Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Why pay an annual fee if others could provide the same function for free? Is It Worth Paying an Annual Fee for a Credit Card?

I may be a credit card guru now, but I was pretty clueless at first.

I received my first debit card during my freshmen year of college, and a ski weekend in the Colorado mountains was a bit more expensive than I thought. Since the debit card had the shiny Visa logo on it, I naively assumed it turned into a credit card after spending more than I had in my checking account.

Yeah… that was a pretty dumb assumption. And after paying off the overdraft fees, I quickly learned I would need a credit card.

But I knew one thing: I was not going to pay an annual fee to use a credit card. Why would I pay an annual fee if other cards could provide the same function for free?

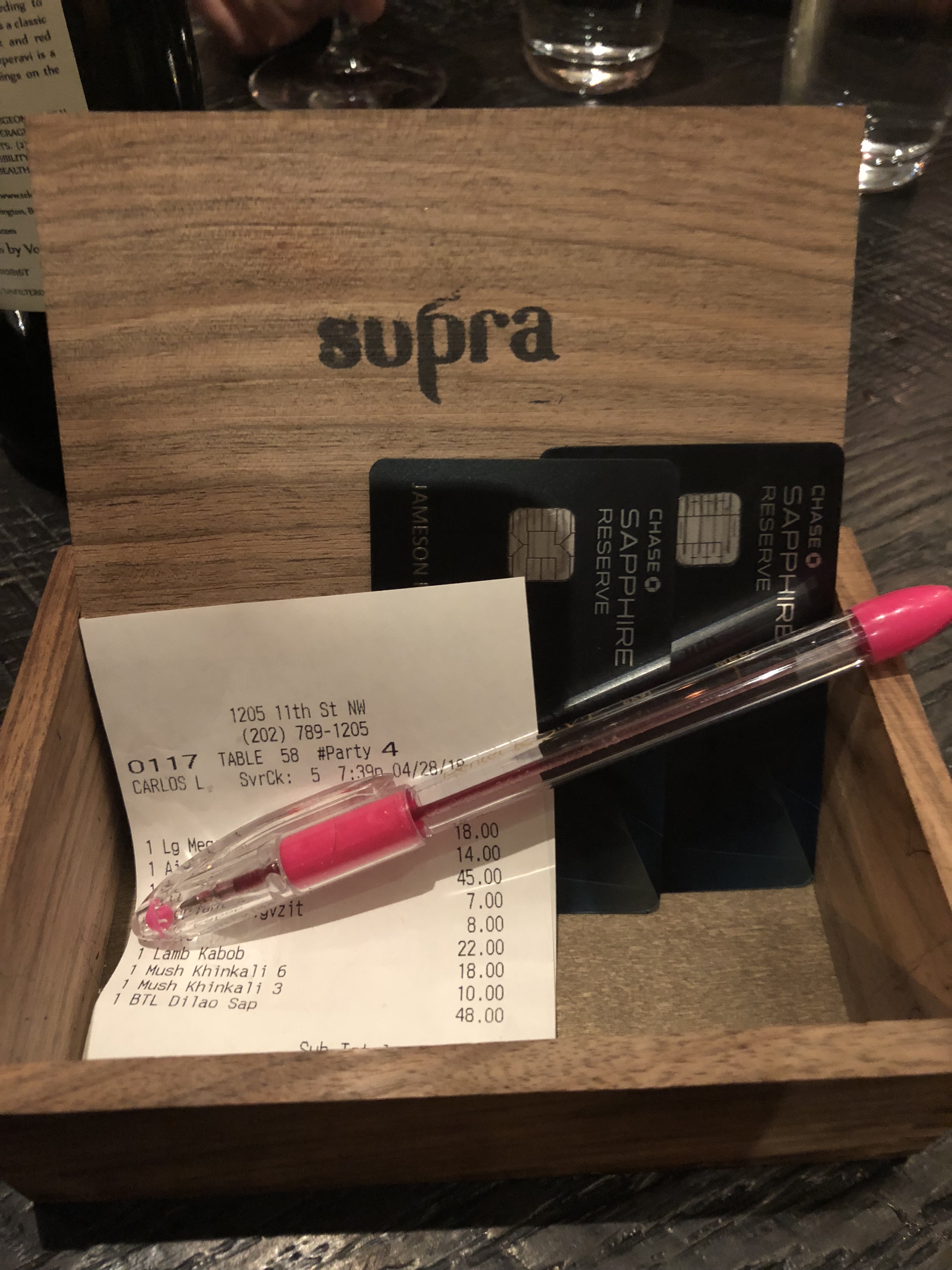

Flash forward to today, and I’m completely comfortable paying a $450 annual fee. So you could say that things have changed.

When initially signing up for credit cards, annual fees are a minor detail. After all, the main objective is earning the sign-up bonus, so a modest annual fee (say $95) for a solid sign-up bonus (say 50,000 credit cards points) is usually worth it. Also, there are some cards that waive the annual fee for the first year, so these fees often aren’t an issue at all when you first receive a card.

However, let’s say that you signed up for a credit card, received the credit card sign-up bonus, and after owning the card for a year, the annual fee is about to be charged. What should you do?

Bottom line: it all depends.

Option 1: Just pay it

Taryn and I are very strategic with our credit card spending, so we’re comfortable paying an annual fee for category spending bonuses that credit cards offer. We have specific credit cards for travel, dining, entertainment, grocery, gas, and then a card for everything else. Annual fees are a small price to pay for the ability for us to maximize our points earning.

Even if you aren’t as points crazy as we are, paying the annual fee in the second year might be advantageous. Let’s say you spend $10,000/year using a Chase Sapphire Preferred Card. We’ll say $2,500 of that is on travel and dining, so each year you’d earn about 12,500 Ultimate Rewards points. That won’t earn you any epic business class award flights. But 12,500 points for a $95 annual fee is .95 cents/point… which is MUCH better than buying United Airlines miles directly from the airline for 3.5 cents each.

To be clear, spreading out that $10,000 in credit card spending across multiple credit cards in order to meet the requirements for multiple sign-up bonuses is the more efficient way to play the game. But still, annual fees shouldn’t be the “boogeymen” that 19-year-old Jameson was so scared of.

Another aspect to consider when evaluating whether to pay annual fees are the credit card benefits. I just wrote about the Priority Pass, but checked baggage fees are something we all know about. Airline credit cards (Delta, United, American Airlines, etc.) often include one or two free checked bags as one of their perks, which could save well over the card’s annual fee in a single roundtrip itinerary.

Read More: Chase Sapphire Preferred Review + Perks

Option 2: Waive the annual fee (again)

Here’s the real pro tip to avoid paying annual fees: simply call and ask the bank to waive them.

Banks want to keep credit card customers, and many will offer to waive your annual fee if you spend a little more. Not all credit cards are eligible (sorry, you still need to pay the annual fee on the Chase Sapphire Reserve!), but I have first-hand experience with my Citi Premier credit card. I have had the card for three years now, and I’ve never paid an annual fee.

The month before the annual fee is scheduled to post, I’ll call the number on the back of the card and say that I’m thinking about canceling. I’ll then ask for a retention offer. Each time, Citi happily waived the annual fee in exchange for $1,000 or $2,000 in spending within three months. Super easy. I’ll note that each credit card is different, so you can’t count on this strategy for every card. But still a good option to consider.

Option 3: Downgrade the card

Many credit cards have multiple versions in the same “family” of credit cards. For example, the Chase Sapphire Reserve, Chase Sapphire Preferred, Chase Freedom Flex, and Chase Freedom Unlimited are all in the same “family.” Rather than paying the annual fee for the Chase Sapphire Preferred card, you could instead opt to downgrade to a no-annual-fee Chase Freedom Flex card. Plus, there’s no additional pull on your credit, so it will not have a negative impact on your credit score (if the credit limit remains the same).

This is exactly what I did when I wanted to apply for the Chase Sapphire Reserve Card. I already had a Chase Sapphire Preferred card, but individuals are no longer allowed to have both the Reserve and Preferred card at the same time. So I downgraded the Sapphire Preferred card to a Chase Freedom Unlimited card, waited two weeks, then applied for the Chase Sapphire Reserve card. That way, I could use the Chase Double Dip to rack up even more points.

Keep in mind that downgrading credit cards won’t usually earn you any sign-up bonuses. I could have easily canceled my Chase Sapphire Preferred card, and later signed up for the Chase Freedom Unlimited card to earn the modest sign-up bonus. However, if you are playing the points game (that’s me), signing up for too many credit cards can limit your ability to acquire other high-value credit cards given the Chase 5/24 rule. So downgrading was the best option for us, even though we didn’t earn the sign-up bonus.

Option 4: Cancel the credit card

There’s nothing wrong with canceling a credit card. Yes, there could be a small dip in your overall credit score. This is because your overall credit utilization ratio will go up since you won’t have as much credit available since you can’t access that line of credit anymore. But that small dip isn’t with paying a $95 annual fee for a card that you may not use, especially since you can easily recover within a few months.

For example, Taryn and I have both signed up for the United MileagePlus credit card. As I’ve pointed out before, credit card spending on the Chase Sapphire Preferred or Reserve cards can earn us MANY more United Airlines frequent flyer miles than using the United credit card itself. Plus, Taryn and I carry on our luggage for 95% of our flights, so the card wouldn’t save us much in baggage fees. So after we earn the sign-up bonus, there’s little reason for us to keep the card. We’ll wait for the 12 months and then cancel the card before ether annual fee is charged. This is our same strategy for most airline or hotel-branded credit cards.

Read More: Chase Sapphire Credit Cards: Earn Rewards Points

The big caveat with canceling credit cards is this: NEVER cancel your oldest credit card. Since the length of credit history is an important factor in your credit score, canceling your oldest credit card will have a negative impact on your score. Much more impact than opening and closing cards like we do. For a more thorough explanation of credit scores, check out “But My Credit Score…”

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.