Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

5 Things Frequent Flyers Should Know

Discover It Miles is primarily used as a travel credit card because its rewards program focuses on mileage bonuses. The card offers unlimited and fixed mileage earnings for every dollar you spend on whatever purchase you make.

There’s no limit to the number of miles you can redeem, and it can either be in the form of a cashback or a statement credit to any of the program’s partner merchants.

Discover It Miles Basics

We’ve broken down the features of this card for beginners and frequent flyers. These five basic features might help you decide why you should or should not get this card.

1. No Annual Or Foreign Transaction Fees

As travelers and frequent flyers, you’d want to cut down on costs so you can maximize your budget for other travel-related expenses. Typically, annual fees usually cost around $90-$500 while foreign transaction fees can charge at a minimum rate of 3%.

These fees can be a burden so it’s a good thing the Discover It Miles’ is a no-annual-fee card and so also cardholders don’t have to a penny on annual fees. It’s also a card that has zero foreign transaction fees so cardholders can splurge all they want while traveling abroad without having to worry about added costs.

In addition to that, Discover will not charge late fees if it’s your first time missing a payment on your balance. However, there is a cash advance fee of $10 or 5% of the amount of the borrowed amount (whichever is higher). Discover is also having a limited time offer of 3% intro fees on balance transfers.

2. Unlimited Miles Earnings Per Dollar Spent

Some credit cards like Discover It and Chase Freedom have rotating categories per quarter that require activation. These cards also have spending limits, so you can’t really maximize the rewards you’ll earn.

However, Discover It Miles offers cardholders unlimited miles earnings at 1.5x per every dollar spent on all purchases. The rewards you earn will not expire either.

3. Bonus Miles Earnings with Discover It Miles

Discover It Miles doesn’t have a traditional sign-up bonus where you get bonus miles or cash after applying. However, Discover will double the miles you’ve earned at the end of the year.

For example, if you earn 25,000 miles over the course of the year, you’ll get an additional 25,000 miles at the end of the year. If you calculate it, that’s about $500 worth of cash you can use to redeem flights, hotel stays, and other promotions.

4. Introductory 0% APR On Purchases

There’s an introductory 0% APR period of 14 months which means you can make purchases without incurring any interest. The variable APR is 11.99% to 22.99% after the intro period.

5. Discover It Miles Flexible Redemption Options

Discover It Miles allows cardholders to redeem rewards quickly without any hassle. There are no blackout dates so you can choose to redeem anytime, whether it’s for flights, hotels stays, or car rentals. On top of that, you’ll get a $30 in-flight WiFi credit.

What Points Panda Thinks

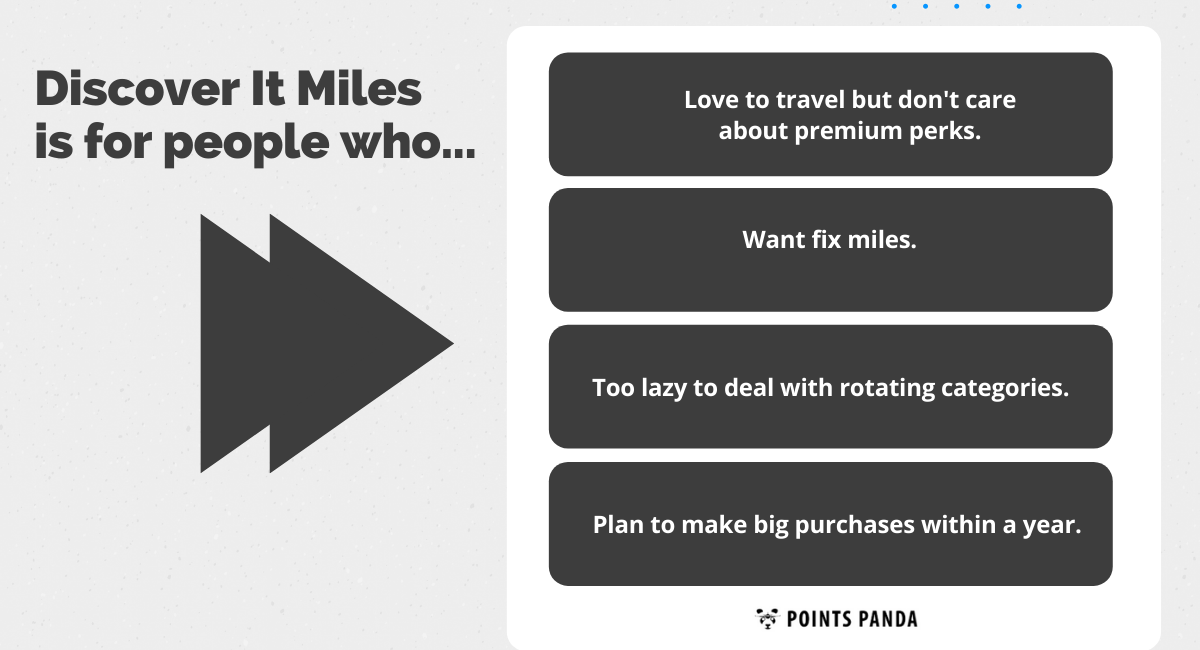

People who are planning to make multiple big purchases within a year can benefit a lot from the card. We do recommend you use it exclusively so you can maximize the card’s 0% APR period.

There are also other 0% APR cards such as the Discover It, Amex Blue Cash Preferred, and Chase Freedom. Try to compare which one works best for you. The cards mentioned are cashback cards which means you get cashback for every dollar you spend. The cashback percentages are usually at 5% on rotating categories.

But if you think the rotating categories don’t match your spending habits, a credit card with fixed rates like Discover It Miles is better for you.

Travelers can greatly benefit from this card since it has zero annual and transaction fees. However, if you’re someone who’s after premium travel perks and bonuses, you might want to get cards with annual fees. Most business cards like the Delta Reserve Business or the Amex Platinum Business offers free access to VIP lounges, priority check-ins, free hotel stays, and more.

If you need credit card advice or award travel assistance, you can sign up for our travel concierge. We offer one full year of unlimited credit card consulting so you don’t have to do all the tedious work.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.