit card accounts in the last 24 months. This rule shook the whole credit card and travel hacking community back in 2015, and people weren’t pleased about it.

Chase did not formally publish or recognize this rule, but people started to notice five cards was the common threshold for rejection. The community just accepted the new policy, made a name for it, and it’s been an unspoken rule ever since.

2. Which Credit Card Accounts Count In The Rule?

The 5/24 rule includes Chase and non-Chase credit card accounts. So, if you have three Chase cards and two Amex cards, the rule will still apply to you.

Some examples of these accounts include:

- Personal credit cards you have at any bank. Chase will count these accounts even if you close them, as long as they’re included in the 24-month period.

- All credit cards you’ve opened. Costco, Kohls, and Target are some examples of retailers that issue these cards.

- Credit card accounts that listed you as an authorized user.

If you’re wondering why Chase keeps track of your credit history, it’s because of company policy. Credit bureaus keep track of your personal credit report, and Chase will ask for these reports upon your credit card application.

These reports include all of your existing and closed accounts. They also provides details like the dates you’ve opened your accounts and the payments you’ve made for them.

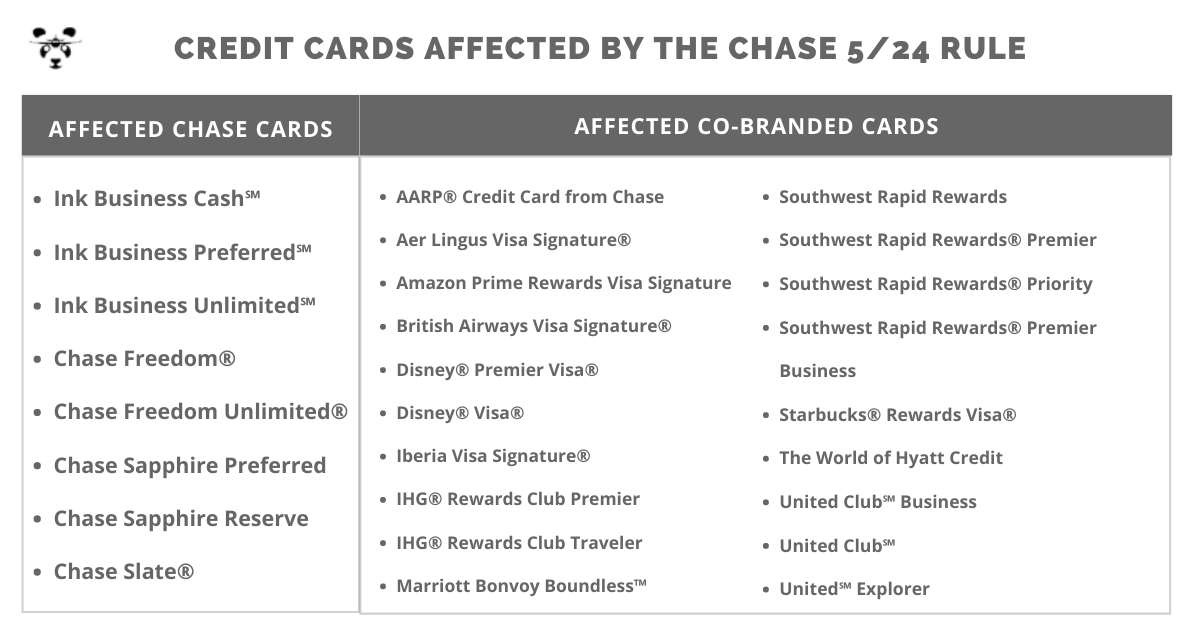

3. What Chase Cards Does The 5/24 Rule Affect?

Before 2018, people could still apply for a few Chase cards despite the 5/24 rule, but that is not the case anymore. Almost every Chase card, especially the popular ones like the Chase Freedom Unlimited, Ink Business Cash, Ink Business Preferred, Chase Sapphire Reserve, and Chase Sapphire Preferred are now subject to the rule.

Related Article: Chase Freedom Unlimited – The Ultimate Everyday Spending Card

4. Is The Rule Used By Other Companies?

The answer is NO, it’s only Chase that has the 5/24 rule. Other companies may have their own application policies though, so we advise you to do some research first.

5. Are There Strategies To Get Around The Chase 5/24 Rule?

Chase made it hard to find loopholes concerning this rule, but there are still a few ways on how to get around it. Here are some strategies you might find helpful:

- Make Sure The First 5 Cards You Get Are Chase Cards – If you have come to the conclusion that Chase cards are right for you, go all-in with 5 cards. Don’t waste your credit card count on other companies, and make sure to get the Chase cards that are useful to you.

- Sign-up For A Chase Card In Person – Some local banks still offer Chase card pre-approvals for their clients, so it won’t hurt to see if you can go over the 5/24 rule.

- Credit Card Offers Via Mail – Banks may also send credit card offers through the mail, and you can complete your application online or through a local bank.

- Keep Your Eye On Chase Updates – Take note that the rules are subject to change. Chase may remove some restrictions or add more, so always keep an eye on blogs and forums.

Related Article: How To Earn Chase Ultimate Rewards Points

Bonus: What Does Points Panda Think?

We know that Chase cards are probably the most sought after credit cards such as the Chase Freedom Unlimited, however, there are other good cards out there too. You can check out Citi, Amex, and Barclay since these companies offer valuable credit cards for miles and points hackers. Just remember, if you’re just getting in the credit card game, make sure your first five cards are Chase cards.

If you need help with credit cards and points redemptions, you can also sign up for our travel concierge. You get one whole year of credit card advice and award booking assistance from our team.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.