Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Maximizing Points with Credit Card Spending

There are multiple ways to earn credit card points and frequent flyer miles.

You could:

- actually fly commercially on paid airline tickets and earn points the old fashion way

- utilize credit card sign-up bonuses for a quick windfall of points

- or you could strategically spend money on certain credit cards

Most of this blog has highlighted welcome bonuses, so now let’s discuss credit card spending.

For our around-the-world trip, our award booking strategy focused primarily on credit card sign-ups to earn the necessary points for our award redemptions. However, to earn the points needed for our Bali trip, we used a combination of credit card sign-ups and making everyday purchases using specific credit cards.

We used our credit card points for business class flights and a hotel in Bali

We first started signing up for award credit cards in September 2015, which means we’ve had over three years to accumulate credit card points via spending. If you maximize credit cards category bonuses (3x on travel, 4x dining, 3x gas, etc.), earning enough credit card points is much easier than you think.

More Points Without Increasing Spending

Overall, our goal is to average more than 2x points for every dollar we spend.

For example, the travel credit cards that are in my wallet right now are the Chase Sapphire Reserve and Chase Freedom Unlimited credit cards. The Sapphire Reserve card earns 3x points on travel and dining while the Freedom Unlimited card earns 5% back on travel purchases made through the Chase Ultimate Rewards, 3% back at restaurants (including takeout and delivery), 3% back on drugstore purchases, and 1.5% back on other purchases.

We tend to spend a lot on travel and dining, so it’s fairly easy to have our average points earning be right around two points per dollar spent.

Taryn recently received the new American Express Gold Card, which earns 4x points on U.S. restaurants and grocery store purchases. So not only does it earn more points at restaurants (within the United States) but it also gives a huge bonus in a completely new category.

Our go-to card for 4x on dining and groceries.

Sadly, there are no easy ways to earn a category bonus on Amazon purchases… unless you get a little creative. Many grocery stores sell a variety of gift cards, including ones from Amazon. As a reminder, Taryn earns 4x points at grocery stores with the new American Express Gold card. Therefore, she can purchase gift cards at grocery stores in order to earn 4x points, and then spend the gift cards at Amazon, Bed, Bath, and Beyond, Best Buy, etc. as she normally would. The grocery store category bonus can help achieve many more credit card points than you’d typically be able to earn.

Our Spending Strategy

As far as everyday credit card spending, we primarily use four different credit cards:

- Jameson’s Chase Sapphire Reserve (3x travel, 3x dining)

- Jameson’s Chase Freedom Unlimited (5x on travel purchased on the Chase portal, 3% on restaurants, 3% on drugstore purchases, 1.5% back on other purchases)

- Taryn’s Chase Freedom (5x on rotating categories, such as gas stations, drug stores, grocery stores, department stores, and Lyft)

- Taryn’s American Express Gold card (4x dining in the U.S., 4x grocery stores, 3x airfare)

- (Please note bonus categories are subject to change)

When used alone, the Chase Freedom and Freedom Unlimited credit cards only provide points good for cashback rather than points eligible for transfer to airline partners. However, when you have one of the Chase Sapphire cards in addition to one of the Chase Freedom cards, all of the points are eligible for transfer to airline partners. Even better, you can combine Chase Ultimate Rewards points between accounts associated with the same mailing address, so Taryn and I can consolidate all of our points into one actual account.

This shows that maximizing points doesn’t mean carrying around 20 different credit cards. We each have two cards, and together they help us efficiently earn about 2x points per dollar spent.

Shopping Portals

Many different banks and airlines have shopping portals that will also earn additional points/miles. Essentially, you log into your credit card or frequent flyer account, use a link from the shopping portal to access an online retailer’s website, then proceed to buy products and services as you normally would. Since you use the specific link provided in the shopping portal, the bank/airline receives a small kickback for referring a customer to the retailer, and in exchange, you can earn points and miles.

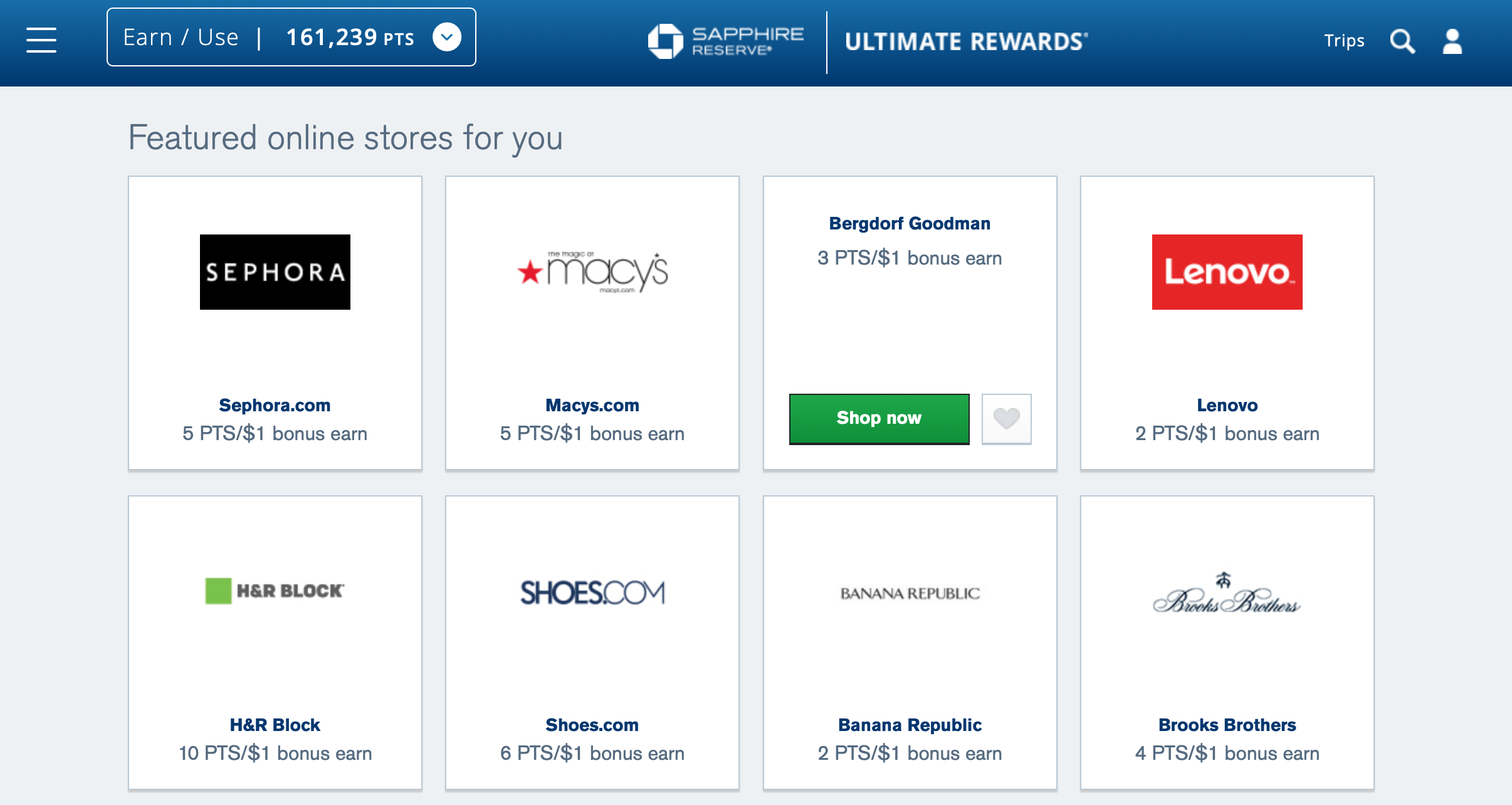

A few stores on the Chase Ultimate Rewards shopping portal

These portals can be a great way to earn even more points for spending the money you are already spending. And the best part is these points are in addition to the points you would already be earning through typical credit card spending. So not only would you earn 1,000 points for spending $100 at H&R Block through the portal, but you would also be eligible for the 150 points earned through using the Chase Freedom Unlimited credit card.

The problem with these shopping portals is 1) remembering to use them and 2) finding which online stores are eligible for the bonus. Since banks and frequent flyer programs have different relationships with different stores, determining which shopping portal to use can be overwhelming.

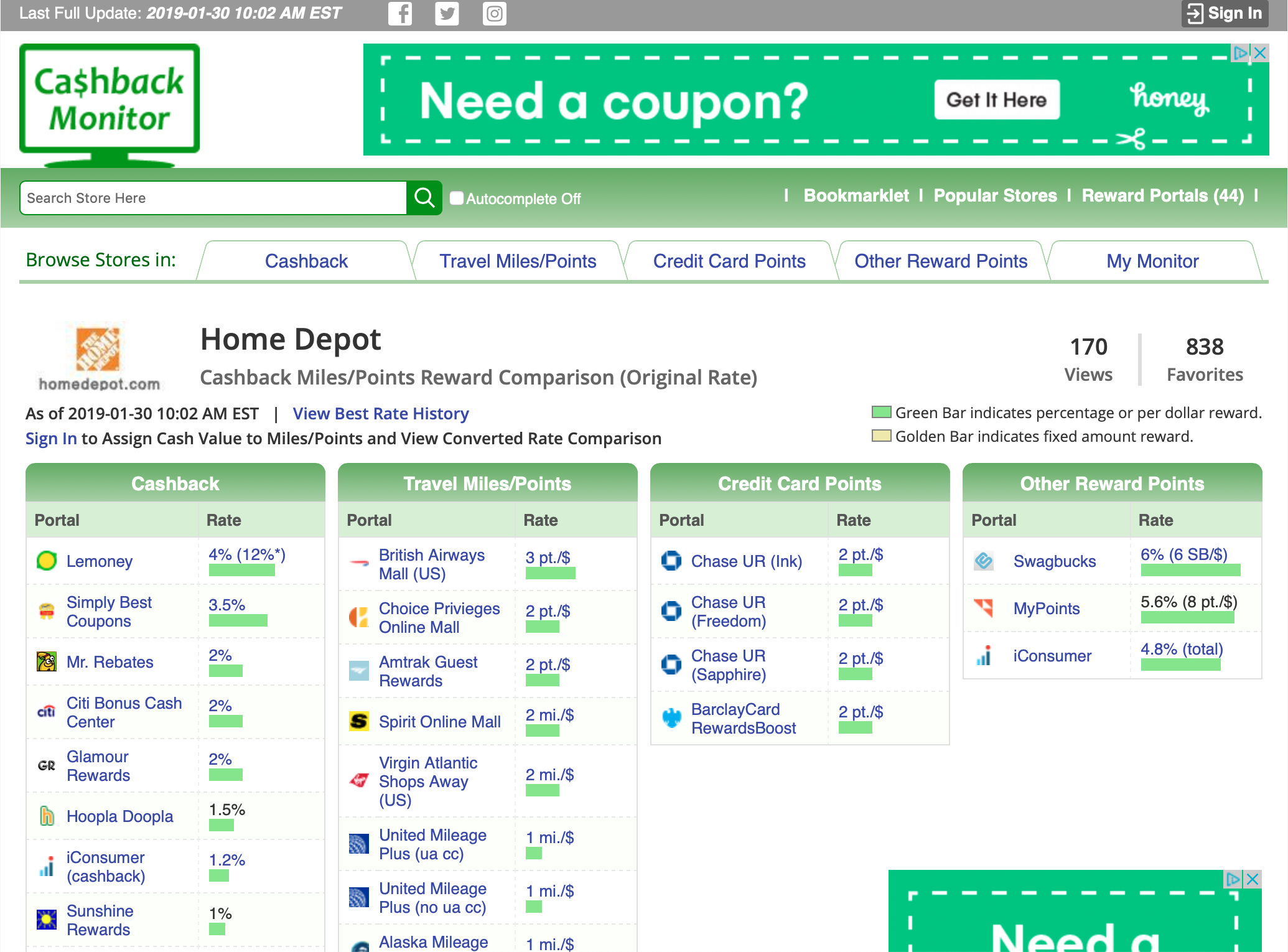

Luckily, there’s Cashback Monitor. Cashback Monitor allows you to search all of the different miles/points portals to help determine which shopping portals are the more advantageous to use for each eligible online store.

For example, here’s the Cashback Monitor page for Home Depot:

Home Depot partners with Chase Ultimate Rewards, British Airways, and United Airlines, just to name a few.

You can see there are a variety of different cashback, travel, and credit card shopping portals that partner with Home Depot. Since I value credit card currencies the most, I would use the “Chase UR (Sapphire)” link to use the Ultimate Rewards shopping portal. Then I could earn 2x Chase Ultimate Rewards points on any purchase through Home Depot’s website.

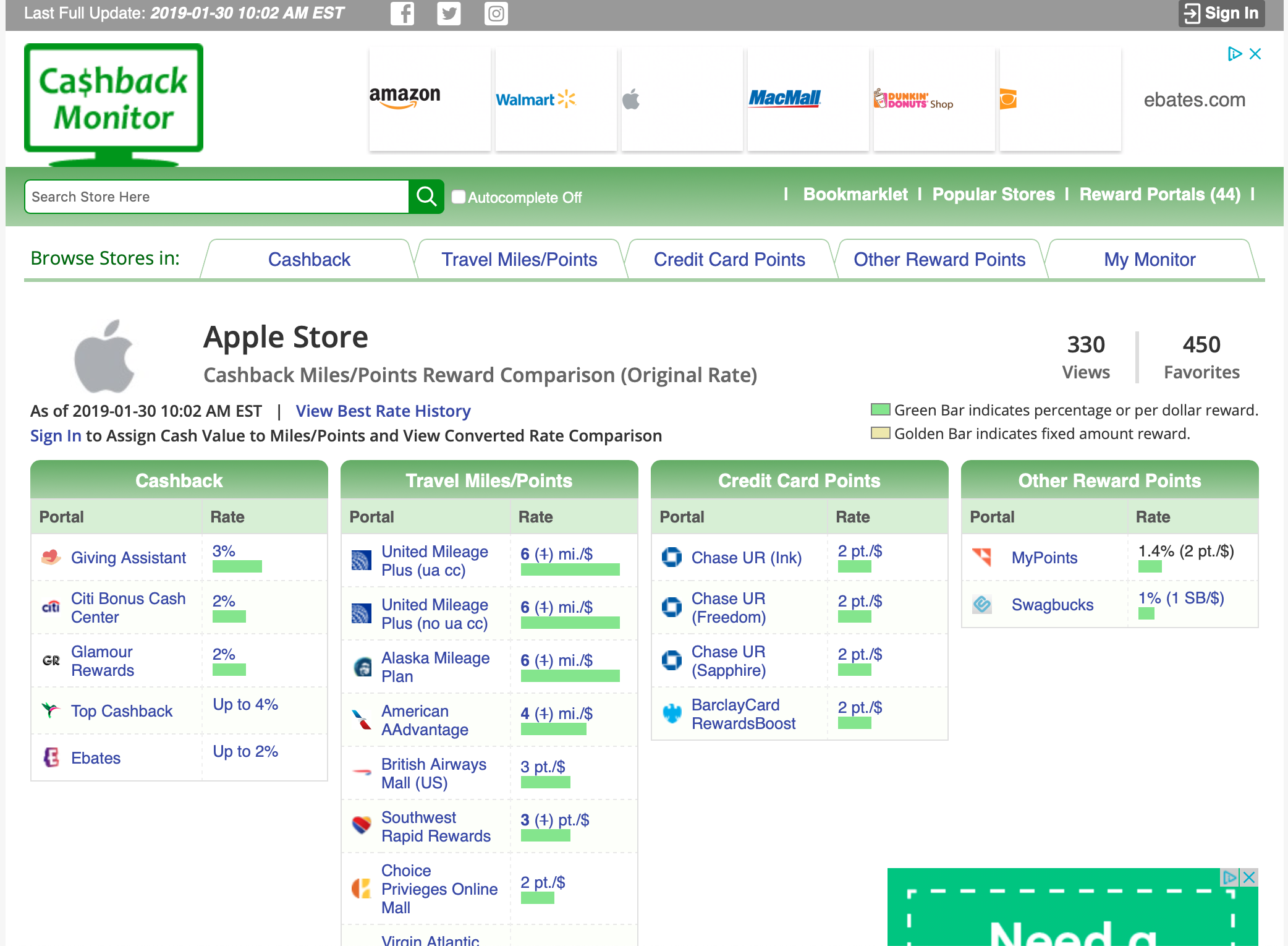

From time to time, the shopping portals provide a limited time “bonus” for purchases at certain stores. For example, on January 30, the United Airlines and Alaska Airlines portal offered 6 miles/dollar spent on the Apple website.

Sometimes, banks and airlines give additional bonuses for shopping at certain retailers. Such as using the United Airlines or Alaska Airlines portals for buying Apple products.

Planning to buy a new laptop or phone? If you bought a $1,000 Apple product using the shopping portal link and paid with the Chase Freedom Unlimited card, you could earn 6,000 United Airlines miles and 1,500 Chase Ultimate Rewards points. Since Chase Ultimate Rewards has United as a transfer partner, that one purchase with Apple could be worth 7,500 United miles. That’s roughly equivalent to the miles earned for actually flying a Washington, DC to/from Paris revenue flight.

So yes, credit card sign-up bonuses are the best way to earn a massive amount of points. But just using the right credit card at the right time can also help you earn free airline tickets and hotel nights.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.