Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

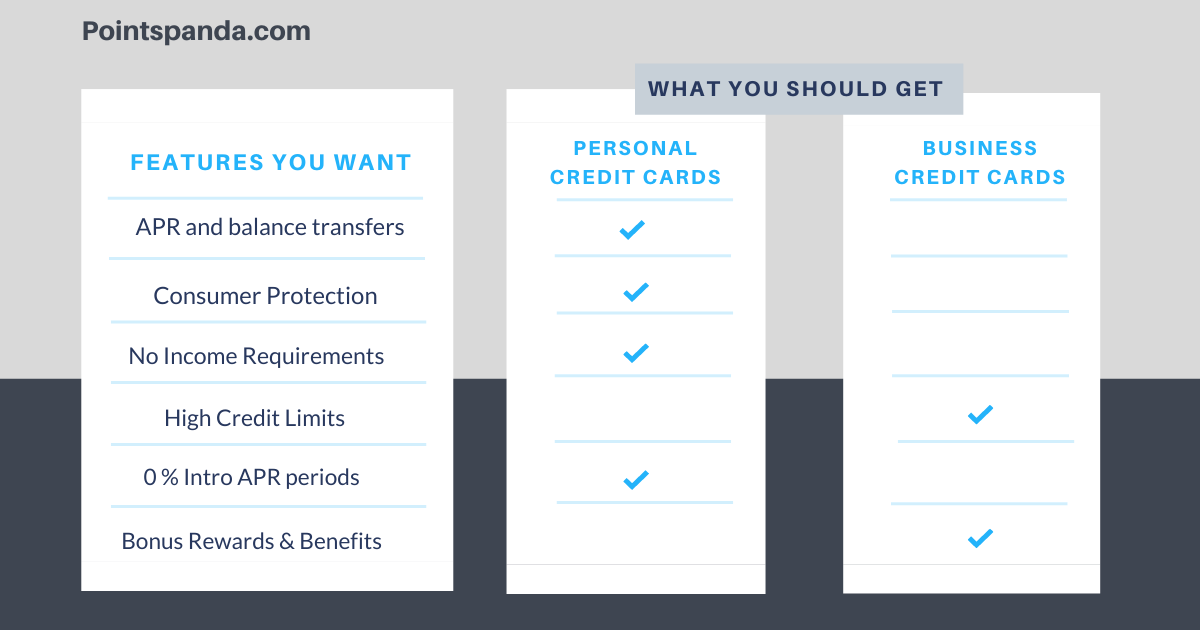

It’s no doubt credit cards are the backbone of today’s economy. Why? Try imagining yourself without one. Kidding aside though, people need to be aware of two types of credit cards: personal credit cards and business credit cards.

Choosing which one to get is still a dilemma, even for people who have a credit history. If you’re a total newbie, here are some pointers to take note of.

Difference Between Personal Credit Cards and Business Credit Cards

Both cards aren’t entirely different from one another because they both have annual fees, interest, and rewards. However, there are major differences between the two every card applicant must take note of. It’s vital for you to pick the right card to maximize their benefits.

Now, what are these differences? Let’s find out.

1. Funding Or Credit Limits

Business credit cards will always have higher credit limits compared to personal credit cards. Why? It’s because businesses have huge operating costs and credit card companies know that if they help these businesses earn revenue, they will benefit from it too.

Sure, you need to pay expensive annual fees and must have a high credit score but the benefits are also worth it. For those businesses that earn low to average income, there are also small business credit cards that are easy to get approved for.

However, not all businesses have huge expenses so there are times that getting a personal credit card is advised. For example, a personal card is perfect for business owners who run a small digital marketing agency with just 3-5 members on their team. Just remember not to give your employees authorization over your personal card because you will be held liable for any debt incurred.

2. Zero Percent Intro APR periods for Personal Credit Cards and Business Cards

There are 0% APR cards for both personal and business cards. The difference is that credit card companies are usually generous when giving 0% APR periods to personal credit cardholders. These 0% APR periods usually last between 12-24 months and apply to purchases and balance transfers.

Business cards have a shorter 0% APR period that usually last between 9-12 months, and most cards only cover purchases. If ever there are business cards that offer balance transfers too, it would usually have expensive transfer fees that make it harder for you to move your debts.

3. Credit Score Reporting

There’s no income requirement if you wish to apply for personal credit cards, but you do need to have good credit scores. Credit card companies work with Equifax, Experian, and TransUnion which are the three credit bureaus that keep track of your scores.

Most business credit cards report all your spending activities to both commercial and personal credit bureaus. Whenever you apply for a business card, there’s usually an agreement where you will be personally liable for any debt your business accrues.

However, some companies like Citi and Bank of America® only report your business credit card pending activities to commercial bureaus. The top commercial credit bureaus include Dun & Bradstreet, Equifax Small Business, and Experian Business.

4. Bonus Categories

Bonus categories are expenses that a certain credit card covers, wherein you can earn points for every dollar you spend on the mentioned categories. Some examples of bonus categories include groceries, gas, streaming services, and more.

For example, personal credit cards like the Amex Blue Cash Preferred has a cashback rate of 6% on bonus categories like groceries and streaming services. You can see that most of these categories are common personal purchases.

On the other hand, business credit cards such as the Chase Ink Business Cash Card include bonus categories like office supplies and internet services. On top of that, you should take note to get a card with flat rates if you think you’re going to spend on a variety of categories.

Just remember that when choosing a rewards credit card, make sure that you are actually spending money on the bonus categories of that card.

5. Consumer protections

Generally speaking, there aren’t a lot of consumer protection laws that cover corporate and small business credit cards. The TILA (Truth in Lending Act) and Credit Card Act of 2009 only applies to personal credit cards. However, there are still a few credit companies that would extend protections to business owners as a courtesy gesture.

It’s best to review the policies carefully before you sign up for any business card.

What Points Panda Thinks

Both credit cards have pros and cons so there’s a healthy debate whether a personal credit card is better than a business credit card. However, a rule of thumb when choosing credit cards is to always look at the bonus categories and rewards program.

If you think you’ll be spending on bonus categories like groceries and gas, get personal cashback cards. If you think you’re going to spend a lot on travel and office supplies, then get a business card.

You can maximize every dollar you spend if you choose the card that specifically caters to your spending habits.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.