Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Is this the right card for me?

You’ve probably heard about the American Express Blue Cash Preferred card before and asked yourself – “Is this the right card for me?” There are countless numbers of rewards credit cards to choose from, and it’s such a pain thinking which one would best suit you.

Stop spending countless hours googling information on the web, because this blog will answer all of your most basic questions about this card. We’ll make it easy for you as we break down the benefits, rewards, pros, and cons.

The video above discusses everything we’ve reviewed below, but if you’re more of a reader than a listener, then keep scrolling down.

Who Can Benefit The Most?

The Blue Cash Preferred Card from American Express is perfect for folks, especially big families, who spend most of their time and money on groceries, gas stations, and US streaming services. CNBC Select analyzed over 200 frequently used credit cards by consumers, and we concluded that American Express clearly has the edge over the others within the last five-year period.

New cardholders will earn a $350 statement credit after spending $3,000 in purchases within the first 6 months.

The Amex Blue Cash Preferred annual fee is $95. Then again it doesn’t really matter much because the welcome bonus is already enough to cover your fees for about two years or so.

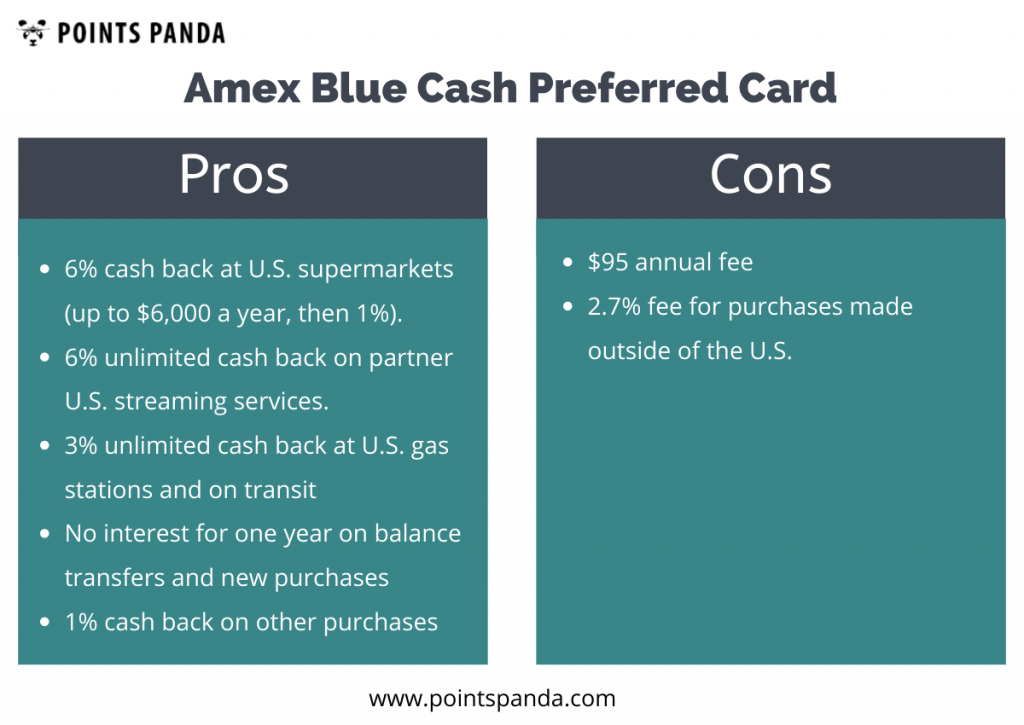

Pros & Cons of Amex Blue Cash Preferred

Let’s weigh down on the pros and cons of the Amex Blue Cash Preferred. The illustration below shows that this card has more advantages.

Please note welcome bonuses and bonus categories are subject to change.

Big supermarket spenders can benefit a lot from this card. You’re entitled to get a cashback of $324 if you have annual spending of at least $5400 ($450 monthly) for groceries and streaming services.

You’ve already covered your yearly fees on these two categories if you spend this much. Plus, you can still earn a 3% cashback from your gasoline purchases and 1% cashback from your general purchases.

You’ll get your cashback as Blue Cash Reward Dollars. These rewards can then be credited to your account once your balance reaches the $25 threshold. Cardholders can also have the option of redeeming their rewards in the form of merchandise or gift cards.

Amex Blue Cash Preferred VS Everyday

You have to options: the Blue Cash Preferred or the Blue Cash Everyday Card from American Express. Now you’re left with one question, which one should you choose?

Choosing between these two cards isn’t that hard because the deciding factor is whether you want a no-annual-fee card or a card with an annual fee but gives you great rewards on gas and groceries.

Here’s are some of the differences between the two:

Amex Blue Cash Preferred

- Has a $95 annual fee

- 6% cashback on groceries

- 6% cashback on streaming

- 3% cashback on transit

- 3% on gas

- 1% on all other purchases

- Get a $350 statement credit after you spend $3,000 within 6 months of getting the card

- Get the Disney Bundle which includes Disney+, Hulu, and ESPN+. Your decision is made easy with $7/month back in the form of a statement credit after you spend $13.99 or more each month on an eligible subscription with your card. Enrollment required.

Amex Blue Cash Everyday

- Earn a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

- No Annual Fee.

- 3% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases, then 1%.

- New! 3% Cash Back on U.S. online retail purchases, on up to $6,000 per year, then 1%.

- 3% Cash Back at U.S. gas stations, on up to $6,000 per year, then 1%.

- Get $7 back each month after using your Blue Cash Every Card to spend $13.99 or more each month on an eligible subscription to The Disney Bundle, which includes Disney+, Hulu, and ESPN+. Enrollment required.

Read More: Why The Amex Blue Business Plus Is Perfect For Startup Businesses

What We Think of The Amex Blue Cash Preferred

You need to compare the benefits to the lifestyle or spending habits that you have. That’s a rule of thumb when choosing a credit card. Anyways, let’s cut to the chase and figure out whether this card is perfect for you or not.

If you’re a big spender on groceries, gasoline, and streaming services, then this card is for you. A monthly spend of $250-$500 is ideal since this is the spending range that would cover your annual fees. That’s why we would recommend this card for big families.

The Amex Blue Cash Preferred foreign transaction fee is 2.7% so this card might not be suitable for travelers. And if you think that the annual fee is just too much, then don’t get this card.

You can sign up for our travel concierge if you need help maximizing the features of your credit card. It’s one full year of unlimited consultation.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.