Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

I’ve been writing about my love affair with Chase credit cards and (more specifically) Chase Ultimate Rewards points. UR points are easy to earn, and they are also super redeemable (transfer partners with United, Southwest, Singapore Airlines, etc.). While I love my Chase points, I also understand the importance of diversifying in credit card points.

I just wrote how I’ve had my Citi Premier® Card for 3 years and never had to pay an annual fee, so I also want to point out WHY I signed up for the Citi Premier card in the first place. Like the Chase Sapphire cards, there is a variety of reason to sign up for the Citi Premier card:

- $95 annual fee

- Solid sign-up bonus of 60,000 ThankYou points after spending $4,000 on the card within the first three months

- 3x points restaurants, supermarkets, gas stations, and travel

- 1x on all other purchases

- No foreign transaction fees

Overall, the perks are similar to the Chase Sapphire Preferred® Card, however, there are two significant and important differences. The Citi Card earns 3x on category bonuses while the Sapphire Preferred Card only earns 2x on travel, which doesn’t include gas stations.

Before I signed up for the Chase Sapphire Preferred card, I used the Citi Premier for all travel purchases since the 3x category bonus out-earned the Sapphire Preferred card. But why wouldn’t I just amass a bunch of ThankYou points instead of even bothering with Chase Ultimate Rewards points?

Bottom line: Citi ThankYou transfer partners aren’t nearly as valuable as Chase Ultimate Rewards transfer partners.

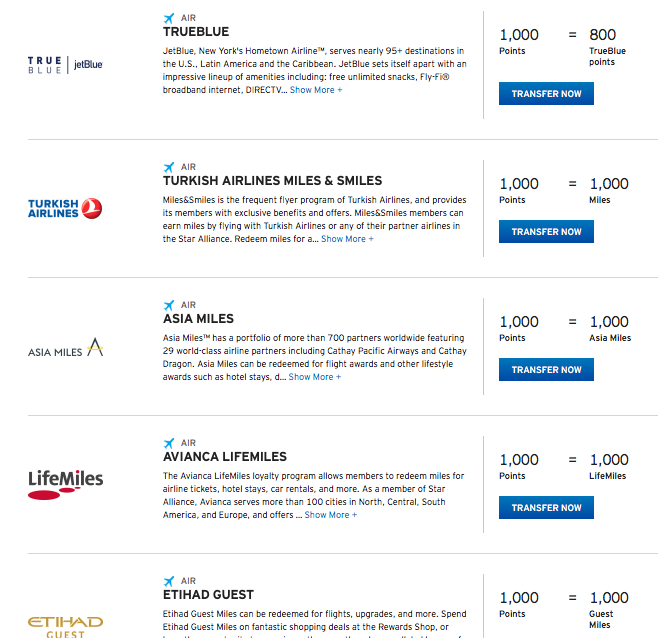

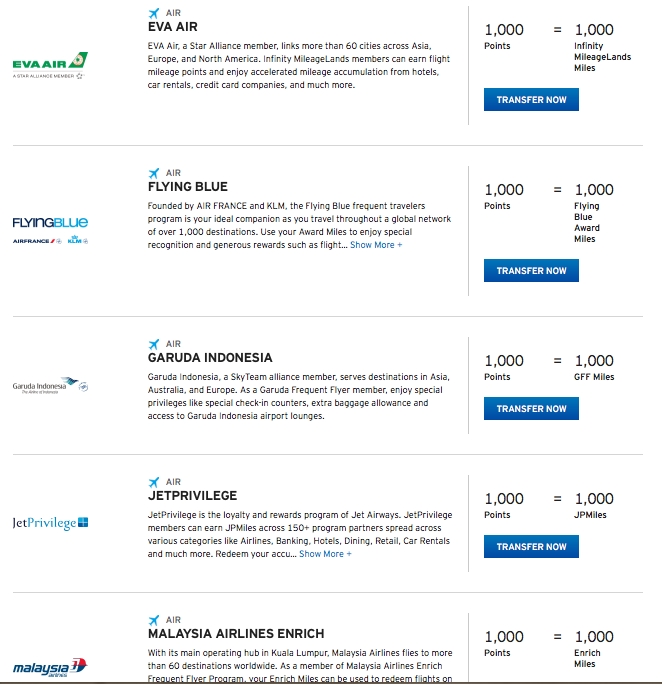

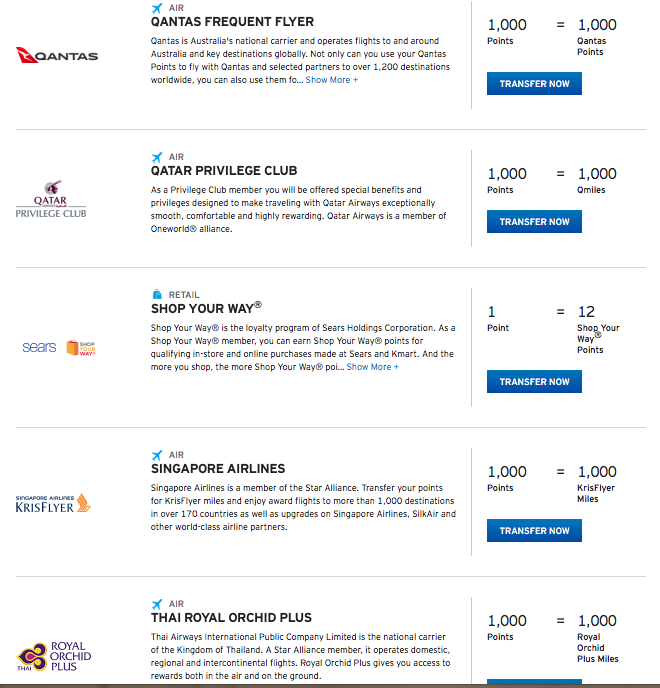

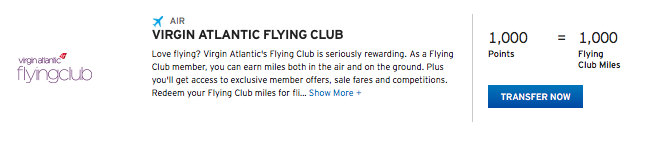

Here’s a list of the Citi ThankYou transfer partners:

It seems like a lot of options, but the only frequent flyer program I’d recommend paying attention to is the Singapore Airlines KrisFlyer program. Since it is a transfer partner with all FOUR credit card currencies (Chase, Citi, AMEX, SPG), it’s super easy to earn a lot of Singapore Airlines miles.

Why would you ever want to transfer all of your credit card points to an airline that you may have never flown?

1) Because Singapore Airlines is a member of the Star Alliance, allowing you to redeem KrisFlyer miles for flights on one of the 27 Star Alliance members such as United Airlines, Lufthansa Airlines, Austrian Airlines, ANA, and Air China. For example, you could redeem Singapore Airlines frequent flyer miles to fly on a domestic United Airlines flight without stepping foot in Singapore or flying on a Singapore Airlines plane.

2) Because the Singapore Airlines award chart has redemptions that are a terrific value. For example, the Singapore Airlines award chart considers Hawaii in the same geographic category as Central America. Using United MileagePlus miles, a roundtrip business class flight would cost either 80,000 or 100,000 miles each. However, even when redeeming Singapore Airlines miles for the exact same United Airlines flights, the roundtrip business class flight would only cost 60,000 miles.

3) Because you might want to actually fly with them! Singapore Airlines has one of the best first/business class seats in the airline industry, and most seats are only bookable using KrisFlyer miles. This includes the brand new Singapore Airlines Suites, which are absurdly cool.

Since the Singapore Suites are so awesome, there’s a lot of people who want to redeem their points for them, which means they can be hard to come by. And right now, the only flight from the U.S. that has the Singapore Suites is from New York to Frankfurt to Singapore, and unfortunately, not even that flight has the upgraded suites as seen in the pictures. 😢

Still, flying Singapore Airlines’ first class is quite the experience. Even if you aren’t in the suites, first-class passengers are provided pajamas to keep, Dom Perignon and Krug Grande Cuvèe champagne, and access to the Private Room, which is a lounge within the business class lounge within the first-class lounge at the Singapore airport. Basically it’s the “Inception” of airport lounges, complete with a la carte menus, white table cloths, and table service. Way better than any Priority Pass lounge I’ll ever go to.

Yes, there are other potential airline transfer partners for ThankYou Points. Air France/KLM’s Flying Blue program has potential, as does Avianca’s Lifemiles and Cathay Pacific’s Asia Miles. There are SO MANY OPTIONS… probably too many options. And I’ve spent way too much of time looking into them. So while I could potentially use ThankYou Points for other redemptions, I’ll still stick with Singapore Airlines KrisFlyer program.

If you want to learn the ins and outs of maximizing your travel credit cards, you can sign up for our travel concierge. It’s one full year of unlimited credit card and travel assistance so you can get the best travel deals!

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.