Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Improve your credit score!

I was doing a periodic check of our credit reports on Credit Karma and decided to tally the open credit card accounts both Taryn and I have in our names.

The total: I have 10 open credit cards, and Taryn has another 10. Yes, we have 20 open credit cards between the two of us.

For me (in chronological order):

- USAA Rewards credit card

- USAA Association of Graduates credit card

- Chase Freedom Unlimited credit card

- Citi ThankYou Premier credit card

- Chase Sapphire Reserve credit card

- American Express EveryDay credit card

- Chase Hyatt credit card

- Chase IHG Rewards Club credit card

- American Express Hilton Ascend credit card

- American Express SPG Luxury credit card (soon to be Bonvoy Brilliant card since SPG and Marriott recently merged)

For Taryn (also in chronological order):

- Chase Freedom credit card (Now Chase Freedom Flex)

- USAA Association of Graduates credit card

- Chase Sapphire Preferred credit card

- Chase Southwest Rapid Rewards Premier credit card

- Chase United MileagePlus Explorer credit card

- Citi ThankYouPremier credit card

- American Express SPG Business credit card (soon to be the Bonvoy business card since SPG and Marriott recently merged)

- American Express Gold charge card

- American Express Blue Business Plus credit card

- Bank of American Alaska Airlines MileagePlan credit card

Yes, that is a lot of credit cards a mix of both travel credit cards and your typical rewards credit cards. And to be honest, there are 20+ more that we have closed in the past few years as well.

But when friends and family ask how they too can fly business class to a free hotel in Bali, it’s more complicated than just signing up for one credit card. You don’t need 20 credit card sign-ups, but to have a trip as we did around the world, you’ll need a strategy to earn multiple sign-up bonuses to fully realize the benefits of using credit card points.

You’ll see that Taryn and I both have old USAA credit cards, which aren’t exactly the cards to use for accumulating credit card points. However, since they were opened in 2007 and 2011, they help establish a longer credit history, something that banks like to see when deciding whether to issue their cards. We haven’t used the cards since 2014, but we definitely won’t be closing them any time soon since they are actively improving our credit score.

You’ll also see that we rarely have the same credit card. Adding someone as an authorizer user counts against Chase’s 5/24 calculation, therefore making the authorized user less able to sign up for new Chase credit cards and get more sign up bonuses. We learned this the hard way, but have since strategically signed up for cards that helped us achieve our travel goals, such as a whirlwind weekend trip to Chile.

Finally, we spread our “loyalty” across a variety of different credit cards. I have many different Chase credit cards but have also signed up for four different hotel credit cards back-to-back-to-back-to-back. Because of transfer partners, we can consolidate these hotel points to maximize their benefit. Meanwhile, since Taryn earned the Southwest Companion Pass, she’s gone over Chase’s 5/24 rule and shifted her focus on American Express credit cards since they aren’t impacted by the same restriction.

Believe it or not, I’m on a credit card diet until January 2020 so that I can be under 5/24 and be eligible for the Chase Southwest credit cards to obtain the Companion Pass for two more years. In fact, the AMEX SPG Luxury credit card is the only card I’ve applied for in the past year. Shocking, I know. So instead, Taryn has been accumulating credit cards for both of us, applying for seven in the past year. And I have a few more credit cards in mind for the next few months…

You don’t have to be as “extra” as we are. But our example helps show what is possible for a relatively aggressive credit card strategy. You could certainly be more conservative, applying for one or two cards. Or you could be a professional points blogger and have 25 credit cards in your wallet.

“But my credit score…”

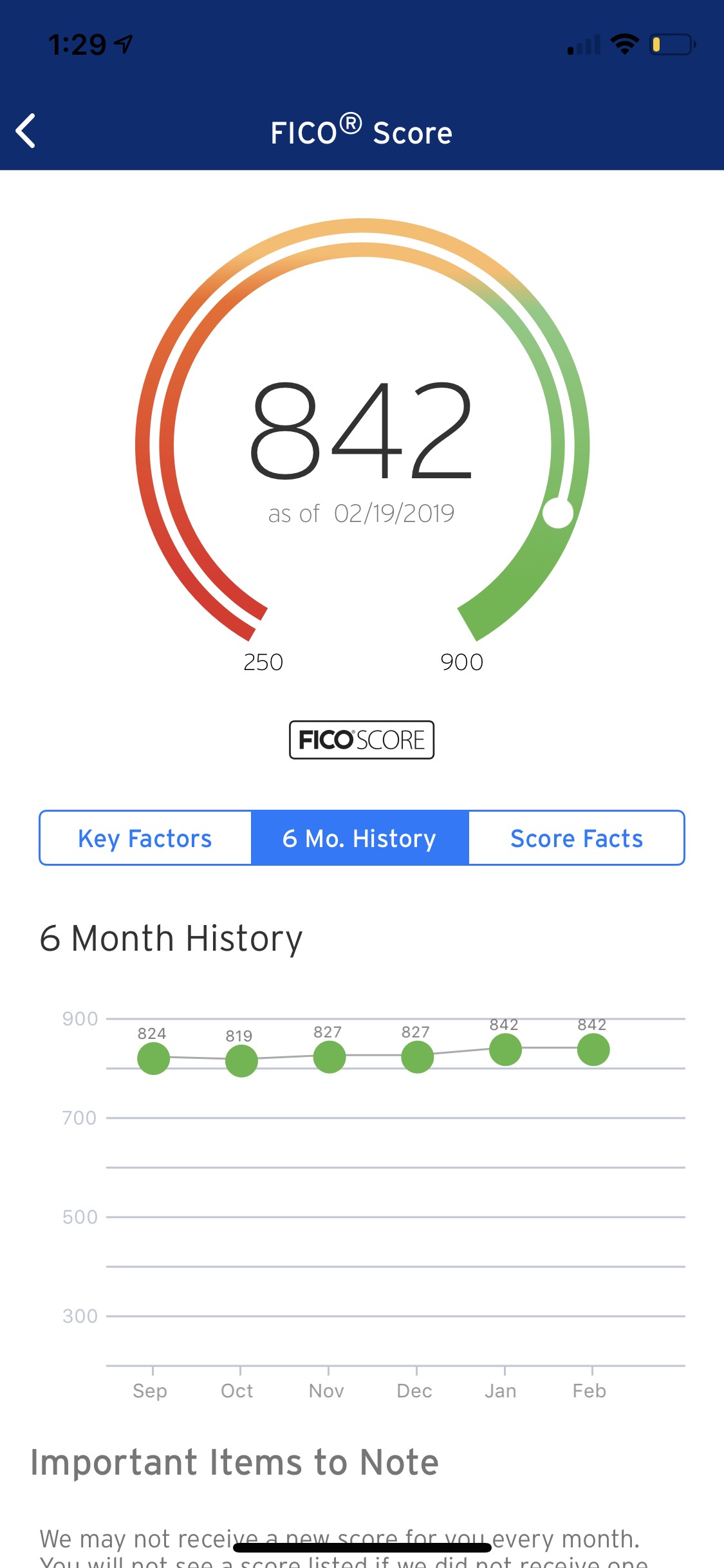

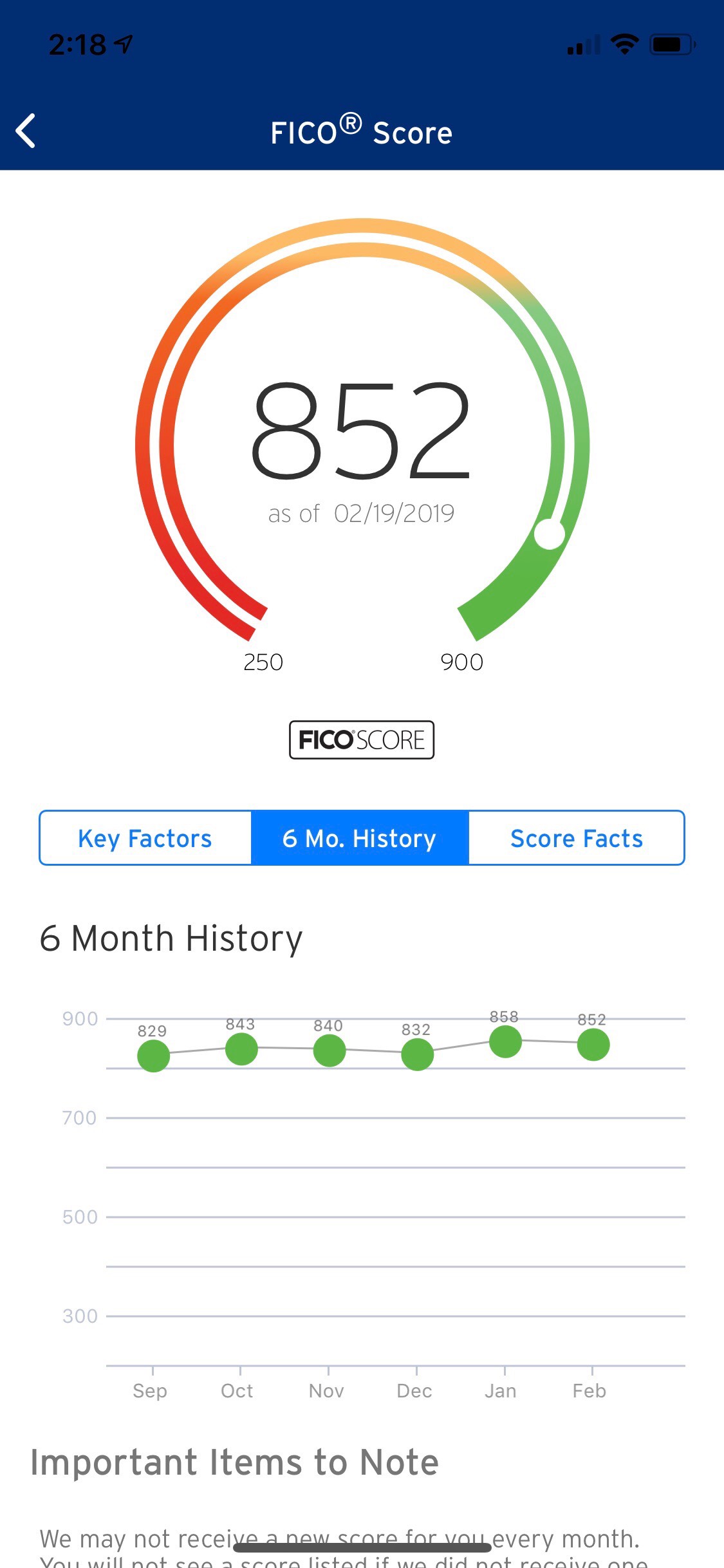

And I know what you’re thinking… Taryn and I must have horrible credit scores because we have signed up for so many credit cards.

Much to the contrary. Because we have so much credit extended to us that we aren’t using, opening these credit cards have actually improved out credit score.

I’m definitely not suggesting someone with poor credit or credit card debt start signing up for a bunch of credit cards. If you carry a balance from month-to-month, the credit card points game isn’t for you. But understanding how banks calculate your credit score is valuable information and an important aspect of earning points through credit card sign-up bonuses.

I was initially too risk-averse to do anything that would impact my credit score. So I started slowly, only opening a few cards and seeing how it affected my score. Needless to say, I became much more comfortable after seeing my credit score actually go up.

Bottom line: signing up for credit cards in itself does not ruin someone’s credit, and for the responsible credit card user, it can improve their credit score.

So having 10+ credit cards may seem like a lot, but it’s actually been beneficial for the both of us. If you want to learn more on how to find the right cards, utilized your points, and book award flights or stays, you can sign up for our travel concierge.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.