Points Panda has partnered with a variety of financial companies including CreditCards.com for our coverage of credit card products. Points Panda and CreditCards.com may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. For more information please read our full Advertiser Disclosure.

Hawaii is an oddity! It is part of the US, but it is all out in the middle of the Pacific, giving it the charm and feel of an exotic island vacation. It is, therefore, no surprise that it is one of America’s most popular domestic travel destinations. A tropical paradise at the end of a domestic flight is hard to beat. That being said, its location far away can mean getting to Hawaii can be expensive. However, you can get to Hawaii relatively inexpensively if you are smart and used your points and miles tactically. so if you ever wondered how to fly to Hawaii using points and miles, read on the find out how to get to Hawaii for a points bargain!

American Express Membership Rewards

One of the leading players in the travel rewards industry, American Express is almost synonymous with earning and burning points for travel. The following cards all earn membership Rewards that you can then transfer to book flights to Hawaii.

The Platinum Card from American Express

The premium card offering from American Express, the platinum card provides a wide range of features and benefits as well excellent earning rates on travel. the card is generous enough that it stacks up well in comparison to other cards. It is arguably the best card for lounge access available today. Feature of the platinum card include:

- Earn a 100,000-point welcome bonus after spending $6,000 in the first 6 months of Card Membership.

- Earn 5X on flights booked directly with airlines or through American Express Travel (up to $500,000 per year).

- Complimentary access to the Amex centurion lounges.

- Earn 5X on prepaid hotels booked with American Express Travel.

- The card carries a $695 annual fee.

The above is just a small sample of the impressive list of card benefits the Platinum card brings to the table. The card also features a host of non-travel-related benefits like return and purchase protection coverage.

American Express Gold Card

The Amex Gold card is one of the best travel Rewards Cards available on the market today and is one of our favorite cards. For a mid-level card, it packs a powerful punch and has a host of benefits that you would typically associate with a more premium card. Features of the American Express Gold Card include:

- Earn a 60,000 points welcome bonus when you spend $4,000 on eligible purchases within the first 6 months of card membership.

- Earn 4X at US supermarkets on purchases up to $25,000 per calendar year

- Earn 4X at restaurants, plus takeout and delivery

- Earn 3X on flights booked directly with the airline or via amextravel.com.

- Earn 1x points on all other purchases

- No Foreign Transaction Fees

- The card carries a $250 annual fee

You can also earn American Express Membership Rewards with any of the following consumer cards.

- The Amex EveryDay Credit Card from American Express.

- The Amex EveryDay Preferred Credit Card from American Express.

- American Express Green Card.

When it comes to business cards, you have a wide selection to choose from. There are options for premium and mid-level cards as well as more entry-level business cards. Business cards that earn American Express Membership Rewards include:

The Business Platinum Card from American Express

A premium business card The Business Platinum Card from American Express gives the small business owner a wide range of benefits across a wide range of areas. Features of the card include:

- Earn a 120,000 Membership Rewards point bonus after spending $15,000 on eligible purchases in the first 3 months of card membership.

- Earn 5X on flights booked directly with the airlines and prepaid hotels booked via amextravel.com.

- Earn 1.5X points on eligible purchases at US construction material & hardware suppliers, electronic goods retailers and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- The card carries a $695 annual fee (Terms apply).

You can check out our full review of the Amex platinum business card to find out about the range of features and benefits the card has to offer.

American Express Business Gold Card

Similar to its consumer version, the American Express Business Gold Card is a mid-level card that punches above its weight. Features of the card include:

- Earn a 70,000 bonus when you spend $10,000 on eligible purchases in the first 3 months of card membership.

- Earn 4X on the 2 categories you spend the most on each month. (For instance, stationary and travel, or gas stations and dining) depending on your spending. 4X earning is capped on the first $150,000 of combined spending per calendar year.

- Receive 25% of your points back when you sue point to pay for flights via Amex Travel, up to a maximum of 250,000 points per year.

- Pay Over Time Optionn: Pay eligible purchases in full each month or pay over time with interest

- The card comes with a $295 annual fee (Terms apply).

The Blue Business Plus Credit Card from American Express

The entry-level business card from American Express The Blue Business Plus Credit Card from American Express which comes with a welcome bonus of 15,000 Membership Rewards (R) points after spending $3,000 in eligible purchases within 3 months of account opening. The card does offer decent earning rates on a range of business expenses. Features of the card include:

- Earn 2X points on business purchases (capped for the first $50,000 of spending per year) earn 1X on all other spending after that

- $0 annual fee

- 0% intro APR for 12 months, then a variable rate, 13.24% – 21.24%, based on your creditworthiness and other factors at account opening (Terms Apply)

You can find out more about the AmEx Blue Business Plus and how to make it work for your small business by reading our comprehensive review.

Avianca LifeMiles Awards to Hawaii

Getting to Hawaii with Amex, your first port of call should be LifeMiles. Membership Rewards transfer to Avianca Life miles at a ratio of 1:1, with a minimum transfer of 1,000. Typically transfers occur instantaneously, so it can make sense to search for an award, and once you have found one perform a quick transfer to lock it in.

Main cabin one-way awards to Hawaii from the west coast of the US can be excellent value. With a one-way from Los Angeles Lax to Honolulu HNL, setting you back 15,000 miles plus a meager $15.20 in taxes and fees.

If you are looking to travel from further east in the US to Hawaii, there are still bargains to be had using Avianca. A one-way award in main cabin from Chicago ORD to Honolulu HNL will set you back 22,500 miles plus $15.20 in taxes and fees.

When flying to Hawaii using points and miles, transferring American Express Membership Rewards to Avianca Life Miles can yield some excellent deals.

British Airways Awards to Hawaii

If you don’t want to fly with United (Avianca’s star alliance partner), you can also transfer your American Express Membership Rewards points to British Airways Avios. Using BA, you have the option of booking awards on either Alaska or American Airlines metal.

American Express Membership Rewards transfer to British Airways at a ratio of 1:1 with a minimum transfer of 1,000 points. Fortunately, data points and historical evidence show that transfers are typically instantaneous. This means you can take your time to do your search and planning, then rapidly transfer your points to Avios and complete your booking.

British Airways operates a distance-based award chart, so the price of your award in miles will vary depending on where you are originating from in the continental US.

One-way awards in economy on Alaska or AA metal will set you back 13,000 Avios plus around $6 in taxes and fees.

If you are looking to fly from further afield to Hawaii, then there some bargains to be had from Chicago O’hare ORD to Honolulu HNL.

Oneway main cabin awards are a bargain for 25,750 Avios plus around $6 in taxes and fees.

Bear in mind that this is a long flight (in the region of 9 hours), about the same time it takes to fly to Europe, so you may want to consider using more points and fly Business Class.

Using Avios to Book a business class fare from ORD is good value but is not outstanding. A one-way business class award will set you back 77,250 Avios plus around $6 in taxes and fees.

One of the best value builders by using Aviso to book awards on AA and Alaska for flights from the Contiguous 48 to Hawaii is the very Low taxes fees and fuel surcharges. These typically can be expensive with BA and massively reduce the value of their awards.

You may want to consider these charges when transferring your Membership Rewards Points. You need to work out where the best value for you is factoring in both the cost of the Award in points and cash, not just points. There is no point booking a cheap award in points that carries several hundred dollars in taxes and fees, bringing up its cost to almost the cash price of the booking.

Chase Ultimate Rewards Points

Another long-established name in the travel rewards industry, Chase Ultimate Rewards points are one of the most valuable points out there. You can leverage your points for flights to Hawaii either by redeeming directly through the Chase travel portal or transferring them to a partner airline. Often you will be able to leverage points earned for everyday spending for higher value by transferring them to partner airlines. The following cards earn Chase Ultimate Rewards points.

Chase Sapphire Reserve Card

The Chases Sapphire Reserve is the Premium Ultimate Rewards card from Chase. While the card carries a hefty annual fee, it comes with a huge array of benefits, making it one of the best, if not the best, travel rewards credit cards available today. Features of the card include:

- Earn a 50,000 Ultimate Rewards Points welcome bonus when you spend $4,000 in the first 3 months of card membership.

- $300 Annual Travel Credit that used to offset travel purchases made on your account.

- Earn 10X points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards(R) immediately after the first $300 is spent on travel purchases annually

- Earn 5X total points on air travel

- Earn 3X points on other travel and dining

- Earn 1 point per $1 spent on all other purchases

- Airport lounge access with complimentary Priority Pass Select membership.

- The card carries a $550 annual fee.

The Chase Sapphire Reserve Card list of benefits is enormous; you can read our complete and comprehensive review of the card to find out whether it is the right card for you or not.

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is one of our favorite mid-tier travel reward cards. The card provides a wide range of benefits and a very lucrative welcome bonus. The long list of features comes for a very reasonable $95 annual fee. Benefits of the Sapphire Preferred include:

- Earn a 80,000-point bonus when you spend $4,000 in the first three months of card membership.

- Get a $50 annual Ultimate Rewards Hotel Credit.

- Earn 5X points on travel purchased through Chase Ultimate Rewards(R)

- Earn 3X points on dining.

- Earn 2X points on all other travel purchases.

- The card carries a $95 annual fee.

The above is just the tip of the iceberg with the Chase Sapphire Preferred Card. To find out more, you can check out our in-depth review of the card. To find out why we rate it so highly.

Remember, if you hold either of the Chase Sapphire cards, you can convert the cashback you have earned from the following cash back cards into Ultimate Rewards points at a rate of 1cent per point.

- Chase Freedom Unlimited

- Chase Freedom Flex

- Chase Freedom- not currently accepting applications.

The following Business credit card also earns Chase Ultimate Rewards Points.

Ink Business Preferred Credit Card

A mid-tier business credit card, the Ink Business Preferred Credit Card serves up a range of benefits traditionally associated with more premium cards and performs above and beyond its $95 annual fee. Features of the In Preferred include:

- Earn a 100,000-point welcome bonus when you spend $15,000 in the first 3 months of account opening.

- Earn 3X on travel and select purchases (capped at $150,000 per anniversary year)

- Receive Fraud Protection monitoring to help secure your account.

- The card carries a $95 annual fee.

Air France/KLM Flying Blue

A SkyTeam member, you can use Flying Blue miles to book awards from the US to Hawaii on Delta metal. Chase Ultimate Rewards transfer to Flying Blue at a ratio of 1:1 with a minimum transfer of 1,000 points. Transfers typically occur the same day within a short period of time (one or two hours).

Like many big legacy carriers, Flying Blue has done away with award charts and moved to a dynamic pricing model. However, the airline has helpfully created a mileage cost estimator tool, which gives you an approximate cost of your awards.

One-way awards from Los Angeles LAX to Honolulu HNL will set you back 17,500 miles in main cabin, or 43,000 miles in business.

Fortunately, it seems Air France/KLM Flying Blue treats all US flights to Hawaii as the same in terms of pricing regardless of distance flown. One-way awards from Atlanta ATL to Honolulu HNL will also set you back 17,500 miles in main cabin, or 43,000 miles in business.

If you are looking to fly business class, then that is excellent value for your miles. While 43,000 miles may not be great value flying from LA, it is terrific value flying from Atlanta to Hawaii, which is significantly longer than flying to London or Paris.

United Airlines Mileage Plus

If you hold a substantial balance of Chase Ultimate Rewards, you can also transfer them to United Airlines. Points transfer at a ratio of 1:1 with a minimum transfer of 1,000 points required. Transfers typically occur instantly, allowing you to plan and find your awards before committing to moving your Chase Ultimate Rewards points.

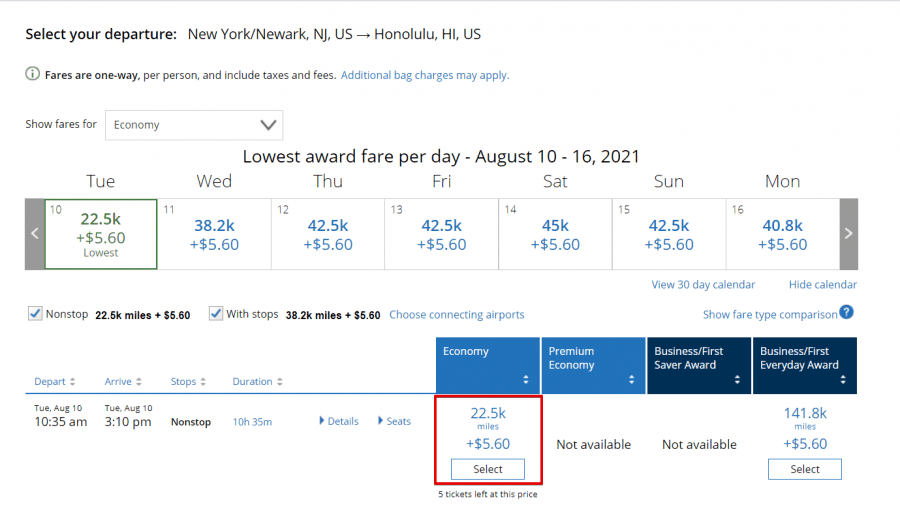

Again, the best deals are to be had with main cabin awards, and one-way flights from the east or west coast to Honolulu will set you back 22,500 miles plus $5.60 in taxes and fees.

The deal gets sweeter if you are looking to travel from the east coast. Flights from New York to Honolulu also setting you back 22,500 miles plus $5.60 in taxes and fees one way in main cabin.

If you are looking to fly in a premium cabin (premium economy or business), things are a little more complicated, and while there is some value to be had, finding award availability for the cheapest fares is extremely difficult.

Capital One Rewards miles

Although a relative newcomer to the world of points and miles, having launched its airline transfer program in 2018. Unlike Chase, Citi, and American Express, which have had long-established programs. Since its launch, the program has gone from strength to strength, adding new partners and most recently improving the transfer ratios to several major partners.

Earning Capital One points for everyday and small business spending has never been easier. The Capital One lineup of cards includes two consumer and two business credit cards.

Capital One Venture Rewards Credit Card

The main consumer Capital One Miles earning card, it is a strong performer, and its main features include:

- Get 75,000 (worth $750 in travel) miles after spending $4,000 within three months of account opening

- Earn 5X miles on hotels and rental cars booked through Capital One Travel

- 2X earning on purchases

- No foreign transaction fees

- A $100 statement credit every 4 years towards Global Entry or TSA PreCheck(R)

- The card carries a $95 annual fee

Capital One VentureOne Rewards Credit Card

The second tier card from Capital One which still offers a good set of features and earning rates, including:

- Earn a 20,000-mile welcome bonus after spending $500 in the first 3 months of card membership

- Earn 1.25X on every purchase you make using the card

- Earn 5X miles on hotels and rental cars booked through Capital One Travel

- 0% intro APR on purchases and balance transfers for 15 months

- No foreign transaction fees

- The card carries no annual fee

Capital One Spark Miles for Busines

The main business card that earns Capital One Miles is a solid performer with a very similar offering to the main consumer card. Features of the Card include:

- Earn 50,000 miles welcome bonus after spending $4,500 in the first 3 months of card membership.

- 2X earning on all business purchases.

- No foreign transaction fees.

- A $100 statement credit every 4 years towards Global Entry or TSA PreCheck(R).

- Transfer your miles to 15+ travel loyalty programs

- The card carries a $95 annual fee.

- You can issue free employee cards.

Capital One Spark Miles Select for Business

The second tier of business cards from Capital One, the card still provides a well-balanced set for benefits and earning rates, including:

- Earn 20,000 miles welcome bonus after spending $3,000 in the first 3 months of card membership.

- 1.5X Earning on all your business purchases.

- No foreign transaction fees.

- The card carries no annual fee.

- You can issue free employee cards.

One thing to remember with Capital One is that it has multiple various transfer ratios. So while some partners like Avianca are excellent value with a ratio of 1:1, others like Singapore Kris flyer are poor value with a transfer ratio of 2:1. That being said, there are some excellent transfer options for the Capital One program, and even though it is a relative newcomer to the points and miles world, it has hit the road running with a wide range of options and value.

Avianca Life Miles

Your best and most economical option when using points and miles to fly to Hawaii is to transfer your Capital Miles to Avianca life miles at a ratio of 1:1. Transfers occur instantaneously, and there is a minimum transfer of 1,000 miles.

As outlined in the American Membership Rewards section, there is some excellent value on flights from across the US to Hawaii. So if you have a bunch of Capital One points your Hawaiian vacation, just a few mouse clicks away.

Citi ThankYou Points

Earning Citi ThankYou points that you can leverage for flights to Hawaii through transfers to airline partners is relatively simple. Several cards earn Citi ThankYou points, and not all are premium ones. In fact, there are cards aimed at students who want to get into travel reward point collecting. The following cards all earn Citi ThankYou points:

- Citi Prestige Card

- Citi Premier Card

- Citi Rewards+ Card

- AT&T Access Card From Citi

- Citi Rewards+ Student Card

Turkish Airlines Miles and Smiles

The best value to be had with Citi ThankYou points booking flights to Hawaii is via transfers to Turkish Airlines Miles and Smiles Program. Points transfer at a ratio of 1:1 with a minimum required transfer of 1,000 points. One thing to note is that transfers typically take a couple of days. So planning and preparation is essential.

One possible way to accommodate this delay is to reserve your award via email or on the phone; after searching online, this effectively puts the award on hold and takes it off the market. Now you have to physically go to one of the sales offices to complete the award booking. This gives you a time window to transfer the required points from your Citi ThankYou account to your Miles and Smiles account.

Where miles and smiles offer incredible value is on its saver awards with star alliance partner United airlines to Hawaii. With a regional-based award chart, there is no difference in the award cost wherever you are flying from in the US to Hawaii since it is classed as part of North America.

Roundtrip fares in economy on united to Hawaii will set you back 20,000 miles plus taxes and fees. Keep in mind United charges a very reasonable $5.60 in taxes and fees which are passed on to you. Business-class awards are a stunning bargain, especially if you can find one from the east coast with round trip saver awards setting you back 30,000 miles.

Although these are incredible deals that can be done, one thing you need to remember is that the availability of these saver awards is extremely rare. So if you have your heart set on getting a bargain to Hawaii, you will have to persistent with your searches, flexible with your travel dates, and hope for a little bit of luck!

Marriott Bonvoy

Although it is a hotel program, Marriott Bonvoy has one of the most versatile points currencies. Its network of transfer partners is enormous, compared to most others, unlike other hotel programs, which typically transfer to airlines at terrible ratios. Marriott Bonvoy points tend to have a much better ratio, typically transferring at a ratio of 3:1.

Aside from staying at Marriott properties, you can also earn points for everyday spending with a couple of Marriott Bonvoy co-branded credit cards.

Marriot Bonvoy Boundless Visa Signature Credit Card

The premium offering in the Marriott card lineup, the Marriot Bonvoy Boundless (R) Visa Signature Credit Card, comes with a generous welcome bonus and carries a reasonable annual fee. Features of the card include:

- Earn 3 Free Nights (each night valued up to 50,000 points) after spending $3,000 on purchases in your first 3 months from account opening.

- Earn 3X Bonvoy points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining.

- Earn 1 Elite Night Credit towards Elite Status for every $5,000 you spend.

- 1 Free Night Award (valued up to 35,000 points) every year after your account anniversary.

- Earn up to 17X total Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy(R) with the Marriott Bonvoy Boundless(R) Card.

- 2X Bonvoy points for every $1 spent on all other purchases.

- Receive 15 Elite Night Credits annually, automatic Silver Elite Status each account anniversary year, and path to Gold Status when you spend $35,000 on purchases each calendar year.

- No foreign transaction fees.

Marriott Bonvoy Bold Credit Card

Don’t be deceived by the $0 annual fee and the entry-level status of the Marriott Bonvoy Bold (R) Credit Card. It is still an excellent offering with great earning rates, a generous welcome bonus, and a host of ancillary benefits. Highlights of the Card include:

- Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening.

- Earn 14X per dollar for spending at Marriott Bonvoy properties.

- Earn 2X on travel purchases, including taxis, trains, as well as airfares.

- Earn 1X on all other purchases.

- Receive 15 Elite Night credits annually.

- No foreign transaction fees when using your card abroad.

- The card carries no annual fee.

Korean Air SkyPass

If you have a stack of Marriott Bonvoy points and want to use them to travel to Hawaii, look no further than Korean Air Sky Pass. Marriott Bonvoy points transfer to Korean Air at a ratio of 3:1, and transfers typically can take up to 2 days. One thing to remember is the Marriott Bonvoy inbuilt transfer bonus when you transfer 60,000 points or more. Transferring 60,000 points, you receive a 5,000-mile bonus, so 60,000 points would yield 25,000 miles instead of 20,000 miles.

Korean AIr classes Hawaii as in the North America region, so there are some fantastic deals to be had flying from anywhere in North America, including Canada, Mexico, and Puerto Rico to Hawaii.

A member of SkyTeam, you can book awards to Hawaii with Korean Air on its partner Delta. Roundtrip economy fares will set you back 25,000. While Business and first-class fares are a steal at 45,000 miles roundtrip plus taxes and fees.

How to fly to Hawaii using points and miles by combining points

If you do not have enough points in one account for an award to Hawaii, you should turn your attention to Singapore Krisflyer. Although not the most economical program in the world for redemptions, Krisflyer has one main strong point. It is a transfer partner to almost every single significant point currency. You can combine a small balance of American Express Membership Rewards, chase ultimate rewards, Capital One Rewards, Marriot Bonvoy points, and Citi ThankYou points into one account. This makes Singapore Krisflyer the perfect option for pooing a small balance from each currency for award redemption.

Looking at the partner award chart for Alaska airlines, booking awards from the continental US to Hawaii using Kris flyer can also be great value, with one-way awards from the west coast to the islands setting you back 12,000 miles plus taxes and fees one way in the main cabin.

The main problem with Singapore is it does not allow bookings from zone 4 with Alaska, which covers most of the east coast. While this is a problem, you can get around it by booking an award on United instead. Kris flyer awards from the contiguous 48 to Hawaii on United start at 35,000 miles round trip in main cabin.

Depending on where you live in the US or Canada, consolidating small mileage balances gives you even more flexibility when flying to Hawaii using points and miles.

Multiple Transfer Partners

Several loyalty programs mentioned have multiple transfer partners. You can check out the table below to see how many transfer partners each airline program has.

Table

Final thoughts

Hawaii offers a unique experience for US travelers. All the pleasures and charms of a south pacific tropical holiday, a destination with none of the hassle of international travels and most of the comforts you would find at home. While it can be expensive to book flights to Hawaii, you have choices if you are determined and clever with travel rewards strategy. There is a massive array of options for you to use points earned from everyday credit card spending to book your next Hawaiian vacation.

Advertiser Disclosure

PointsPanda Deal of the Week!

Looking for the best flight deals? Each week we'll send you updates with the best deals on flights and hotels both using points and cash.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.