Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Exploring the advantage of credit card points vs. airline miles

There are few industries impacted more by the coronavirus than the airline industry. The virus brought international travel to a trickle, customers are worried about their safety inside airplanes, and more people are opting to connect remotely rather than meeting with friends, families, and colleagues in person. It will take airlines and the travel industry years to recover. But what about airline miles and credit card points? Let’s discuss potentially how coronavirus affects airline miles, credit card points, and just travel credit cards in general.

1) Best Case Scenario: Awards Galore

The (somewhat naive) rationale is simple. Airlines aren’t flying with full planes these days. They need a way to put butts-in-seats and get people in the air. Why not incentivize people to fly by releasing more award space?

To a certain degree, this is exactly what is happening at the moment. There is an absurd amount of premium cabin award space with many airlines. This is in large part to the huge reduction in business travelers. Since business class is usually meant for, you know, business travelers, the coronavirus has left many of those seats unfilled. Safety matters aside, this an opportune time to redeem those airline miles and credit card points.

For example, here’s award availability from Chicago to Munich on United Airlines (and Star Alliance partners) this summer. The award space is WIDE OPEN.

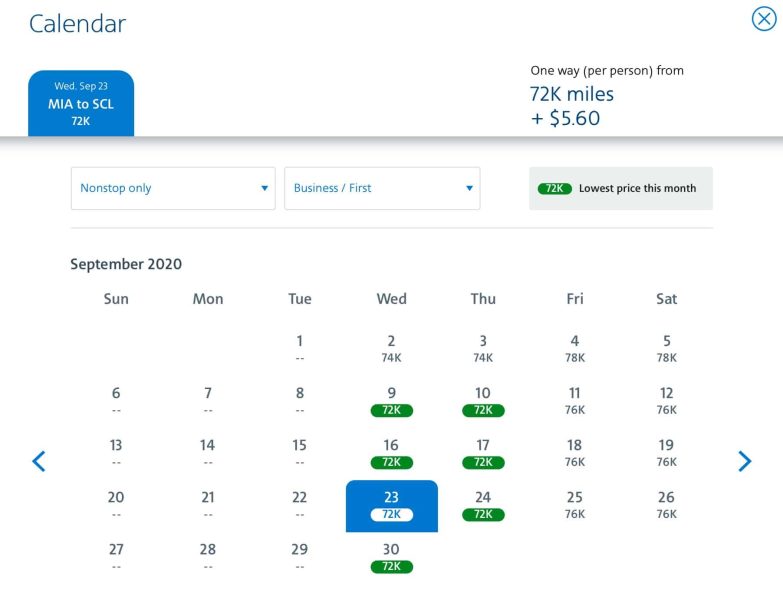

And it’s not just United Airlines and flights to Europe. Here we have more wide open award space on scheduled flights with American Airlines from Miami to Santiago, Chile.

So yes… we’re in the middle of a global pandemic and there are plenty of travel restrictions. But could this kind of award availability be the new normal? With business travel decreasing for the foreseeable future… does this mean airlines will continue to offer business class award space? Perhaps it’s just wishful thinking. But the coronavirus and changing travel trends could benefit award travel options and award availability.

2) Worst Case Scenario: Award Prices Skyrocket

Being less naive and more of a pessimist, the coronavirus might affect airline miles and credit card points in a wholly negative way.

First, we have to remember that airlines own their own frequent flyer miles. The frequent flyer miles have value, but the value is completely dictated by the airline itself. Airlines are going through difficult financial times and looking to squeeze out as many value as possible. So what is preventing them from cutting away some of their frequent flyer miles “debt” but devaluing the currency altogether?

Let’s say a typical business class award from the U.S. to Europe costs 70,000 frequent flyer miles. Not cheap, but still manageable. With all the airline miles being a “debt” or liability against an airline, raising the price of an award flight is one quiet way to devalue the airline miles and reduce debt. Rather than only requiring 70,000 miles for the $4000 flight, it might take 77,000 miles for the same $4000 flight.

This is the exact scenario that United Airlines already implemented. United Airlines changed the prices for their partner awards, increasing the costs by 10%. Luckily, it was only 10%… but what is holding airlines back during these desperate times? They’re about the lay off 1000s of employees to cut costs… why couldn’t they devalue their airline miles as a means to make up some of their shortfalls?

This spring, airlines sold their frequent flyer miles at a discount to the credit card companies. While this assures that credit card points aren’t going anywhere, it also means that airlines are flooding the market with more miles. Do you know what happens when you print more “money?” Inflation. There’s fear that with so many more airline miles available, the prices for award flights will skyrocket.

A nominal 10% increase is one thing… but what’s to stop airlines from raising award prices by 50%? Or even 100%? If they are that strapped for cash, why wouldn’t they pillage their frequent flyer programs to avoid filing for bankruptcy? Also, it’d be naive to assume airlines won’t adapt to the drop in business travel by removing some of the business class seats or flat out retiring some of the bulkier, premium-cabin focused airlines.

This doom-and-gloom scenario would mark the end of the airline miles world as we know it today.

3) Likely Scenario: Some good, some bad

Here’s what is likely going to happen: some aspects of frequent flyer programs will improve, will other elements will worsen. Yes, it is a very novel conclusion.

Let’s start with some improvements. We’re already starting to see airlines provide greater flexibility not just for the cash fares, but also airline tickets purchased with miles/points.

Southwest Airlines has always been the industry leader in this regard. A person could book an award ticket with points, completely cancel their itinerary up to the day of travel, and receive ALL of their points/taxes back. Even better, all cancellations can be done online or via the app without having to call in to a customer service center. Win-win for everyone!

During the pandemic, American Airlines made a somewhat similar change. For award tickets changed or canceled 60 days or more before the flight, American Airlines will make the change without any fee at all.

This sounds like a minor change, but it makes it MUCH easier to more confidently book award space. The fact that this occurred during the pandemic might be a sign of greater flexibility as a result of this.

And while award space is wide open right now, there’s probably some truth to the idea that fewer business travelers means more business class award space. Even when things get back to “normal,” you’ll likely see some companies still wait to send their employees around the world. And even when business travel picks up again, it won’t be at nearly the same levels as before the virus. So more business class award space for us!

But… that business class award space will probably cost you more miles. United Airlines quietly increased partner redemptions by 10%, and I wouldn’t be surprised to see more increases on the horizon. Of course, another option is for airlines to completely go away from award charts and go to dynamic award pricing. Delta is already doing it, while American and United are also turning to dynamic pricing for some routes (thought they both still have award charts).

We’ll need to take the good changes (potentially more award availability, flexibility) with the bad changes (potentially more expensive, fewer flights).

But these uncertain times for the future of airline frequent flyer programs further highlights the advantage of credit card points vs. airline miles. If you try to stockpile United miles only to have the award ticket go up in price by 10% before booking, you’re out of luck. But if you earn credit card points instead, you would have the ability to transfer your points to a different frequent flyer program with a cheaper redemption rate.

To explore your options to earn credit card points, head here for the best sign-up bonus offers and information. You can also sign up for our travel concierge and we’ll help you maximize your credit card points to find the best award redemptions.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.