Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

With SARS-CoV-2 infecting people exponentially, there’s hardly a better time to hunker down at home and focus your spending on a strategy that will gain you a ton of points for the future. When we receive the all-clear, you’ll be ready to jump on all of those open award seats. With all of the uncertainties in the world today, keep these tips in mind and arm yourself with the best credit cards for the coronavirus pandemic.

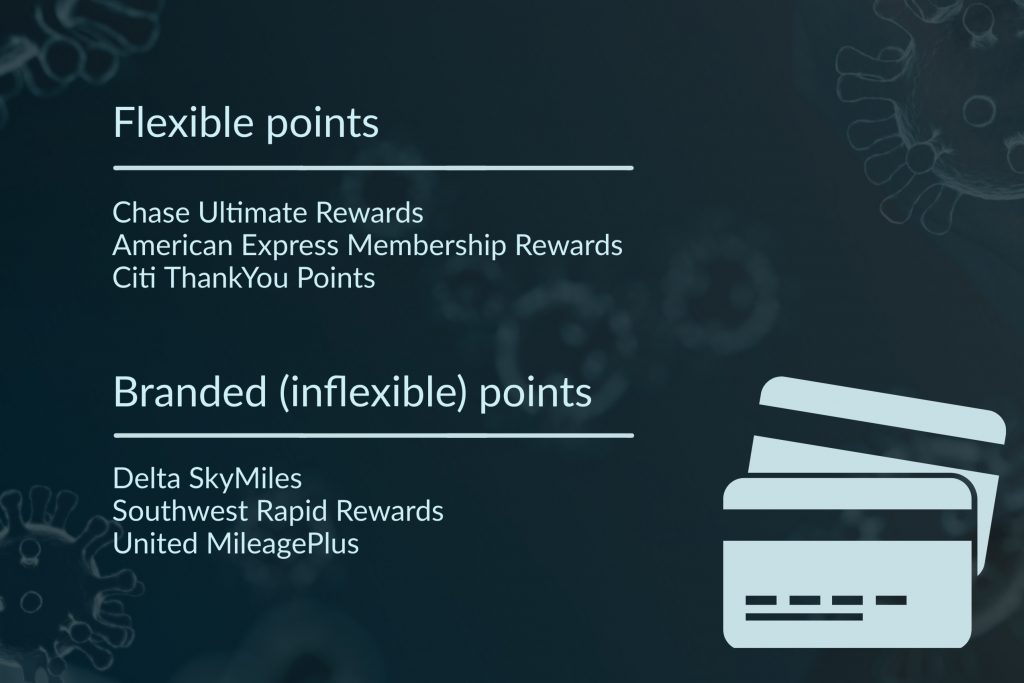

Consider a credit card with flexible points

We don’t know which travel providers will survive COVID-19, so avoid amassing too many points with one provider. Instead, consider rewards credit cards that earn flexible points, like Chase Ultimate Rewards (UR), American Express Membership Rewards (MR), or Citi ThankYou Rewards (TY). With these points, you can transfer to dozens of airline and hotel partners, or even redeem them for cashback if necessary.

The best credit card prepares you for the worst with 0% APR

Spending to earn a bonus can be scary right now with rampant layoffs due to coronavirus. Play it safe, and consider credit cards with an introductory 0% APR. If you already have a debt to carry over or to consolidate, you might also consider balance transfer cards.

Optimize your credit card for coronavirus spending habits

For most of us, our spending over the next few months will mean getting a credit card with bonuses on groceries and other essential spending. While the coronavirus threat has halted travel for the immediate future, it may not be the best time to open a credit card with travel benefits that you can’t use.

Best credit cards for the coronavirus

Take a look at our top recommendations for credit card spending during the coronavirus outbreak.

Chase Freedom Flex

Points Panda loves the Chase Freedom Flex. The card has a $200 welcome offer after spending $500 within three months of card opening. While it’s technically billed in the cashback credit cards category, most savvy users know that combining this card with a Chase Sapphire-branded card allows you to transfer points to travel providers or redeem for travel at a 25% bonus (or 50% bonus if you combine your points with a Chase Sapphire Reserve.

If you think you’re going to get a Chase Sapphire Reserve Card in the near future, the Chase Freedom Flex is a great way to start building those UR points before committing to an annual fee. With a limited 5x return on revolving categories that regularly include everyday spendings, it’s one of the best no annual fee cards available.

Read More: Best Beginner Credit Card For Travel – Chase Freedom Flex Card

Chase Freedom Unlimited

The Chase Freedom Unlimited is very similar to its cousin, the Chase Freedom Flex. It carries no annual fee and it has a welcome offer of an additional 1.5% cashback on all purchases in your first year (up to $20,000 in purchases which is worth $300).

The Freedom Unlimited offers a very competitive cashback rate of 5% on travel purchases made through the Ultimate Rewards portal, 3% cashback on dining (including delivery and takeout), 3% on drugstore purchases, and 1.5% on all other purchases.

For those of you who don’t know, the Freedom Unlimited earned a flat rate of 1.5% a few months back, but now, it’s one of the top-tier cards that can help you earn more points quickly.

Read More: Chase Freedom Unlimited – The Ultimate Everyday Spending Card

Citi Double Cash

Similar to the Chase Freedom offerings, the Citi Double Cash is billed as a cashback credit card, but earns rewards that can be transferred as Citi ThankYou Rewards if you have either a Citi Premier or a Citi Prestige. While Citi’s transfer partner list is still growing, the return rate on the Citi Double Cash is 2% on all purchases, and the card currently offers 0% interest for 18 months on purchases and balance transfers. That makes this credit card a strong contender during the coronavirus outbreak.

Read More: Should I Cancel my Citi ThankYou Premier Credit Card?

American Express Gold Card

If you’re not too worried about your financial forecast, the American Express Gold Card is a fantastic option to maximize points on everyday purchases. The earn rate on this charge card is a staggering 4x in both supermarkets and restaurants. Once the coronavirus scare dies down, this card also makes a great travel companion, with 3x MR points on flights booked through amextravel.com, $100 in statement credits for incidental fees on the airline of your choice, and no foreign transaction fees. American Express is offering a generous signup bonus.

Read More: American Express Gold Card Review – The New King of Credit Cards?

TL;DR: Earn lots of points during the coronavirus outbreak

It’s a great time to start building your bank of points with these best credit cards for the coronavirus pandemic. Focus on building flexible, transferable points now, and consider getting a card with a 0% APR to avoid economic turmoil.

Be mindful of your spending categories, and use a credit card that incentivizes the areas you shop most frequently. Also, watch out for next year because a lot of the discontinued cards in 2020 will surely make a comeback. You can sign up for our travel concierge so we can assist you to find the best credit cards of 2021 and get you amazing travel deals too.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.