Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

American Airlines is one of the most well-known airline companies and is one of the big three legacy carriers still operating in the US. Despite many devaluations and benefit cuts, the AAdvantage program is still solid, with a lot to offer if you know how to use it. So read on for our comprehensive guide to the American Airlines AAdvantage and how to best earn and redeem AA miles!

American Airlines AAdvantage Elite Status

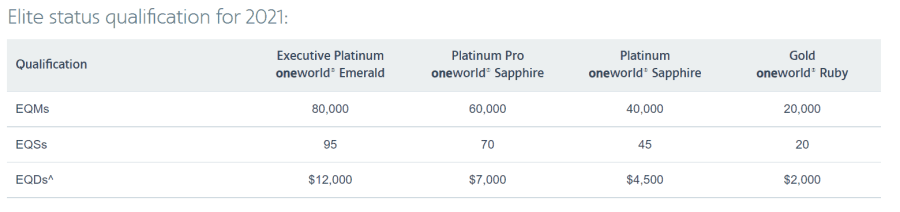

Aside from the basic AAdvantage membership, the program has 4 levels of Elite status Gold, Platinum, Platinum Pro, and Executive Platinum. Qualifying for each level requires you to meet a minimum number of miles flown through the Elite Qualifying Miles (EQMs) requirement. Plus, you have to meet a minimum spending threshold with AA through EQDs (Elite Qualifying Dollars). This ensures that if you fly a lot on the cheapest tickets, you will have to fly significantly more than someone who predominately flies on premium tickets to achieve the same elite status level. You can find the AA elite Qualifying requirements for 2021 below, with top status requiring you to fly 80,000 EQM’s and spend $12,000 EQDs.

Each elite level brings a host of benefits, with higher levels providing a wide range of perks.

AAdvantage Gold

- One free checked bag.

- Earn a 40% elite mileage bonus on AA flights.

- Receive complimentary upgrades on flights of 500 miles or less when available.

- Receive complimentary Main Cabin Extra Seats at check-in and complimentary Preferred Seats.

- 24-hour upgrade window.

AAdvantage Platinum

- Two free checked bags.

- Earn a 60% elite mileage bonus on AA flights.

- Receive complimentary upgrades on flights of 500 miles or less when available.

- Receive complimentary Main Cabin Extra Seats at check-in and complimentary Preferred Seats.

- 48-hour upgrade window.

AAdvantage Platinum Pro

- Choose One Elite Choice Reward.

- Two free checked bags.

- Earn an 80% elite mileage bonus on AA flights.

- Receive complimentary upgrades.

- Receive complimentary Main Cabin Extra Seats at check-in and complimentary Preferred Seats.

- 72-hour upgrade window.

AAdvantage Executive Platinum

- Choose two Elite Choice Reward.

- Three free checked bags.

- Earn a 120% elite mileage bonus on AA flights.

- Receive complimentary upgrades.

- Receive complimentary Main Cabin Extra Seats at check-in and complimentary Preferred Seats.

- 100-hour upgrade window.

- Receive Additional Rewards when you reach 120,000 Elite Qualifying Miles (EQMs).

Earning AA Miles

Earning AA miles is simple, and you can earn AA miles for a host of activities, with a lot not even requiring you to fly. You can earn AA miles for the following:

- The first and simplest way is to earn miles by flying with AA.

- Earn miles when you fly with AA’s Oneworld partners including, British Airways, Qatar Airways, Cathay Pacific, and more.

- You can also earn AA miles when you credit non-alliance partner flights with the likes of China Southern, Etihad Airways, and JetBlue.

- Earn miles when you dine out using the AA dining program or when you shop online through the AA shopping portal.

- Earn miles when book a cruise or vacation package with AA.

- Donate to charity and earn AA miles at the impressive rate of 10 miles per dollar donated to “Stand Up To Cancer.”

- If you are not a hotel loyalty program member, you can credit your hotel stays to AA. You can credit stays at hotels including Rocketmiles, Marriott Bonvoy, Hyatt Hotels, and Resorts.

- You can also credit car rentals to AA to boost your mileage balance. You can credit car rentals from the following companies: Alamo, Avis, Budget, Dollar, Hertz, National, Payless, Thrifty.

Earning AA Miles With Credit Cards

American Airlines has one of the most well-developed networks of co-branded credit cards both for personal and small business use. AA is not restricted by one card issuer either, with multiple cards issued by both Citi and Barclaycard. All the following cards earn you AA miles for everyday spending.

- Citi / AAdvantage Executive Card

- Citi / AAdvantage Platinum Select Card

- Citi / AAdvantage Gold Card

- AAdvantage MileUp Card

- CitiBusiness / AAdvantage Platinum Select Card

- CitiBusiness / AAdvantage Select Card

- Aviator Silver MasterCard

- Aviator Red MasterCard

- Aviator Blue MasterCard

- Aviator MasterCard

- Aviator Business MasterCard

Read More: Latest AAdvantage Program Updates Make Earning Status Easier For Members

Each one has its own unique set of perks and benefits as well as earning rates. Choosing the right card for you will depend on multiple factors, including your travel goals, how much you will spend on the card annually, what you are looking for (maximum earning Vs. travel benefits), and your overall credit history. AA Aficionados may opt to have more than one card so that they can maximize their returns across a wide range of activities.

Transfer Partners

Unlike most other US airlines, American Airlines is not a transfer partner with any major credit card point currencies. The only points you can transfer to AA are Marriott Bonvoy points. Points transfer at a ratio of 3:1. One thing to remember is that Marriott has a 5,000-mile bonus inbuilt in its system when you transfer 60,000 points. So, transferring 60,000 Marriott points to AA would yield 25,000 miles instead of the normal 20,000 at a ratio of 3:1.

Fortunately, you have plenty of different options for earning Marriott Bonvoy points. Aside from stays, you can earn Marriott Bonvoy points for everyday spending with one of the following co-branded credit cards:

- Marriot Bonvoy Boundless Visa Signature Credit Card

- Marriott Bonvoy Bold Credit Card

- Marriott Bonvoy Brilliant American Express Card

- Marriot Bonvoy Business Card from American Express

Redeeming Your AA Miles

There Are multiple options for you to maximize your AA mileage balance. The AA program has some great sweet spots when flying AA metal and some excellent redemption options on partner airlines, especially the legendary Qatar Qsuite.

Complex Pricing

Where AA stands out compared to other US legacy carriers is with its award pricing. Unlike United and Delta, which have done away with award charts, American Airlines still publishes an award chart. However, things are not so simple with a regular and saver price. Instead, AA officially has four tiers of pricing.

- MileSAAver Off Peak

- MileSAAver

- AAnytime Level 1

- AAnytime Level 2

A glance at the Main cabin award chart shows that the price difference is enormous depending on the type of award you book. For instance, a oneway award in economy from the US to Asia Region 1 (Japan or Korea) will set you back 32,500 miles with a MileSAAver Off Peak awards (which is excellent value) or 80,000 miles with an AAnytime Level 2 award (which is horrible value).

Another level of complexity is added when you try and book online, and web specials come into play. AA regularly discounts some of its awards using web special. There is no set rule for the discounts, and AA regularly applies them to all 4 tiers of its awards. This makes it essential that you hunt around a little on the AA website to see if you can strike gold and get an even better deal than the award chart. That is also why it serves to be a little flexible with your travel plans to be able to take full advantage of and discounts or offers that may pop up.

US originating Redemption Options

Glancing at the American Airlines AAdvantage award chart, there are multiple good value redemption options originating/terminating in the 48 contiguous US states. One thing to remember is that not all of these will be onboard AA metal. In fact, some of the best uses of your AA miles is aboard partner airlines, even though the partner award chart is priced differently.

Flights from the US to Europe in first Business and Economy

There is good value to be had booking MileSAAver Off Peak award in economy on AA metal with fares setting you back 22,500 miles one way. If you want a more luxurious experience, then the same route in business will set you back at 57,500.

If you are looking at partner awards, then flights from the US to London onboard British Airways first class will set you back 85,000 AA miles one way, which is still excellent value, despite all the shortcomings of British Airways first-class travel.

Flights from the US to Asia 1 in First

Whether you are flying with AA or a Oneworld partner, one-way awards to the Asia 1 region will set you back 80,000 miles plus taxes fees. That is a really good deal for a flight from the US to Japan or Korea since both are in Asia 1. Even though AA first class is good, its partner Japan Airlines has a much better hard and soft product, and a first-class one-way award for 80,000 miles plus taxes and fees is a steal.

Flights from the US to Africa in Qsuites

If you are looking to head to Africa from the US. Then look no further than a business class award with Qatar. A one-way award from the US to Africa will set you back 75,000 miles plus taxes and fees. That is excellent value for miles two business class flights, from the US to Doha, then onwards to your destination in Africa.

While availability can be a little tricky with some perseverance, you can find award space. One thing to remembers is to first check and make sure the flights you are booking with are QSuite equipped aircraft.

Flights from the US to India in Qsuites

There is tremendous value to be had heading from the US to India when booking a partner award with Qatar. A Oneway award will set you back 70,000 miles plus taxes and fees. That is outstanding value for miles and is an excellent way to experience the joy of flying the best business class product in the sky. You can check out our review of a QSuite flight during COVID-19.

Global originating Redemption Option

If you happen to be outside the US or are planning on a more extensive trip, there are plenty of excellent redemption options originating or terminating outside of the US using American Airlines AAdvantage miles.

Within Europe (including Morocco) in Economy

If you are spending the summer exploring Europe and are planning on taking multiple short flights to move around, you have plenty of options with AA. Oneway awards in economy around Europe will set you back 12,500 AA miles plus taxes and fees. This is a great deal and is perfect when taking multiple short-hop flights, where you don’t care if you have a lie-flat business class seat.

This can represent even better value since AA decided to redo its regions and moved Morocco to its European region, opening up even more redemption options within the region.

Flights from Europe to India and the Middle East in Qsuites

Again if you are in Europe and are planning on heading to the Indian subcontinent or the middle east, there is outstanding value to be had booking Qatar QSuites using AA miles on both routes. In both cases, a oneway business class award will set you back 42,500 miles.

That is tremendous value, especially if you are flying to the Indian subcontinent since the trip involves two relatively long flights in a QSuite. One thing to remember is that with the current political situation with Qatar and its neighbors in the region, it is not possible to fly to most middle easter countries from Qatar.

Reduced Mileage Awards

A little hidden gem for domestic travel in the US within the AA redemption program is the AA Reduced Mileage Awards. It is one of the best uses of AA miles for domestic travel within the US. These special awards are only open to cardholders of the various AA co-branded credit cards. With the Reduced Mileage awards, cardholders can receive a discount of up to 7,500 miles on the MileSAAver price of the award. The discount you receive will depend on the type of card you hold and the distance of your flight.

For flights over 500 miles, holders of the following cards will receive a 7,500 miles discount, while for flights under 500 miles, they will receive a 2,000 AA mile discount.

- Citi / AAdvantage Executive World Elite™ MasterCard

- Citi / AAdvantage Platinum Select World Elite MasterCard

- CitiBusiness / AAdvantage Select MasterCard

- CitiBusiness / AAdvantage Platinum Select MasterCard

- AAdvantage Aviator Silver World Elite MasterCard

- AAdvantage Aviator Red MasterCard

- AAdvantage Aviator Business MasterCard

On the other hand, holders of the following cards will receive a 5,000- or 1,000-mile discount on flights over and under 500 miles respectively.

- Citi / AAdvantage Gold World Elite MasterCard

- AAdvantage Aviator Blue MasterCard

The list of participating cities across the US is vast, and there is some excellent value to be had, so it is always worth checking this list before you book domestic travel. One thing to remember is that the list is updated regularly, and booking can sometimes be made up to 4 months in advance. So if you travel a lot domestically, it is always worth keeping an eye out for the AA Reduced Mileage Awards.

Final Thoughts

The American Airlines AAdvantage program remains a solid performer despite a series of devaluations and cuts over the years. If you travel a lot, domestically it is worth a closer look, even though reaching elite status is difficult, and redemptions on AA metal can be expensive. On the other hand, if you significantly travel internationally and can leverage your AA miles for awards on Oneworld partner airlines, then the AA program is definitely worth considering.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.