Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Update: While SPG cards are a thing of the past, several transitioned into current Marriott cards.

Please be aware that the cards mentioned in this article no longer exist.

For the two Amex-issued Marriott cards, the rule is one welcome bonus per card per lifetime, and while the Bonvoy cards feature a new design, they aren’t technically counted as new products from the old SPG days. That means you won’t be able to earn the 100,000-point bonus on the Marriott Bonvoy™ Business Card from American Express if you ever earned a welcome bonus on the Starwood Preferred Guest® Business Credit Card from American Express (no longer available).

Chase, Citi, and American Express all have their own respective credit card currencies. Generally speaking, earning these types of points gives the most flexibility when transferring for high-value airline and hotel redemptions.

However, the Marriott/Starwood Preferred Guest (SPG) hotel group is the exception, and in fact, I value Marriott points as the second-best credit card currency (behind Chase Ultimate Rewards). Marriott points can be used for redemptions at one of the 30 different hotel brands in the group, including St. Regis, Sheraton, and Westin hotels. In addition to the hotels, Marriott points can also be transferred to a number of airlines, including American Airlines, Delta, Korean Air, British Airways, and (my favorite) Alaska Airlines.

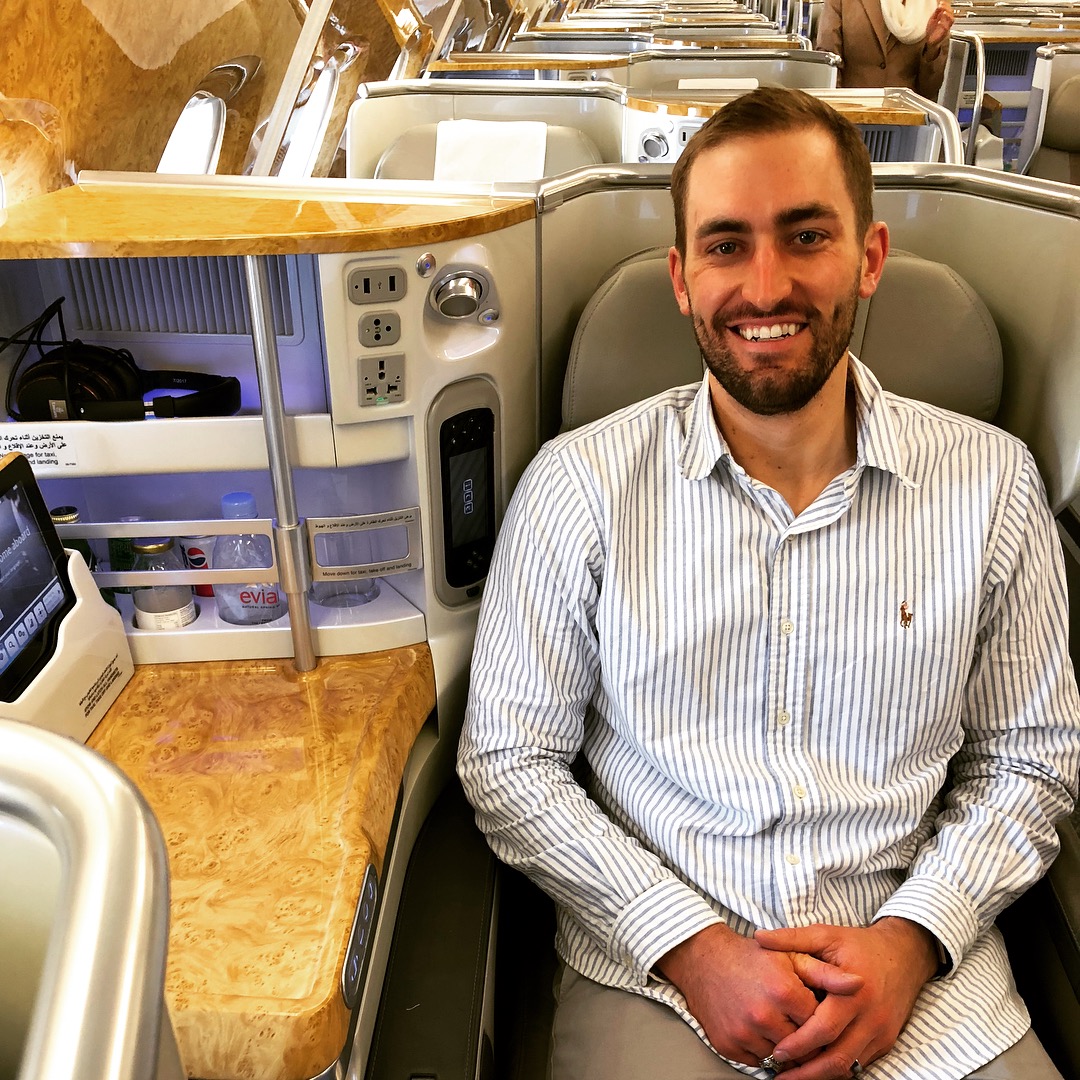

Why is the Alaska Airlines frequent flyer program my favorite? Because despite devaluations and changes over the past few years, it’s still the best way to redeem credit card points for redemptions in Emirates business class. It’s exactly how Taryn and I managed to fly in Emirates business class to the Maldives. *And you can easily do it, too!*

Before going on, I should flag that the Marriott International hotel group recently acquired the SPG hotel group. The “new” Marriott International is now the world’s largest hotel company with over 5,700 properties and 1.1 million rooms. Points hackers (like me) have been waiting for the new behemoth of a company to announce how they would merge the two hotel chains’ loyalty programs, and much to our surprise, the new unified loyalty program is extremely fair. While I expected a huge devaluation, I was happy to see Marriott keep the favorable airline’s transfer partners, which is what made the SPG (and now Marriott) credit cards so attractive. The unified loyalty program won’t be fully implemented until later this year, so there are still a few details that need to be determined.

There is a slew of new Marriott/SPG credit cards, but I will focus on two of them. I’ll start with the Marriott Bonvoy Boundless credit card which was previously the Marriot Rewards Premier Plus credit card.

Just to give you a preview of what the old card looked like, here were some fo the features of the Marriott Rewards Premier Plus credit card:

- $95 annual fee (not waived for the first year)

- 100,000 Marriott points (after $5,000 in spending within three months, which is a higher spending threshold than most mid-tier credit cards)

- No foreign transaction fees

- 6x points on Marriott/SPG purchases with credit card

- 2x points on all other purchases

- Automatic Silver Elite Status at Marriott and SPG hotels (late check-out, free wifi, 20% bonus points during stays)

- Free night award on account anniversary (limited to a room valued at 35K/night and only valid after owning the card for one year)

Now, this is what the Marriott Bonvoy Boundless credit card (new version) offers.

- 6x per $1 spent at over 7,000 participating Marriott Bonvoy hotels

- 2x per $1 spent on all other purchases\

- $95

- Annual Free Night Award (valued up to 35,000 points)

- Get 15 Elite Night Credits each calendar year (spend $35,000 on purchases every year to get Gold Status)

The second Marriott/SPG credit card I’ll highlight is the new SPG American Express Luxury credit card… even though it isn’t even released yet.

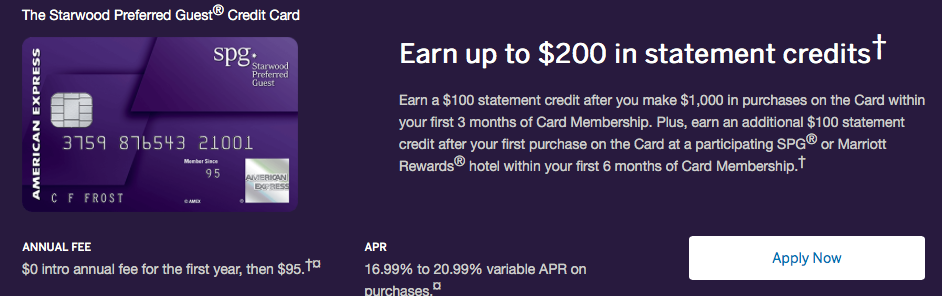

Just two months ago, I would have said that the mid-tier SPG AMEX was the way to go. While it had a modest sign-up bonus of an equivalent 75,000 Marriott points, it’s a low annual fee ($95) was waived the first year, so it was an easy way to acquire another sizable chunk of one of the best credit card currencies.

But the points game is constantly changing, and so are the credit cards. Now the SPG AMEX only gives a modest statement credit as a sign-up “bonus” rather than any points, so the card is essentially worthless in my opinion. Whomp, whomp.

Marriott/SPG introduced a new mid-tier credit card in the Marriott Reward Premier Plus card, and they opted to also introduce a new premium SPG credit card. It is slated for release this August, and while we don’t know all of the *official* details yet, here’s what it looks like the new SPG American Express Luxury card will include (PLEASE NOTE THIS CARD NO LONGER EXISTS):

- $450 annual fee…

- …which is offset by a $300 in statement credit on any Marriott/SPG purchase. Not as flexible as the Chase Sapphire Reserve travel credit, but still makes the effective annual fee $150.

- $100 Global Entry/TSA Precheck fee credit

- Priority Pass Membership (includes cardholder plus two guests)

- Automatic Gold Elite status at Marriott and SPG hotels (guaranteed lounge access/breakfast at eligible properties, guaranteed 4:00 pm check-out, complimentary room upgrade, free enhanced wifi, 25% bonus points during stays)

- Free night award on account anniversary (can be used on any room valued at 50K/night, which is nearly any Marriott/SPG property; only valid after owning the card for one year)

- Boingo wifi access (free wifi access at 200K+ hotspots around the U.S.)

- 6x points on spending with Marriott/SPG

- 3x points on U.S. restaurants and flights booked directly with airlines

- 2x points on all other transactions

- No foreign transaction fees

That’s a lot of benefits. And there better be for a card that charges a $450 annual fee!

In my book, the best benefit is easily the automatic Gold Elite status. Free room upgrades, guaranteed late check out, and FREE BREAKFAST. And not a free continental breakfast like you’d receive at a Hampton Inn, but a full breakfast the hotel typically charges guests $20/each for. So a few nights at one of the eligible properties (JW Marriott, Marriott, Renaissance, etc.) for you and a significant other could easily chip away at that annual fee.

But there’s one thing missing: a sign-up bonus. The card won’t be released until August, and Marriott/SPG still hasn’t announced what the sign-up bonus will be or the minimum spending threshold to earn the bonus.

Given that the mid-tier Marriott Rewards Premier Plus care offers 100,000 points, I would guess the SPG American Express Luxury card to offer a sign-up bonus between 100,000 and 140,000 Marriott points.

While it has a high annual fee, the combination of the benefits, as well as nice sign-up bonus (🤞), could still make the card attractive. Keep in mind that you can only earn sign-up bonuses with American Express credit cards once in a lifetime, so be sure to sign up wisely.

So after meeting the minimum spending thresholds, let’s assume you’ll have 250,000 Marriott points (100k+5k, potentially 140k+5k) which would normally be equal to 83,333 airline miles.

But here’s the best part…

Marriott will give a 15,000 point bonus when transferring 60,000 Marriott points to one of the many airline transfer partners. So instead of having only 250,000 Marriott points after meeting the minimum spending requirements, you essentially have 310,000 Marriott points or 103,333 airline miles.

What can you do with 103,333 frequent flyer miles after you transfer them to one of Marriott/SPG’s airline partners? SO MANY THINGS. I’ll quickly point out two options.

- Option #1: Transfer 247,500 of your Marriott points to Alaska Airlines, redeem for award travel in Emirates business class from the United States to the Maldives (82,500 Alaska Airlines miles)

With just two credit card sign-ups, you too could fly to the Maldives in Emirates business class. The entire flight experience with Emirates was incredible, and the Maldives were easily the best part of our around-the-world trip. Check out the trip report from our Emirates flight and the Maldives in case you need any more convincing.

- Option #2: Transfer 300,000 Marriott points to Alaska Airlines, redeem for roundtrip award travel in Hainan Airlines business class to/from the United States and China or Thailand (50,000 Alaska Airlines miles each way)

Hainan Airlines is a relatively new airline partner with Alaska Airlines, so it wasn’t an option when planning our around-the-world itinerary. But 100,000 frequent flyer miles is insanely cheap for 40+ hours in round-trip business class. And while Hainan Airlines isn’t Emirates or Qatar Airways, it’s considered China’s best airline and is one of only 10 airlines in the world awarded a five-star rating on Skytrax, an airport ranking company.

These are just two options with one of Marriott/SPG’s transfer partners. This doesn’t even take into account a few of my other go-to frequent flyer programs, such as Korean Air, British Airways, and Singapore Airlines. Not to mention redemptions options in Cathay Pacific First Class, another airline partner with Alaska Airlines. Like I said… SO MANY OPTIONS. It’s a bit confusing at first, but the 15,000 point transfer bonus and unique airline partners make the Marriott/SPG awards program especially valuable.

This is all a bit speculative since the sign-up bonus still hasn’t been announced for the SPG American Express Luxury card. But I still can’t help getting a little giddy thinking about another trip to the Maldives.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.