Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

I’m an unabashed fan of Chase credit cards. Exhibits A-C: The Chase Sapphire Credit Cards, The Chase “Freedom to Double-Dip”, and The Chase “5/24” Rule, I value Chase Ultimate Rewards points the most of all of the credit card currencies, and the two credit cards in my wallet are the Chase Sapphire Reserve and Chase Freedom Unlimited cards.

But the new American Express Gold Card may make me reconsider my strategy. It’s different from your usual credit card because cardholders are allowed to carry a balance for certain charges, but not all.

I previously wrote about the Amex Premier Rewards Gold card. It had some nice perks, but it still paled in comparison to Chase Sapphire cards. The 3x travel bonus was nice… but it only counted towards airline purchases rather than including hotels, taxis, Uber, etc.

The 2x restaurant bonus was equal to the Chase Sapphire Preferred card… but it was only valid at U.S. restaurants, so it’s not as useful while traveling abroad. The card’s price point marketed the card as in-between the base-level cards (Chase Sapphire Preferred) and premium cards (Chase Sapphire Reserve or Amex Platinum), but why pay more when the Chase Sapphire Preferred’s category bonuses are broader and the card is half the price?

Apparently, American Express recognized they needed to up their game, and revamped their old “Premier Rewards Gold” card into the American Express Gold Card.

It still has many of the same perks as the old Premier Rewards Gold card, including:

- No foreign transaction fees

- $120 Uber Cash credit that can be used for uber rides in the US.

- $120 in dining credits at certain merchants

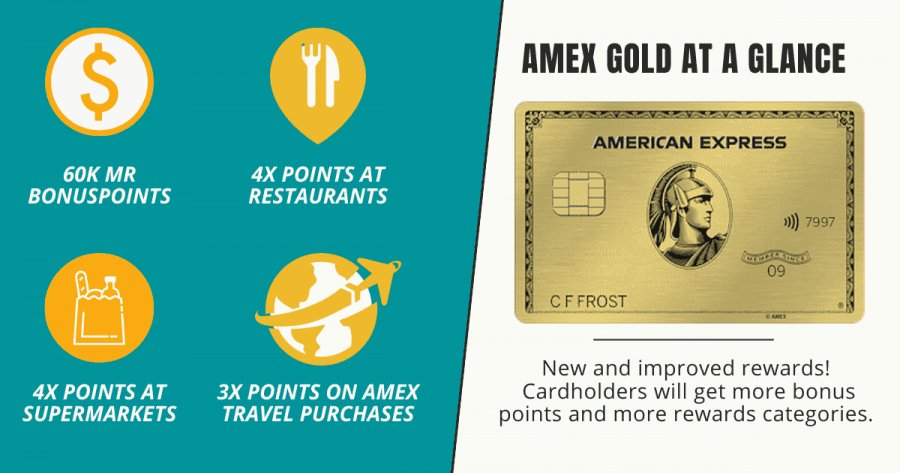

Not bad… but the new perks are what makes me excited:

- 4x points on restaurants (including takeout and delivery)

- 4x points on U.S. supermarket purchases (up to $25,000/year)

- 3X points on direct flight bookings with the airlines or on amextravel.com.

- 60,000 bonus miles after spending $4,000 on eligible purchases within 6 months of getting the card.

- Pay Over Time & Pay It Plan which allows cardholders to carry over a balance.

My critique of the Amex Premier Rewards Gold card was the lackluster award category bonuses, especially compared to the Chase Sapphire Preferred card. But 4x points on U.S. restaurants, airline tickets, and supermarkets are fantastic! The category bonuses still aren’t as expansive as Chase’s definition, but I’ll take 4x points any day.

I’ll also point out that 4x points on U.S. supermarket purchases don’t only include groceries. It can also include gift cards (yes, gift cards). Being the token millennials we are, Taryn and I frequently order from Amazon, and we (ok, more like I) are frustrated that no matter what card we use, we’ll only earn one point for every dollar spent.

However, if we buy a $100 Amazon gift card at a supermarket using the new Amex Gold card, we’ll earn 400 rewards points rather than the typical 100 rewards points. And it doesn’t only have to be Amazon; there are gift cards for the iTunes store, gas stations, and even Home Depot. We spent a LOT of money on our cards while renovating our home this year… if only we could have earned 4x points on all of those Home Depot purchases!

Besides the ability to earn more points, the card also comes with great perks. While the card increased its annual fee to $250, the $100 airline fee credit makes the card’s annual fee more like $150.

Get The Amex Gold $120 Dining Credit

The card also comes with the new $10/month credit ($120 annually) towards select restaurants if you use your Amex Gold card. It’s a pretty random assortment and not particularly restaurants I usually go to, but I will certainly use Grubhub each month if Amex gives me a $10 credit each month.

The eligible restaurants include Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak Houes, Boxed, and participating Shake Shack stores.

On top of the airline fee credit and the dining credit, there’s also the promotional offer to credit back up to $100 in dining purchases at U.S. restaurants in the first year.

So after combining these credits ($100+$120+$100), the perks of the Amex Gold card are worth $320… $70 more than the annual fee. If you can’t tell, I’m sold!

Get The Card In Rose Gold!

The last gimmicky perk of the Amex Gold card is you can choose the color of the card: either gold (duh) or rose gold. Not surprisingly, the rose gold card is quite popular.

I was waiting until January 2020 to try to earn the Southwest Companion Pass, so I had Taryn sign up for the new Amex (Rose) Gold card last week. I still plan to use my Chase Sapphire Reserve Card on travel expenses (taxis, hotels, Uber, parking, tolls, etc.) and foreign restaurant purchases, and we’ll still put any non-category spending on the Chase Freedom Unlimited card. But anything else will definitely be put on the Amex Gold card.

As of February 2021 you can choose if you want the Rose Gold or Gold card.

Are we switching sides to Amex? Not yet… but I’m not ruling it out either.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.