Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

A majority of states in the US currently have “Stay Home, Stay Safe” directives in place into May 2020. However, it is not too early to begin earning miles and points from credit cards for travel after we have flattened the curve with the COVID-19.

We have hand-picked 5 (five) current offers for travel credit cards that have incredible welcome bonuses, without hurting your wallet during these difficult times.

Credit Card Criteria

Each credit card recommended in this post:

- Offers exceptional rewards value in either frequent flier miles, hotel points, or cash back offers

- Offers the ability to perform a balance transfer, with no more than a 5% balance transfer fee

- Has an annual fee of under $100 (or even $0!)

Recommended Credit Cards for Travel

- British Airways Visa Signature Card

- IHG Rewards Premier Credit Card

- Hilton Honors American Express Surpass Card

- Citi AAdvantage Platinum Select World Elite MasterCard

- Chase Freedom Flex

Chase British Airways Visa Signature Card

Welcome Bonus

The Chase British Airways Visa Signature Card offers up to 100,000 British Airways Avios: Earn 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening and earn an additional 25,000 Avios after you spend $20,000 in the first 12 months of account opening.

While your mileage may vary (no pun intended), you may not be able to receive this credit card welcome if you have received five (5) or more personal credit cards in the past 24 months. This general rule referred to as the “Chase 5/24 Rule“, applies to credit cards issued by any bank which may appear on your credit report.

Perks

Earning Avios

The British Airways Visa Signature credit card earns up to 3 British Airways Avios (points) per dollar spent:

- Earn 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL.

- Earn 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel.

- 1 Avios for every $1 spent on all other purchases.

Travel Benefits

There are no foreign transaction fees, making this a great card to use when traveling overseas.

Fees

The British Airways Visa Signature card does have a $95 annual fee.

Potential Rewards

Using Avios

British Airways Avios can be used to book flights on British Airways flights, as well as Iberia and Aer Lingus which are owned by the same management as British Airways.

Also, Avios can be used for flights on Oneworld Alliance member airlines such as American, Cathay Pacific, and Qantas; as well as a few other partner airlines including Alaska Airlines and airBaltic.

You can book Avios reward flights here. You do need to register for a British Airways Executive Club account before searching for Avios award flights.

Example Itinerary

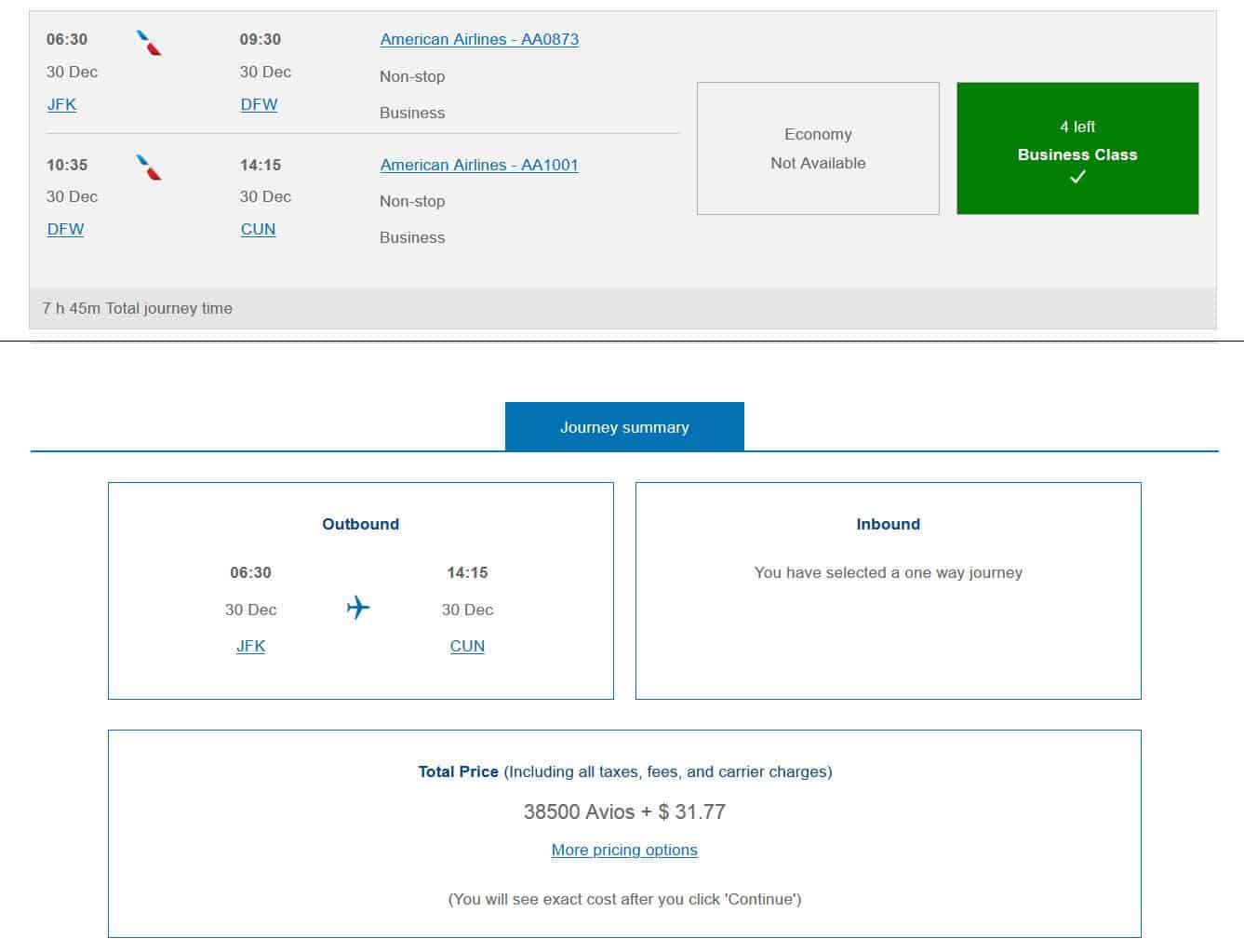

Let’s assume that the situation with SARS-Cov-2 has improved by the end of the year, and we would like to visit Cancun. Using the booking site for Avios award flights, we can see that award flights in Business Class from New York (JFK) to Cancun (CUN) are available for 38,500 Avios plus $36.22 in taxes and fees, per passenger:

It should be noted that Avios award tickets are distance-based, so the number of miles required to book an award flight depends on the distance of each flight. Furthermore, when multiple flights are booked as part of an award ticket, the cumulative cost in miles to book the award ticket, is the sum of the total miles required for each of the individual flights.

While British Airways does not publish its own award chart for flights, Flyertalk member KARFA has posted an award chart on this Flyertalk thread, if you are interested.

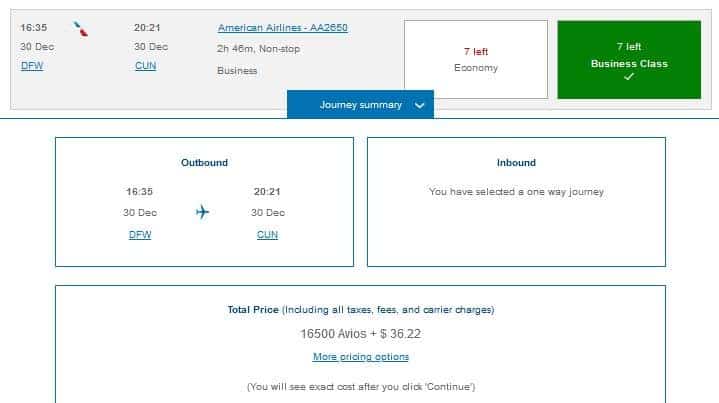

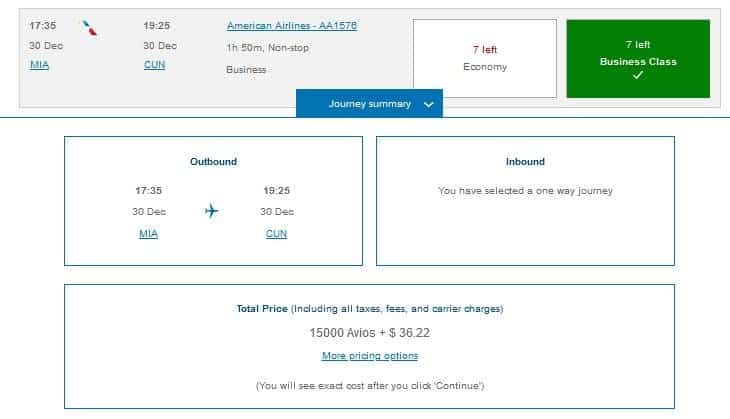

The subject of how to use British Airways Avios is another subject for another post, but for now it is worth mentioning that since Avios awards are priced based on the distance of each individual flight, direct flights from Dallas and also from Miami would cost fewer Avios.

Dallas (DFW) to Cancun (CUN) nonstop can be booked on the same date in Business Class for just 16,500 Avios plus $36.22 in taxes and fees, per passenger.

And Miami (MIA) to Cancun (CUN) nonstop on this same date can be booked in Business Class for a mere 15,000 Avios plus $38.22 in taxes and fees:

Card Summary

In summary, the Chase British Airways Visa Signature credit card has no foreign transaction fees and can be very useful travel on short-distance award flights.

Chase IHG Rewards Premier Credit Card

Welcome Bonus

The Chase IHG Rewards Premier Credit Card offers a HUGE welcome bonus of 140,000 IHG Rewards points after spending $3,000 in the first 3 (three) months of opening a credit card account.

As with other Chase cards including the British Airways Visa Signature Card above, the same Chase 5/24 Rule restrictions apply to the IHG Rewards Premier credit card.

Perks

The IHG Rewards Premier card includes IHG Platinum Elite status.

IHG Platinum Elite Status Benefits

Benefits of IHG Platinum Elite status include room upgrades, extended check-out (subject to availability), complimentary internet, “Raid the Bar” or “Raid the Mini Bar” credit, and a welcome amenity.

Extra Reward Night Benefits

The IHG Rewards Premier card includes two sorts of reward night benefits.

After each year of being a cardholder, you will receive an Anniversary Night award, valid for a free night at IHG Hotels with award nights available for 40,000 IHG Rewards points or less.

In addition, when IHG Rewards Premier cardholders book a stay of 3 (3) or more nights, the 4th night is free. With this benefit, cardholders using IHG Rewards points will be charged the Reward Night point redemption rate for the first three (3) nights, and zero (0) points for the 4th night.

Earning Points

In addition to IHG Platinum status and bonus reward nights, the card earns up to 25 IHG Rewards points per dollar spent:

- 26 points per dollar spent at IHG Hotels and Resorts

- 5 points per dollar on travel, gas stations, and restaurants

- 3 points per dollar spent on all other purchases

Travel Benefits

IHG Rewards Premier cardmembers can receive a credit of up to $100 towards applications for either Global Entry, TSA Pre-Check, or NEXUS. This free credit is available once every four (4) years.

Fees

This is one of the best credit cards for travel overseas, as there are no foreign transaction fees. The Chase IHG Rewards Premier credit card has an $89 annual fee.

Potential Rewards

IHG Hotels

IHG Rewards Club is the rewards program for IHG Hotels & Resorts, including Kimpton, InterContinental, Crowne Plaza, Candlewood Suites and Holiday Inn/Holiday Inn Express:

Example IHG Rewards Club Booking

You can search for and book IHG Rewards Club reward nights here.

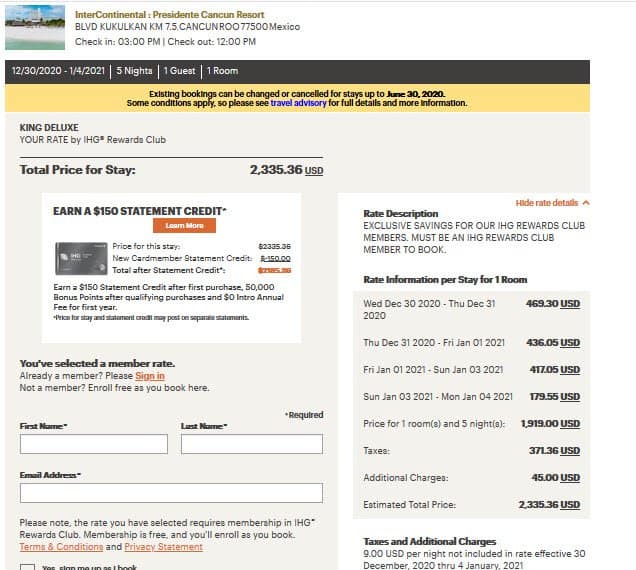

Hotels, especially in resort destinations, can be expensive over New Years. The nightly rate at the InterContinental Presidente Cancun Resort for example, is ~$380 for December 30, 2020 – January 4, 2021.

Including resort fees and taxes, the final bill for this stay would over $2,300!

However, Award nights at the InterContinental Hotels Presidente Cancun Resort can be booked for 35,000 IHG Rewards points, per night. And because, the 4th night is free, the total cost in points is 140,000 (35,000 points/night x 4 nights).

This is an incredible example of how far IHG Rewards points earned from the IHG Rewards Club Premier card can go.

Card Summary

In summary, the Chase IHG Rewards Premier Card is a fantastic credit card for travel after being quarantined. In addition, the card comes with IHG Platinum Elite status and can be used to save thousands of dollars on hotel stays.

American Express Hilton Honors Surpass Card

Welcome Bonus

The Hilton Honors American Express Surpass Card offers a fantastic welcome bonus of 130,000 Hilton Honors bonus points if you spend $2,000 on purchases in the first three (3) months of being a cardmember.

Perks

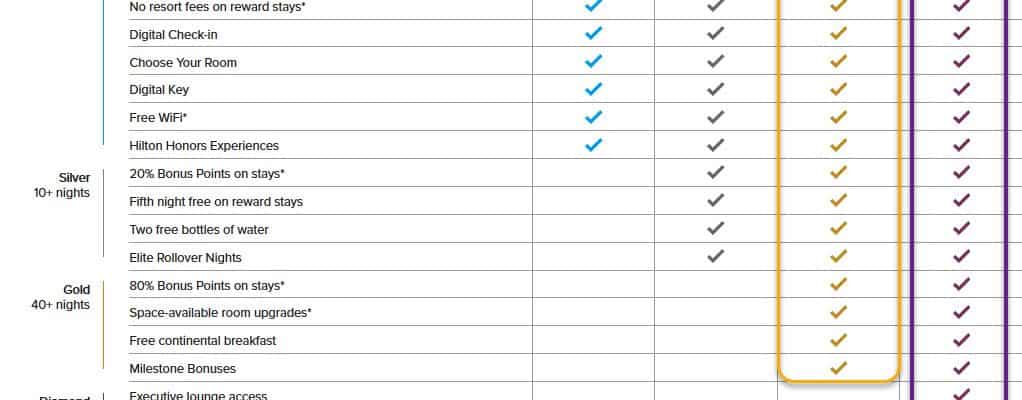

The American Express Hilton Honors Surpass Card comes with complimentary Hilton Honors Gold status.

Hilton Honors Status

Benefits of Hilton Honors Gold Status (outlined by the yellow box above) include an 80% bonus on points earned each stay, room upgrades (up to executive level rooms, pending availability), and free continental breakfast. And to help your points go farther, your fifth night is free on reward stays.

Furthermore, you can even earn Hilton Honors Diamond status (outlined in the purple box above) through the next calendar year by spending $40,000 in eligible purchases on your Honors Surpass Card. Honors Diamond status benefits include a 100% bonus on points earned during each stay, guaranteed executive lounge access (where available), premium wi-fi, and space-available room upgrades (up to a 1-bedroom suite).

Hilton Gold and Diamond benefits vary from hotel to hotel.

Free Weekend Night Reward

Each year that Hilton Honors Surpass card members spend $15,000 on the card in eligible purchases, they will receive a Free Weekend Night reward from Hilton Honors.

The Free Weekend Night Reward can be redeemed for one weekend night standard accommodation at eligible Hilton properties. Keep in mind, there are some Hilton properties that are excluded from the Free Weekend Reward Night.

Earning Hilton Honors Points

The Hilton Honors Surpass Card earns up to 12 Hilton Honors bonus points per dollar spent:

- 12 Honors bonus points per dollar spent at Hilton Hotels & Resorts

- 6 Honors bonus points per dollar spent at U.S. restaurants, supermarkets, and gas stations

- 3 Honors bonus points per dollar spent on all other eligible purchases.

Travel Benefits

The Hilton Honors Surpass credit card has a lot of great perks for travel after COVID-19, even when not staying at a Hilton Hotel.

In addition, the Surpass Card comes with fraud protection, car rental loss and damage insurance; as well as a 24/7 Global Assist Hotline to provide medical, legal, and financial or other services. This hotline, which is available if you are traveling 100+ miles from home, can assist with medical emergencies, passport replacement, and missing luggage.

Priority Pass Select Membership

The Honors Surpass card also includes complimentary Priority Pass Select membership, providing access to over 1300 airport lounges around the world. Furthermore, there are even a number of airport restaurants where Priority Pass members may receive a credit towards their final bill.

With this benefit, Honors Surpass card members may receive up to 10 free airport lounge visits each year, once enrolled.

Fees

Just like the British Airways and IHG Rewards Premier cards, the Honors Surpass Card also has no foreign transaction fees.

The Hilton Honors Surpass Card has an annual fee of $95.

Potential Rewards

Hilton Hotels

Hilton Honors is the loyalty program for Hilton Hotels which includes Hilton Hotels & Resorts, Conrad Hotels & Resorts, DoubleTree, Embassy Suites, and Homewood Suites.

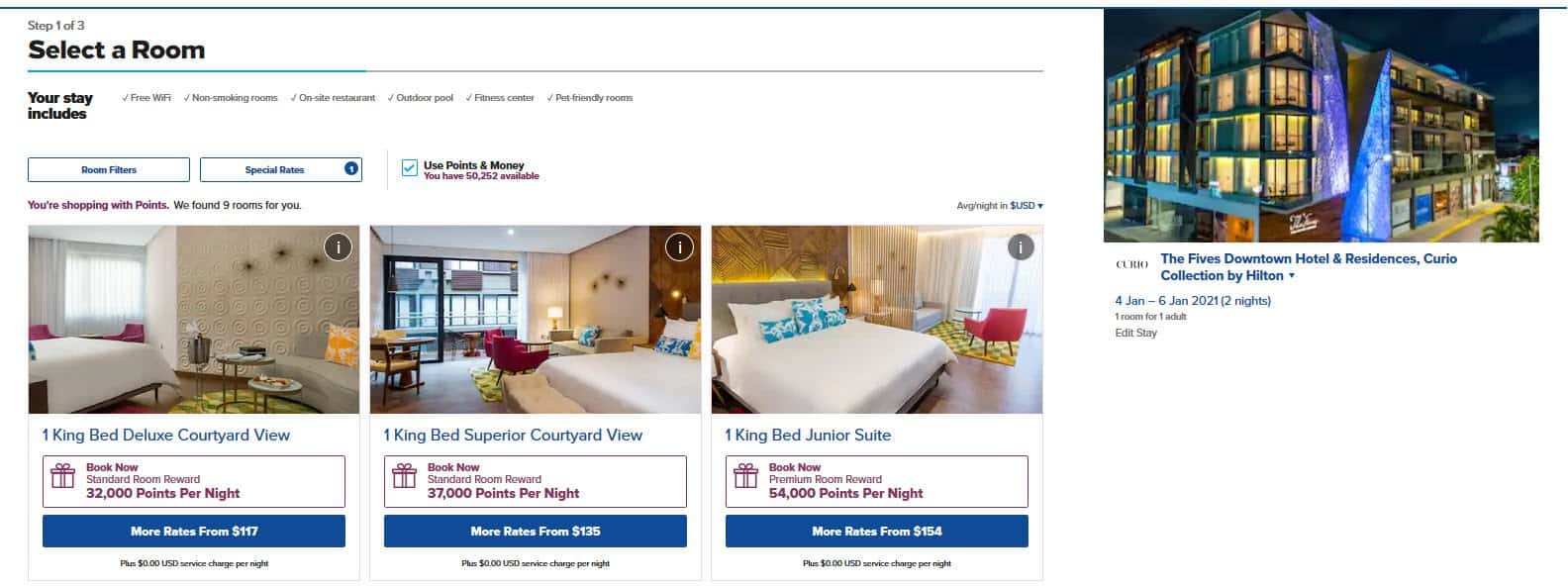

Example Hilton Hotels Booking

You can book Hilton Hotel reward nights here.

If we search for Hilton Hotels in the Cancun area for our post-Coronavirus trip early next year, we can see that we have more than enough Hilton points to book two (2) nights in a Junior Suite at Hilton’s (Curio) Fives Downtown Hotel & Residences. This stay would cost 54,000 Hilton points per night, for a total of 108,000 Hilton Honors points:

Card Summary

The American Express Hilton Honors Surpass credit card has a lot of great travel benefits. This is a great card to use at Hilton Hotels, with the Hilton Gold and potentially Diamond status, and provides good value in the ability to earn and redeem reward stays.

In addition to the ability to perform balance transfers, the Global Assist Hotline benefit can be invaluable when traveling, and Priority Pass membership can upgrade your experience while waiting at an airport.

Citi AAdvantage Platinum Select World Elite MasterCard

Welcome Bonus

You can earn up to 50,000 American Airlines AAdvantage miles if you are approved for the card and spend $2,500 on purchases on the card in the first three (3) months after opening the account.

Perks

American Airlines Benefits

The Citi AAdvantage Platinum Select Card comes with benefits to improve your experience when flying American Airlines.

For starters, you can get a free checked bag when flying American Airlines on domestic itineraries, for you and up to four (4) companions.

You will have access to Preferred Boarding, after Priority Boarding is completed, but before the rest of economy boards.

Onboard, you can receive a 25% savings on eligible food and beverage purchases made with your Citi AAdvantage Platinum Select card.

In addition, card members can receive a $125 American Airlines Flight Discount Certificate after spending $20,000 or more on your Platinum Select World Elite MasterCard each year.

Earning American AAdvantage Miles

The Platinum Select World Elite MasterCard earns up to 2 AAdvantage miles for every $1 spent on eligible purchases:

- 2 AAdvantage miles for every $1 spent on American flight purchases

- 2 AAdvantage miles for every $1 spent at restaurants

- 2 AAdvantage miles for every $1 spent at gas stations

- 1 AAdvantage mile for every $1 spent on other purchases

Fees

The credit card is also great for international travel, as it has no foreign transaction fees.

The Citi AAdvantage Platinum Select Card comes with a $99 annual fee, but it is waived for the first 12 months of being a card member.

Potential Rewards

Using American Airlines AAdvantage Miles

American Airlines AAdvantage miles can be used to book flights on American and American Eagle flights, as well as oneworld Alliance member airlines including British Airways, Cathay Pacific, and Qantas.

Searching for American Award Seats

You can search for and book AAdvantage Award flights directly from the American Airlines homepage.

Example Itinerary

Let’s say that we would like to return to New York on January 6, following the award stays at the InterContinental Presidente and Fives Downtown. If we search American’s website, we see that award flights are available:

The cost for this itinerary would only be 20,000 American miles plus $56.50 in taxes and fees, per passenger:

American Airlines has a zone-based award chart wherein the miles required for an award chart are determined by where you are traveling to and from.

In addition, American Airlines occasionally offers Web Special fares for fewer miles. So while an award ticket from Cancun to New York-JFK would typically cost 25,000 miles each in Business Class, the award ticket we found is being offered at a discount for 20,000 miles each since it is a Web Special fare.

Card Summary

The Citi AAdvantage Platinum Select World Elite MasterCard credit card provides great benefits for travel on American Airlines after COVID-19, including Preferred Boarding, a Free Checked bag, and the opportunity to receive a $125 flight discount each year.

This is a great low-fee credit with a waived annual fee for the first year, and the ability to perform balance transfers.

Chase Freedom Flex

Welcome Bonus

The Chase Freedom Flex credit card allows you to earn $200 cashback or 20,000 Ultimate Rewards points, after spending $500 on eligible purchases within the first 3 (three) months from account opening.

The same Chase 5/24 restrictions that apply to the Chase British Airways Visa Signature and Chase IHG Rewards Premier Cards apply to the Chase Freedom Card.

After spending $500 on your credit card in eligible purchases, you will receive 20,000 Chase Ultimate Rewards bonus points, which can be redeemed for cash back, used in the Chase Ultimate Rewards Travel Portal, or transferred to travel partners.

Perks

Earn up to 5% Cash Back

The Chase Freedom Card allows you to earn up to 5% cash back on purchases of up to $1,500 each quarter in revolving categories.

As shown above, the bonus for April-June 2021 is for spending on gas stations and home improvement stores so maybe it is a good time to fill up your tanks or do some renovations in the house.

In addition, through Chase’s partnership with Lyft, Chase Freedom cardmembers may earn 5% cashback on Lyft rides through March 22, 2021.

Redeeming Ultimate Rewards Points for Cash Back

The welcome bonus is provided in the form of 20,000 Chase Ultimate Rewards bonus points, which can be redeemed for cash back via the Chase Ultimate Rewards Portal (sign-in required). When doing so you have the opportunity to either redeem the cash back reward for a credit card statement credit, or have the cash back deposited in your bank account.

Redeeming Ultimate Rewards Points for Purchases

You can also redeem Chase Ultimate Rewards points in the Ultimate Rewards Portal for purchases with Amazon, Apple, and gift cards for hundreds of retailers and restaurants (sign-in required). While you can get 0.8 cents for each Ultimate Reward point redeemed for purchases with Amazon, you can get 1 cent per point for purchases with Apple and for gift cards.

Redeeming Ultimate Rewards Points for Travel

In addition, the Chase Ultimate Rewards Travel Portal allows you to redeem the points from Chase credit cards directly for flights, hotels, rental, cars, cruises and experiences such as tours and museums. When travel is booked with points through the Ultimate Rewards Travel portal you can receive up to 1.25 cents of value for each point.

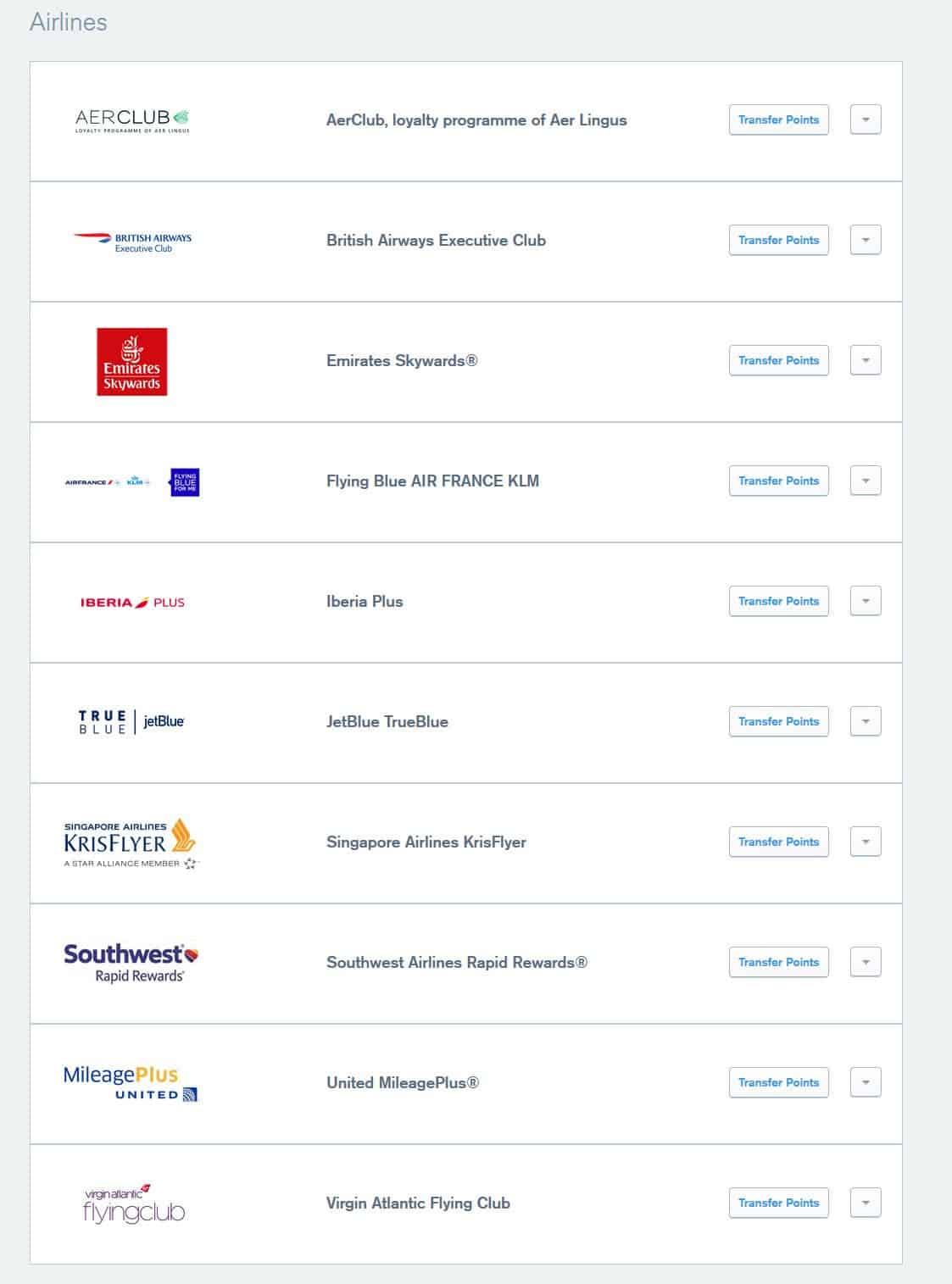

You can also transfer Ultimate Rewards points to a number of hotel and airline partners, all at a 1:1 transfer ratio.

Airline transfer partners include British Airways, Emirates, Singapore Airlines, and United:

The hotel transfer partners are IHG Rewards Club, Marriott Bonvoy, and World of Hyatt:

DoorDash Benefits

Finally, the Chase Freedom Card comes with partner benefits for DoorDash.

A complimentary 3-month subscription to DashPass is included. Dash Pass is DoorDash’s subscription service, which provides an unlimited $0 delivery fee on DoorDash orders of $12 or more.

Fees

The Chase Freedom card has no annual fee, making it a great credit card to keep in your wallet to earn cash back and travel rewards.

The card has an introductory APR rate of 0% on purchases within the first 15 months of having the card.

Potential Rewards

As previously mentioned, the rewards earned from the Chase Freedom Flex welcome bonus can be used for cash back, purchases, travel booked through the Ultimate Rewards portal and transfer them to airline and hotel partners.

While you can get 0.8 – 1.25 cents per point for Ultimate Rewards points redeemed for cash back, purchases and travel booked through Ultimate Rewards, you can often exceed that by transferring points to travel partners.

Ultimately, you should do what makes the most sense for you when redeeming Ultimate Rewards points, using them for cash back, or using them for purchases.

Card Summary

The Chase Freedom Card is one of the best credit cards for travel to add to your wallet with no annual fee.

The Freedom Card can also be leveraged to earn up to 5% cash back on revolving quarterly categories for purchases at gas stations, grocery stores, and department stores.

The Chase Freedom Card is more than simply a cash back card, and can be used to earn pay for purchases and gift cards, and can be used to book travel after COVID-19 by transferring to airline and hotel programs like British Airways, Singapore Airlines, and IHG Rewards.

What Points Panda Recommends for Travel Credit Cards

We currently do not know the full travel and financial implications of COVID-19. But we believe that it is never too early to start earning miles and points from credit cards for travel when it is safe to do so again.

We encourage you to start small, perhaps with the Chase Freedom Flex since it has no annual fee. Also, you need to understand what each card offers and match that to your spending capabilities and habits. If you need credit card or award travel assistance, you can sign up for our travel concierge and get one full year of unlimited consultation.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.