Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

For those of you that didn’t know, American Express has stopped issuing the AMEX Premier Rewards Gold card. They revamped the old card a few years back and it’s now called the American Express Gold Card.

Looking Back At The Old Card

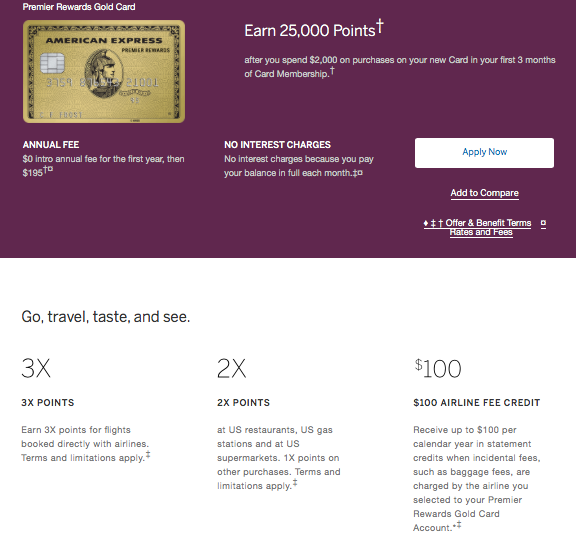

Just to give you a little bit of background of the old Premier Rewards Gold card, here were some of its features. Please note this card is no longer issued, we’re keeping this information here for the sake of research and educational purposes.

- Had a $195 annual fee (waived for the first year)

- Had a variable sign-up bonus of 25,000-50,000 Membership Reward points (after $2,000 in spending within three months)

- Had no foreign transaction fees

- 3x points on airline purchases (must be booked directly from airline) as well as 2x points on U.S. restaurants, gas stations, and supermarkets.

- $100 in airline fee credit; this can be used for checked bags, onboard food/drinks… or potentially redeemable for airline gift cards

Why Did They Change It?

The old PRG card has some decent perks but it wasn’t up to par with the Chase Sapphire Cards. The 3x points on travel purchases were okay but it was only limited to airline purchases.

Plus, the annual fee was $195/year and it was more expensive than the typical $95-annual fee of the Chase Sapphire Preferred. Why would you pay $100 more when the CSP’s bonus categories are broader?

American Express realized that they needed to make some changes and revamp the old “Premier Rewards Gold” card into the American Express Gold card.

Read More: New Amex Coronavirus Categories (2020)

Amex Gold Card Perks & Benefits

The American Express Gold Card has a higher welcome offer compared to the PRG. New cardholders were getting 60,000 Membership Rewards points after spending $4,000 within the first six months of opening an account.

The card’s annual fee has also increased to $250 and even though it’s $60 higher than its predecessor, it’s justified by its perks.

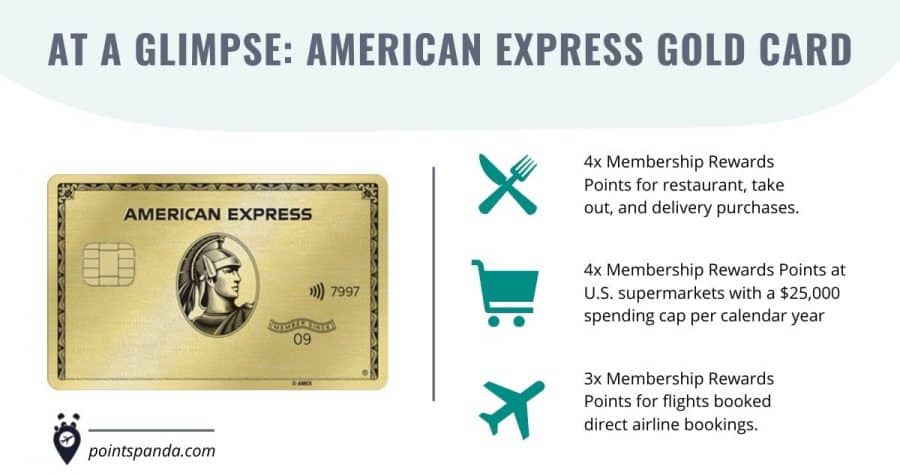

The points earning are bigger and broader for the Amex Gold Card. Cardholders will earn:

- 4x Membership Rewards Points for restaurant, take out, and delivery purchases.

- 4x Membership Rewards Points at U.S. supermarkets with a $25,000 spending cap per calendar year.

- 3x Membership Rewards Points for flights booked direct airline bookings.

Cardholders are also entitled to a $100 annual airline credit and a $120 annual dining credit for Seamless, Grubhub, The Cheescake Factory, Boxed, Ruth’s Chris Steak House, and participating Shake Shack branches.

All these perks make the Amex Gold Card’s annual fee easier for your pockets.

Pros

- Incredibly high rewards for dining and shopping at US supermarkets.

- Statement credits can cover a big chunk of your annual fee.

Cons

- Welcome bonus is low if matched against the $4000 spending threshold.

- Annual airline statement credits have a lot of restrictions.

Redeeming Your Amex Membership Rewards Points

So… what can you do with Membership Rewards points? A LOT! AMEX has 16 airline transfer partners and 3 hotel transfer partners to choose from.

In fact, my wife and I got a really good redemption deal a few years back where we transferred our Membership Rewards points to British Airways. We got roundtrip tickets from Washington-Dulles to Dublin which only cost 26,000 British Airway miles.

Read More: Credit Card Points Transfer Bonuses: Chase to IHG and AMEX to Hilton

One big caveat with Avios: there can be significant taxes and fees associated with the reward ticket. For example, the most natural Avios redemption for most of us in the U.S. is flying on British Airways to London (because, duh).

However, the taxes and fees associated with a one-way business class ticket can be over $500. Economy tickets can also be $200+. Each person has his/her or priorities, but those kinds of fees hardly make points redemption worth it. So as long as your strategy is short, non-stop flights on partner airlines (such as the OneWorld airline alliance), Avios could be a great option.

Read More: British Airways Visa Credit Card Review

Lastly, transferring Membership Rewards points to Delta Airlines could be a good option for novice credit card points collectors or infrequent flyers. In general, the Delta SkyMiles frequent flyer program is far inferior to either American Airlines or United Airlines. I wouldn’t recommend anyone start collecting Membership Rewards points with the sole intent to transfer them to their Delta SkyMiles account. There are SO MANY other options that can provide you with better value!

But I also recognize that many of us already have a stash of SkyMiles in our pockets. And using Membership Rewards points could be a great way to top off your SkyMiles account for a high-value award ticket.

Delta is notorious for not publishing award charts and for having variable pricing on their award tickets, but I have found great redemption options on partner airlines, including business class flights from the U.S. to Shanghai on China Eastern Airlines.

“But I see Emirates and Etihad are transfer partners, too, and I saw those awesome first-class seats on Facebook. Shouldn’t I try to transfer into one of those frequent flyer programs if I want to fly on Emirates or Etihad?”

You would think, but actually, there are better options. For example, Alaska Airlines miles are a much better redemption option for award flights on Emirates, and American Airlines miles are a better way to redeem for award flights on Etihad. It’s a bit counterintuitive, but each frequent flyer program has its own quirks, and the combination of a more favorable award chart as well as cheaper taxes and fees make Alaska/AA more strategic options.

Amex Gold Card Vs Chase Sapphire Preferred

On paper, the Amex Gold Card looks like the solid choice because it only has a $250 annual fee compared to the $550 annual fee of the Chase Sapphire Reserve.

However, if you take advantage of the Chase Sapphire Reserve’s benefits, the annual fee would be easier to swallow. For example, the CSR’s $300 annual travel credit and Priority Pass Access can easily cover a big chunk of the annual fee cost.

The CSR’s welcome offer is 50,000 Ultimate Rewards Points after spending $4,000 within three months of getting the card. It’s 15,000 points higher than the Amex Gold Card even if they have the same spending threshold.

Final Thoughts

American Express Membership Rewards points are another great credit card currency to consider when developing your strategy. Overall, I value Membership Rewards more than Citi ThankYou points, but less than Chase Ultimate Rewards points.

If you want to get expert credit card advice on which cards to get and how to properly redeem your points, we offer a full-service travel concierge. We do all the research and hard work so you can just sit back, relax, and enjoy the perks of your card.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.